Cryptocurrencies are trading another weaker session today, with Bitcoin settling in the $40,000 area. Although the price of BTC has now rebounded to $40,500, the sentiment is clearly bearish, with additional pressure imposed by a strong dollar and a rise in the yield on 10-year treasuries, which rose to 4.16% today.

Grayscale sells Bitcoin reserves?

-

We can tie Bitcoin's decline itself to the sell-off of Grayscale's BTC reserves. According to on-chain data, the fund has deposited 12,865 BTC worth more than $530 million on the Coinbase exchange. Typically, reserves are deposited on crypto exchanges with the intention of gradually reselling them.

- Investors storing their BTC in Grayscale for many years recorded losses, as the fund was listed at a discount to the value resulting, from the valuation of the stored Bitcoins. After it was converted to an ETF (ETP), the discount was erased, and its shareholders (indirectly BTC holders) are realizing profits. Some are also withdrawing funds from Grayscale due to the fund's high fees (1.5% annual TER).

- So far, $2.2 billion has flowed out of the fund in the last 5 trading days. This is still less than 10% of total reserves. Analysts speculate that resale may still continue, with Grayscale regularly sending about $500 million worth of BTC to exchanges, which, according to ETF analysts at Bloomberg, may indicate some limit to daily execution.

BITCOIN is trading below the $41,000 zone, and today's session brought declines that tested the $40,200 barrier with its range. Source: xStation 5

BITCOIN is trading below the $41,000 zone, and today's session brought declines that tested the $40,200 barrier with its range. Source: xStation 5

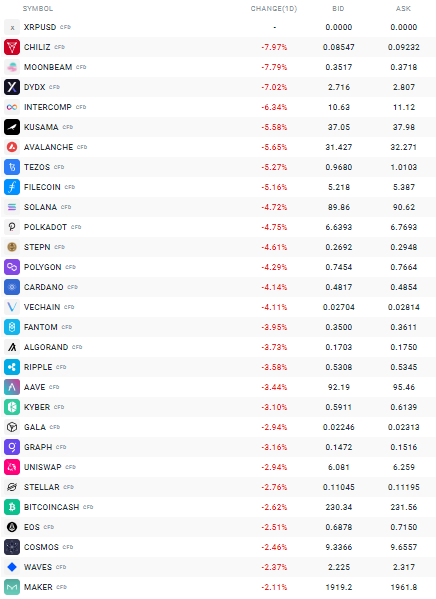

Smaller cryptocurrencies are also trading under pressure today. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?