Bitcoin pulled back from recent highs during yesterday's session however today the price of major cryptocurrency is approaching $46,000 level amid rising interest from retail investors and despite the fact that US lawmakers rejected an attempt to amend tax rules targeting crypto. Also the market seems to ignore the recent Poly network hack, during which approximately US$600 million worth of crypto assets has been hijacked. The hackers siphoned off Ethereum, Shiba Inu, Wrapped Bitcoin and USD coin, among others.

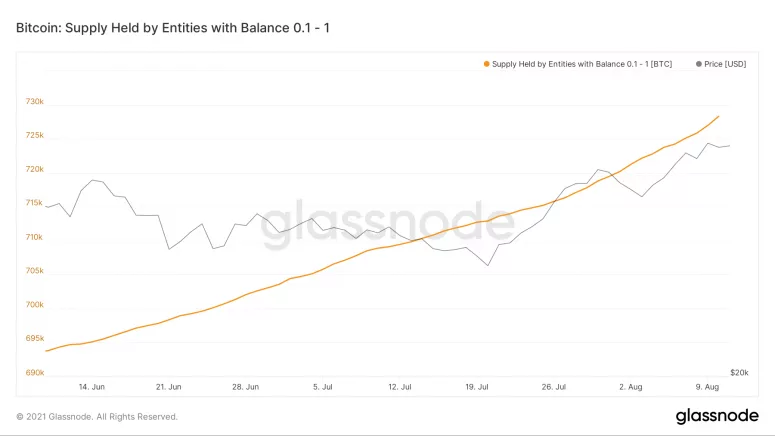

Meanwhile, according to Glassnode data, the total supply of bitcoin held by small investors with a balance of 0.1-1 BTC has continued to increase alongside bitcoin’s price suggesting retail is buying up alongside institutional investors. This is optimistic news as in the past small investors have contributed significantly to the upward movements.

Recent data point to a rising interest from retail traders. Source: Glassnode

Recent data point to a rising interest from retail traders. Source: Glassnode

Bitcoin pulled back from strong resistance at $ 46672 which coincides with 50% Fibonacci retracement of the last downward wave, however sellers failed to break below 200 SMA (red line) which now acts as main support. Should the uptrend be maintained and Bitcoins break above the aforementioned resistance area, the next target for bulls can be found at the 61.8% exterior retracement around $50882. On the other hand, should there be a change in the current sentiment, then the nearest support is located at the $ 42,465 level. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?