Bitcoin price has experienced a massive rally throughout the last couple of days of September and the beginning of October as the Fed ruled out plans to follow China’s lead to ban cryptocurrencies. Further, the Chairman of the US SEC Gary Gensler reiterated support for a bitcoin exchange-traded fund (ETF) rooted in regulated futures markets. Today the most popular cryptocurrency broke above psychological resistance at $50,000 amid rising interest from institutional investors. According to the latest report from CoinShares, BTC investment products generated $68.7 million worth of inflows between Sept. 27 and Oct. 1, representing a 36% increase in exposure week-over-week. Ethereum recorded inflows of $ 20 million although it has lost market share to Bitcoin in recent weeks, falling from a peak of 28% to 25%. There was also a mixed appetite for altcoins last week. Products tracking Cardano (ADA) recorded inflows of $1.1 million, while Polkadot (DOT) and Binance Coin (BNB) funds lost $800,000 each. Digital asset investment products saw inflows of US$90m last week, marking the 7th consecutive week of inflows totalling US$411m.

Institutional crypto appetites have shifted away from altcoin back to Bitcoin. Source: CoinShares.

Institutional crypto appetites have shifted away from altcoin back to Bitcoin. Source: CoinShares.

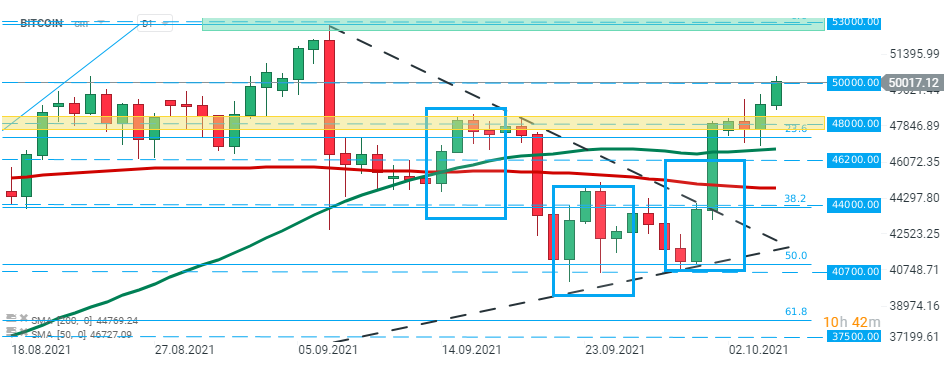

BITCOIN price jumped above $50,000 level during today's session. Buyers are working hard to stay above the new support while keeping the focus on the next resistance at $53,000. However if sellers manage to regain control, then another downward impulse towards $48,000 may be launched. This level coincides with 23.6% Fibonacci retracement of the upward wave launched in July. Source: xStation5

BITCOIN price jumped above $50,000 level during today's session. Buyers are working hard to stay above the new support while keeping the focus on the next resistance at $53,000. However if sellers manage to regain control, then another downward impulse towards $48,000 may be launched. This level coincides with 23.6% Fibonacci retracement of the upward wave launched in July. Source: xStation5

Bitcoin gains 3%, attempting a trend reversal 📈

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Daily Summary: Middle East Sparks Oil Market

Crypto up 4 % despite tension📈