This week's last session on the markets brings huge volatility. Stock market indexes are posting massive declines, and even more interesting is the currency market, which is dominated by the complete capitulation of the British pound. There are several reasons for such a big sell-off, but the most important are:

-

Decline in the pace of rate hikes by the BoE (in the face of huge uncertainty about the further trajectory of inflation)

-

Huge fiscal uncertainty (which could further rock inflation)

Prime Minister Liz Truss' government today unveiled details of the so-called "mini-budget." It aims to boost the long-term growth potential of the British economy and includes massive tax cuts:

-

A reduction in the basic rate of income tax from 20% to 19%

-

Reducing the higher rate of income tax from 45% to 40%

-

The increase in corporate tax to 25%, which was to take effect next year, has been suspended for the time being. The corporate tax will remain unchanged at 19%

If the government enacts these proposals, they will be the largest tax cuts since 1972. While the tax cuts are stimulating the economy and should have a positive impact on the currency, the pound is experiencing a continuation of the discount. This can be attributed to one major uncertainty - how these tax cuts will be financed, and this is what the market is most concerned about. Market analysts indicate that the government will have great difficulty financing the deficit in the face of such economic uncertainty.

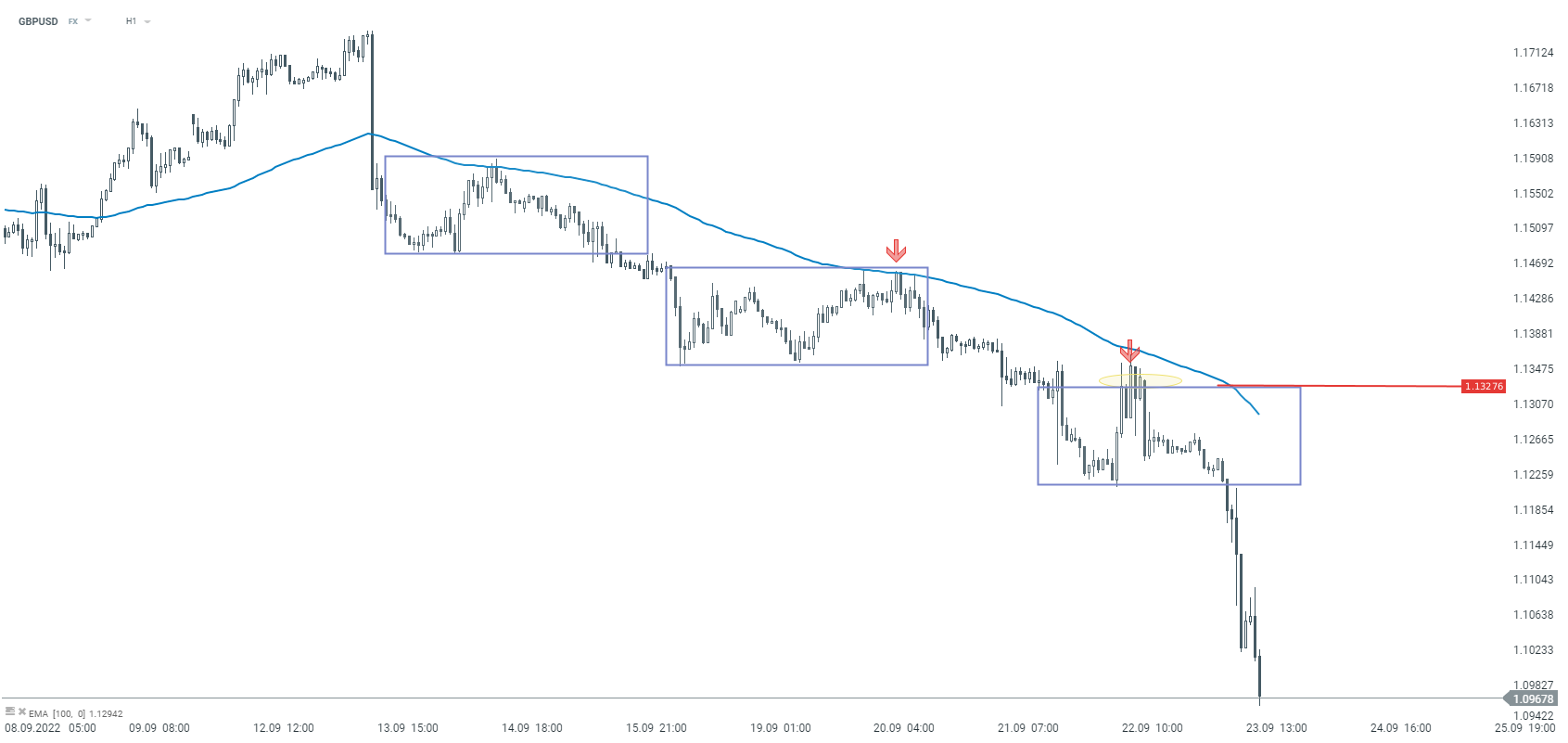

Looking technically at the chart of GBPUSD, we observe a solid sell-off. Despite the huge volatility, the quotation is behaving according to the rules of technical analysis. The last three corrections were almost identical (marked with rectangles), and the downward movement is supported by the average of the last 100 periods. So it seems that as long as the 1:1 arrangement is not negated, or the price does not return above the moving average, the downward movement should be expected to continue.

GBPUSD H1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)