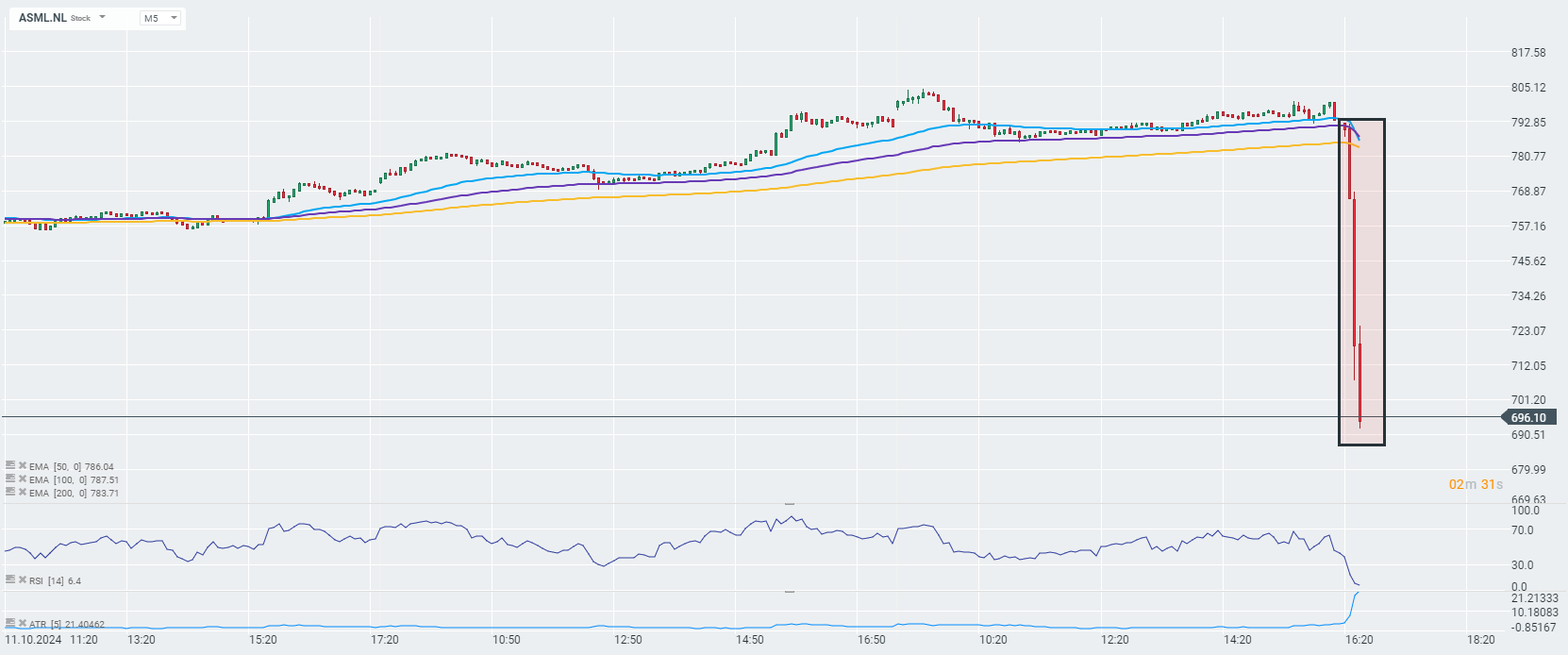

Just before the end of the European session, ASML reported its results. The company's shares lost nearly 11% after the company's orders came in well below expectations, even though other earnings metrics were not so bad. Moreover, the company lowered its guidance for 2025. Moreover, the company lowered its guidance for 2025. Nvidia (NVDA.US) falls 6% in response to the results as Wall Street erases early gains.

THIRD QUARTER RESULTS

- Bookings EU2.63 billion, -53% q/q, estimate EU5.39 billion

- Net sales EU7.47 billion, +20% q/q, estimate EU7.17 billion

- Gross margin 50.8% vs. 51.5% q/q, estimate 50.7%

- Net income EU2.08 billion, +32% q/q, estimate EU1.91 billion

- Cash and other EU4.99 billion, -0.7% q/q, estimate EU4.86 billion

FOURTH QUARTER FORECAST

- Sees net sales EU8.8 billion to EU9.2 billion, estimate EU8.95 billion

- Sees gross margin 49% to 50%, estimate 50.5%

YEAR FORECAST

- Sees net sales EU28 billion, estimate EU27.71 billion

2025 YEAR FORECAST

- Sees gross margin 51% to 53%, saw about 54% to 56%, estimate 53.9%

- Sees net sales EU30 billion to EU35 billion, saw about EU30 billion to EU40 billion, estimate EU35.94 billion

Source: xStation

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment