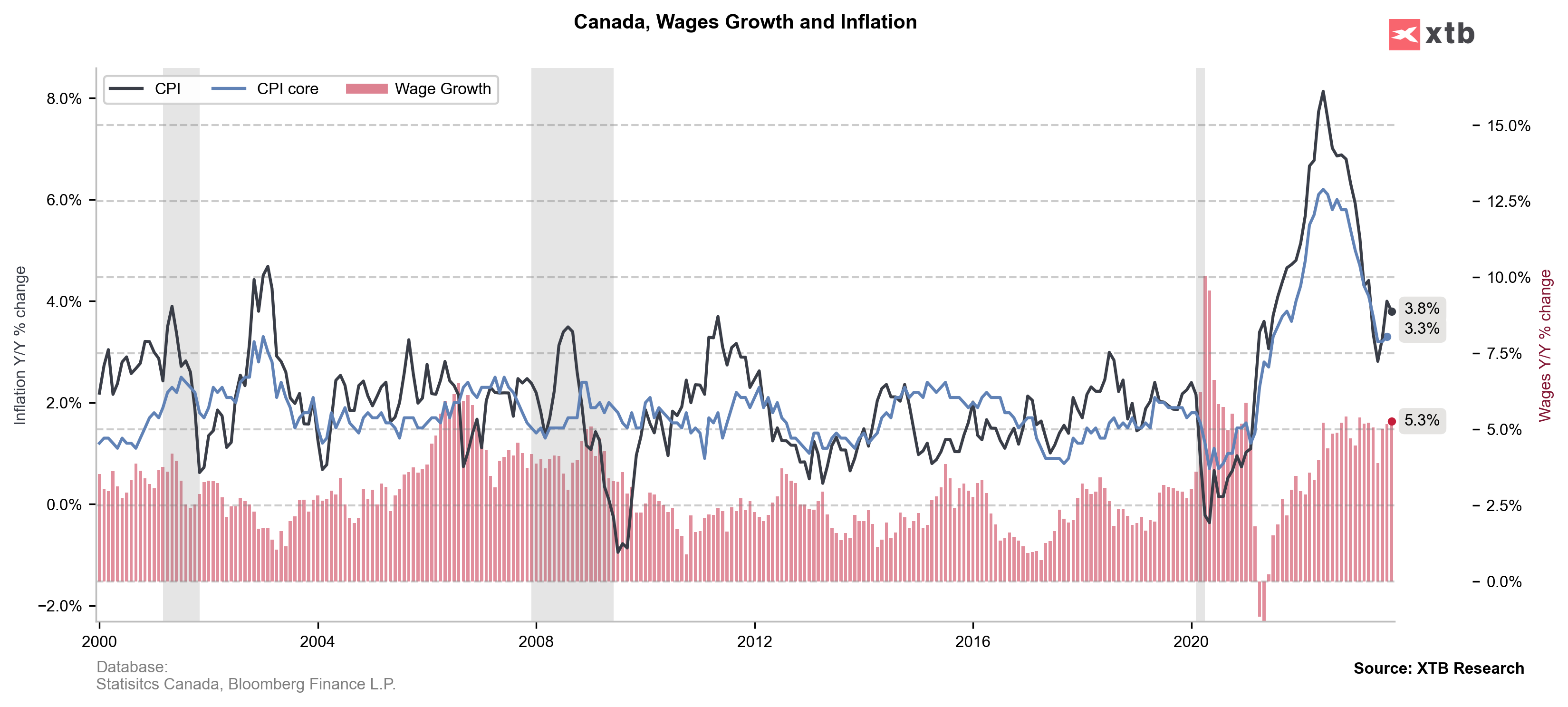

Canadian CPI inflation data for September was released at 1:30 pm BST today. Report was expected to show headline price growth gauge staying unchanged at 4.0% YoY. On a monthly basis, prices were seen increasing 0.1% MoM, following a 0.4% MoM jump in August.

Actual report showed, however, a deceleration from 4.0 to 3.8% YoY in headline Canadian CPI with prices dropping 0.1% month-over-month. Core gauge dropped from 3.3% YoY in August to 2.8% YoY in September. An unexpected drop in CPI inflation further lowers chance of Bank of Canada deciding on more rate hikes and was met with CAD weakening. Money markets are now pricing in a 26% chance of Bank of Canada hiking rates at a meeting next week, down from 43% before inflation data was released.

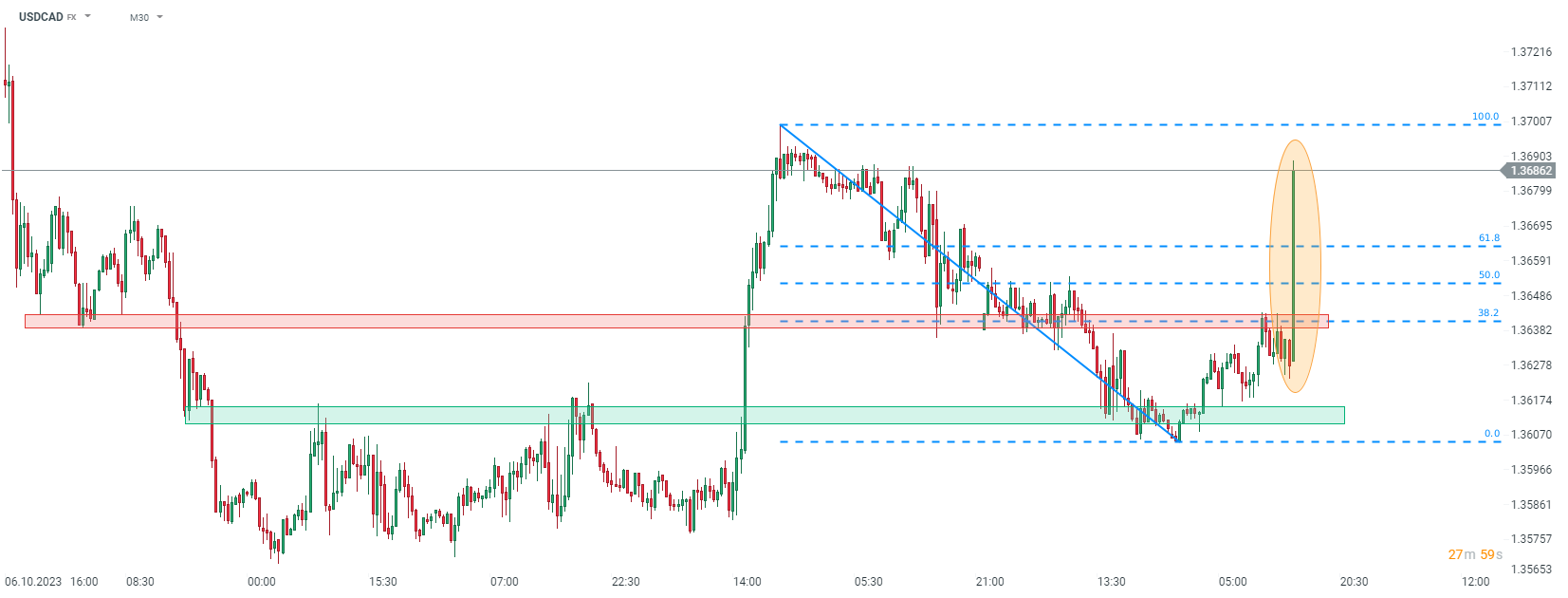

Taking a look at USDCAD chart at 30-minute interval, we can see that the pair spiked following data release. However, apart from CAD-negative inflation report, move on the pair is support by solid US retail sales data that was released simultaneously.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉