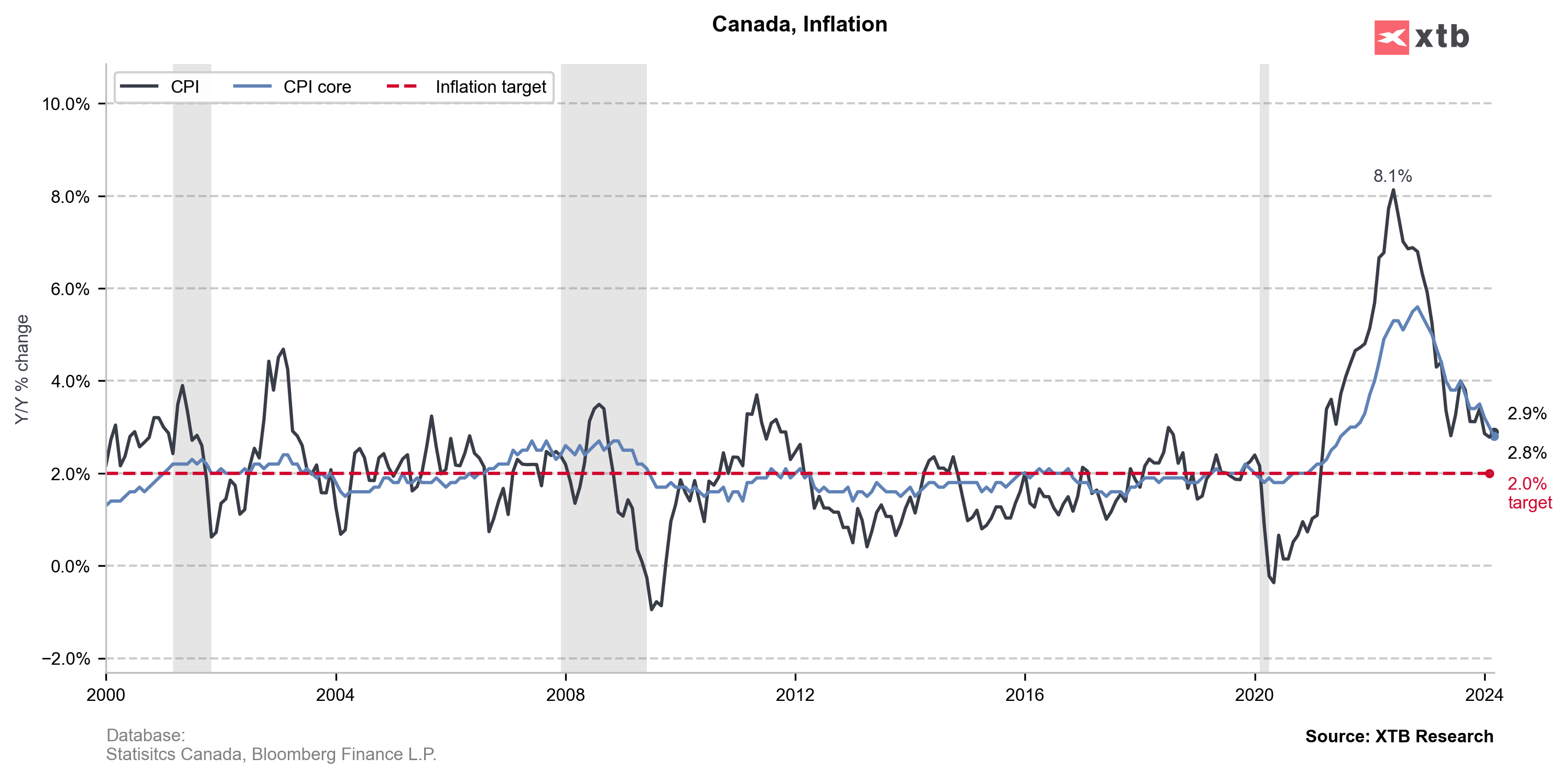

Canadian CPI data for March was released at 1:30 pm BST today. Report was expected to show headline measure accelerating slightly from 2.8% to 2.9% YoY. On a monthly basis, market expected 0.7% MoM increase, following a 0.3% MoM increase in February.

Actual data turned out to be slightly dovish. While annual headline CPI accelerated in-line with expectations, the monthly print turned out to be slightly lower than expected. Annual core inflation measures also showed unexpected slowdown.

Canada, CPI data for March

- Headline (annual): 2.9% YoY vs 2.9% YoY expected (2.8% YoY previously)

- Headline (monthly): 0.6% vs 0.7% MoM expected (0.3% MoM previously)

- Core CPI (annual): 2.0% YoY vs 2.1% YoY previously

- Core CPI (monthly): 0.5% vs 0.1% MoM previously

Canadian dollar took a hit following the release. EURCAD surged over 0.3% following the release. Taking a look at the chart at 30-minute interval, we can seen that the pair jumped above 200-period moving average (purple line) and climbed to the highest level in a week.

Source: xStation5

Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion