07:45 AM BST, France - Inflation Data for September:

- French CPI: actual 1.1% YoY; forecast 1.2% YoY; previous 1.8% YoY;

- French CPI: actual -1.3% MoM; forecast -1.2% MoM; previous 0.5% MoM;

- French HICP: actual 1.4% YoY; forecast 1.5% YoY; previous 1.5% YoY;

- French HICP: actual -1.3% MoM; forecast -1.2% MoM; previous 1.2% MoM;

08:00 AM BST, Spain - Inflation Data for September:

- Core CPI: actual 2.4% YoY; forecast 2.4% YoY; previous 2.7% YoY;

- Spanish CPI: actual 1.5% YoY; forecast 1.5% YoY; previous 2.3% YoY;

- Spanish CPI: actual -0.6% MoM; forecast -0.6% MoM; previous 0.0% MoM;

- Spanish HICP: actual 1.7% YoY; forecast 1.7% YoY; previous 2.4% YoY;

- Spanish HICP: actual -0.1% MoM; forecast -0.1% MoM; previous 0.0% MoM;

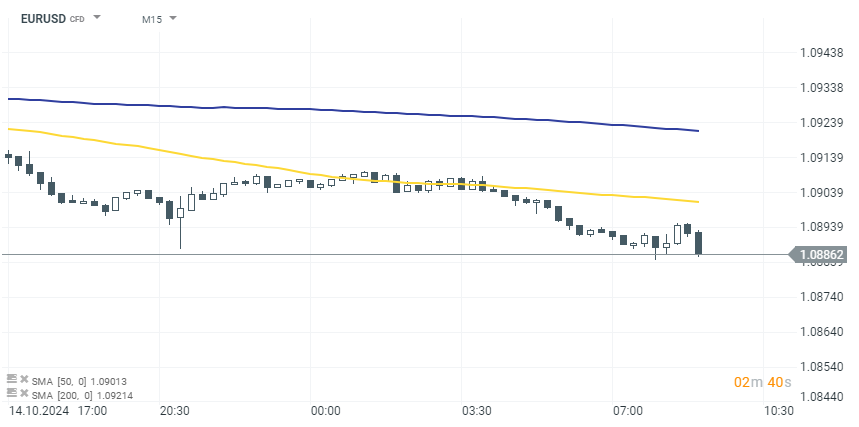

Inflation data from Spain and France came in very low. After struggling with inflation in previous years, we are now moving into deflationary issues. The EURUSD is dropping following the release of the reports, with the Euro weakening. Low inflation figures increase the likelihood of more aggressive rate cuts by the ECB at upcoming meetings.

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)