European indices had a poor start to a new week with major indices from the Old Continent launching today's cash trading session with significant bearish price gaps. This came after a government-brokered deal for UBS to acquire Credit Suisse failed to shore up market sentiment. Issue of Credit Suisse's AT1 bonds being written down to zero sparked concerns that it may be a problem for banks and financial institutions with exposure to those bonds. However, indices began to regain ground as the session progressed and all of the earlier losses have been erased already. Indices from Western Europe trade 0.5-1.0% higher on the day with German DAX adding 0.7% and French CAC40 jumping 0.9%.

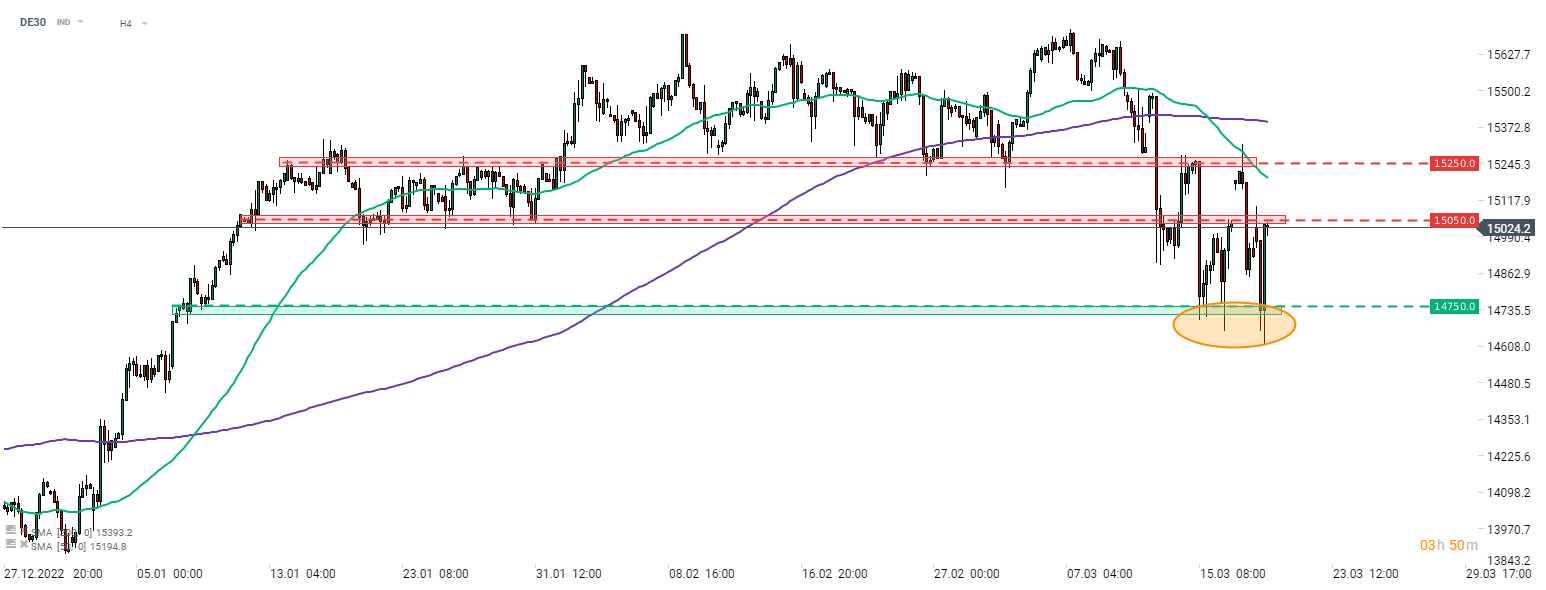

Taking a look at the DE30 chart at H4 interval, we can see that another attempt at breaking below the 14,750 pts support zone was made today and once again it turned out to be a failure. Index caught a bid later on and rallied towards the psychological 15,000 pts mark. While the index managed to break above this hurdle, bulls failed to break above the 15,050 pts swing area. However, the index remains close to this resistance and another attempt to break above it later into the day cannot be ruled out.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%