The ECB left its benchmark interest rate unchanged at 0.00 %, as widely expected. Central bank announced a reduction in the pace of its asset purchases over the coming quarters, citing the progress on economic recovery and towards its medium-term inflation target. The bank also said it would discontinue net asset purchases under the PEPP at the end of March 2022, and reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2024. APP of 40 billion in Q2.

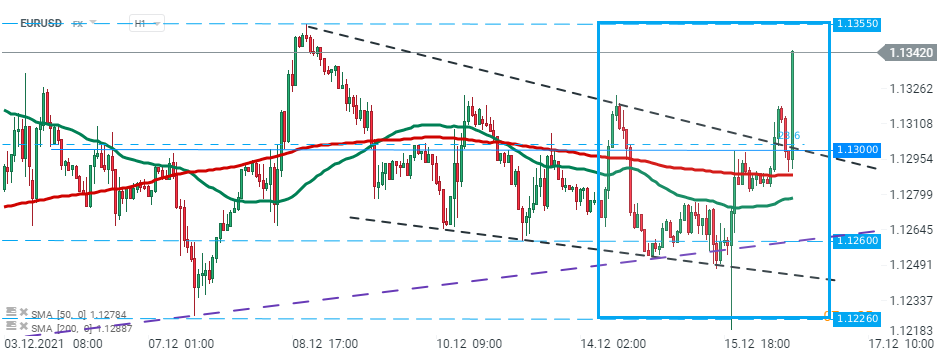

EURUSD bounced off the 1.1300 support after ECB decision and is heading towards next resistance level at 1.1355. Source:xStation5

EURUSD bounced off the 1.1300 support after ECB decision and is heading towards next resistance level at 1.1355. Source:xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)