CPI inflation reading for November for the whole euro area was released today at 10:00 am GMT. As usual, release comes after data from EU member countries has been already released and therefore it did not trigger any major reaction on the market. Market expected CPI inflation in the euro area to decelerate from 10.6% YoY in October to 10.4% YoY in November. Actual reading showed deceleration to 10.0% YoY.

November's inflation data from EU member countries

-

Germany: 10.0% YoY vs 10.4% YoY previously

-

Spain: 6.8% YoY vs 7.3% YoY previously

-

France: 6.2% YoY vs 6.2% YoY previously

-

Netherlands: 11.2% YoY vs 16.8% YoY previously

-

Italy: 11.8% YoY vs 11.8% YoY previously

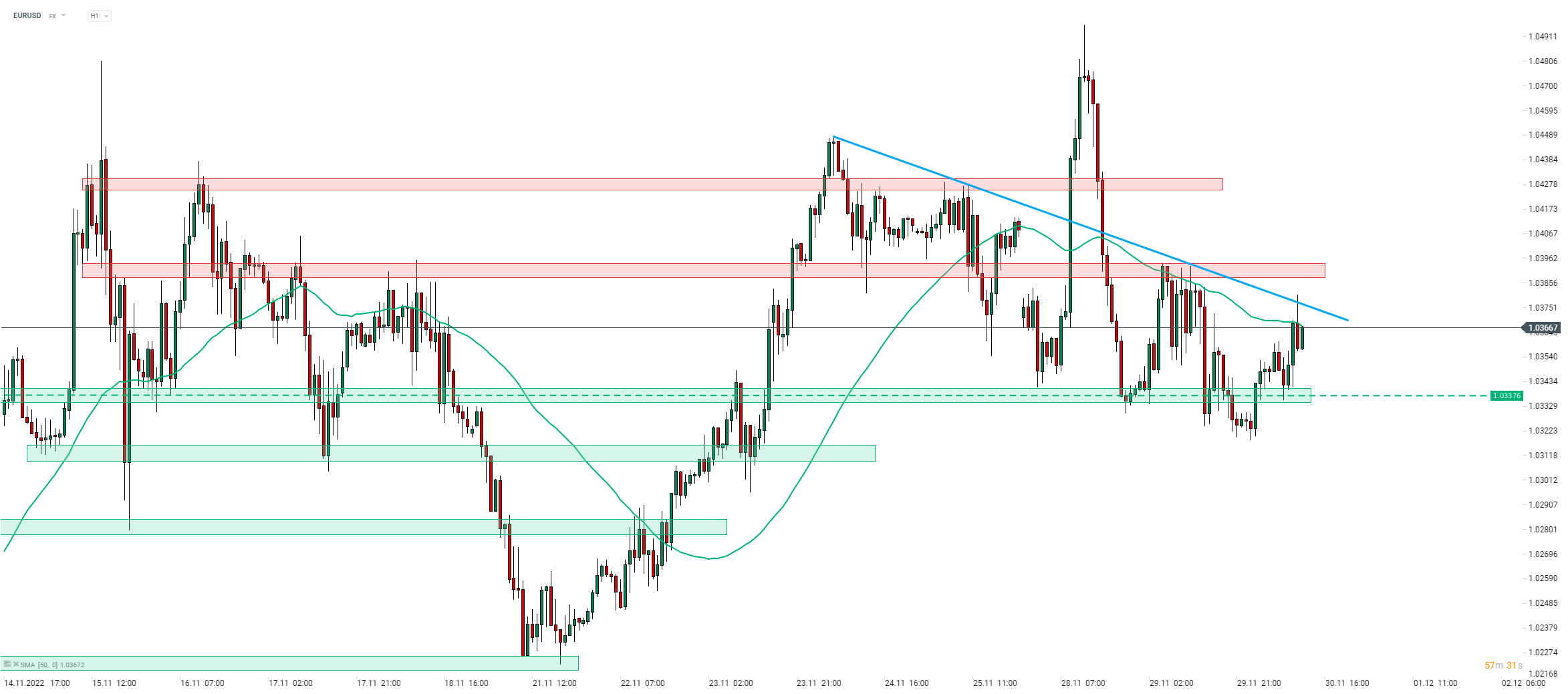

EURUSD saw a small uptick following the release but the scale of the move did not even exceed 0.1%. The main currency pair continues to trade below the downward trendline and below 50-hour moving average (green line) above which it tried to break earlier today but failed.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report