Eurozone – Inflation data (flash) for August:

-

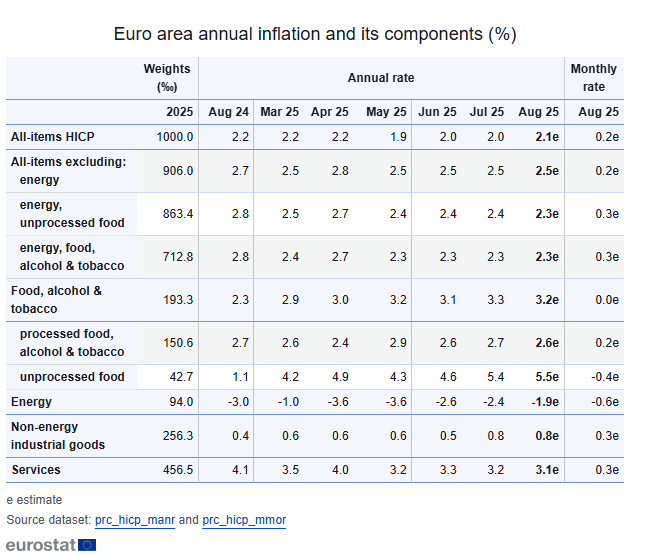

CPI: Actual: 0.2% m/m; previous 0.0% m/m

-

CPI: Actual: 2.1% y/y; forecast 2.1% y/y; previous 2.0% y/y

-

Core CPI: Actual: 2.3% y/y; forecast 2.2% y/y; previous 2.3% y/y

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (3.2%, compared with 3.3% in July), followed by services (3.1%, compared with 3.2% in July), non-energy industrial goods (0.8%, stable compared with July) and energy (-1.9%, compared with -2.4% in July).

Source:Eurostat

Overall, these figures show that the ECB is currently in a very good position with regard to interest rates/monetary policy. The data had a limited impact on the euro, although the surprise of slightly higher figures stabilized the EURUSD exchange rate at around 1.6370.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS