10:00 AM BST, Euro Zone - Inflation Data for September:

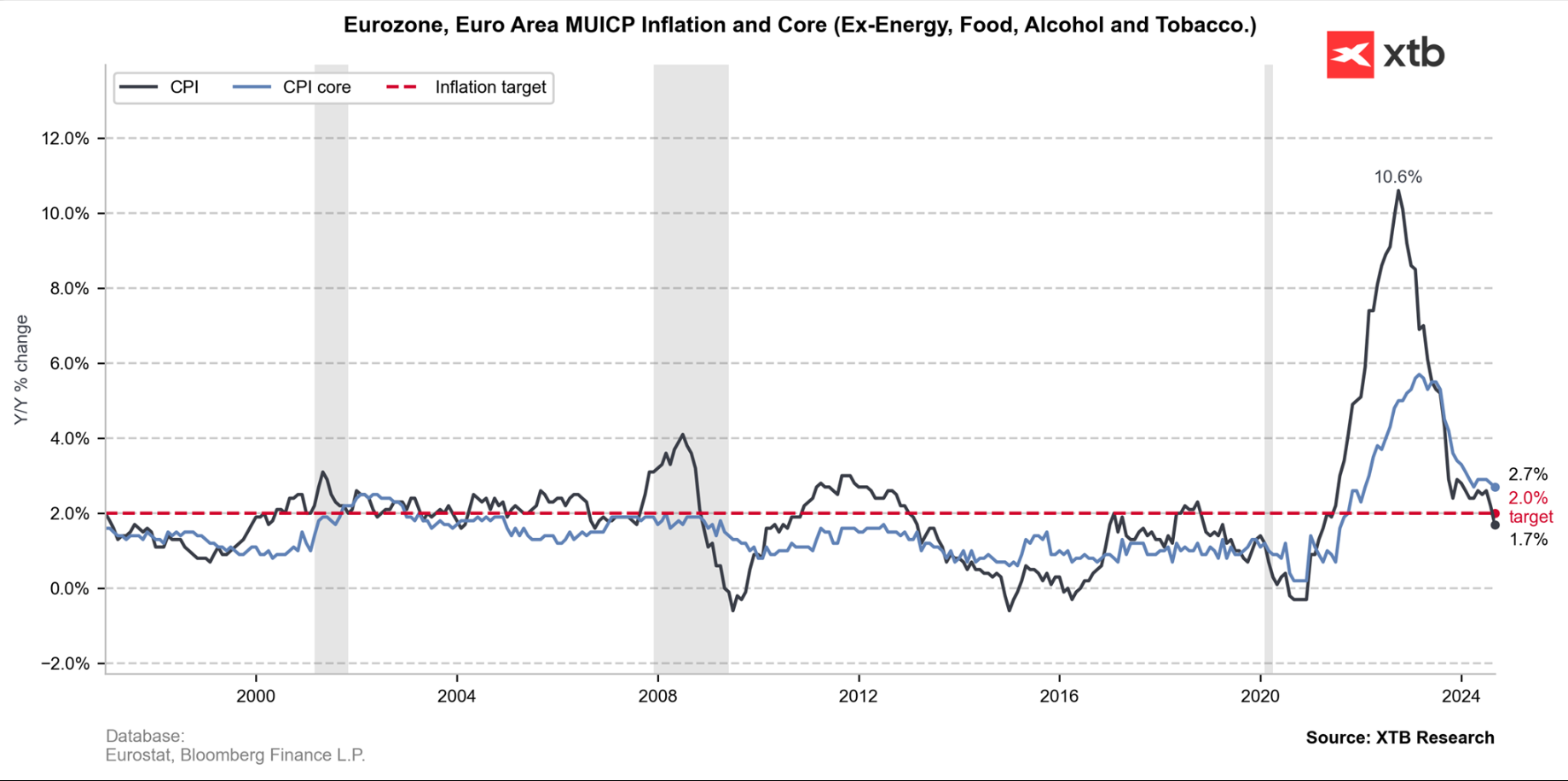

- CPI: actual 1.7% YoY; forecast 1.8% YoY; previous 2.2% YoY;

- CPI: actual -0.1% MoM; forecast -0.1% MoM; previous 0.1% MoM;

- Core CPI: actual 2.7% YoY; forecast 2.7% YoY; previous 2.7% YoY;

- HICP ex Energy and Food: actual 0.0% MoM; forecast 0.1% MoM; previous 0.3% MoM;

- HICP ex Energy & Food: actual 2.7% YoY; forecast 2.7% YoY; previous 2.7% YoY;

Eurostat reported that the euro area's annual inflation rate dropped to 1.7% in September 2024 from 2.2% in August, significantly lower than 4.3% a year earlier; similarly, the European Union's annual inflation decreased to 2.1% from 2.4% in August and 4.9% a year ago; the lowest inflation rates were in Ireland (0.0%), Lithuania (0.4%), and both Slovenia and Italy (0.7%), while the highest were in Romania (4.8%), Belgium (4.3%), and Poland (4.2%); the main contributors to the euro area's inflation were services (+1.76 percentage points), food, alcohol & tobacco (+0.47 pp), and non-energy industrial goods (+0.12 pp), with energy subtracting -0.60 pp from the overall rate.

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)