US, NFP report for May

- Non-farm payrolls: 339k vs 190k expected (253k previously)

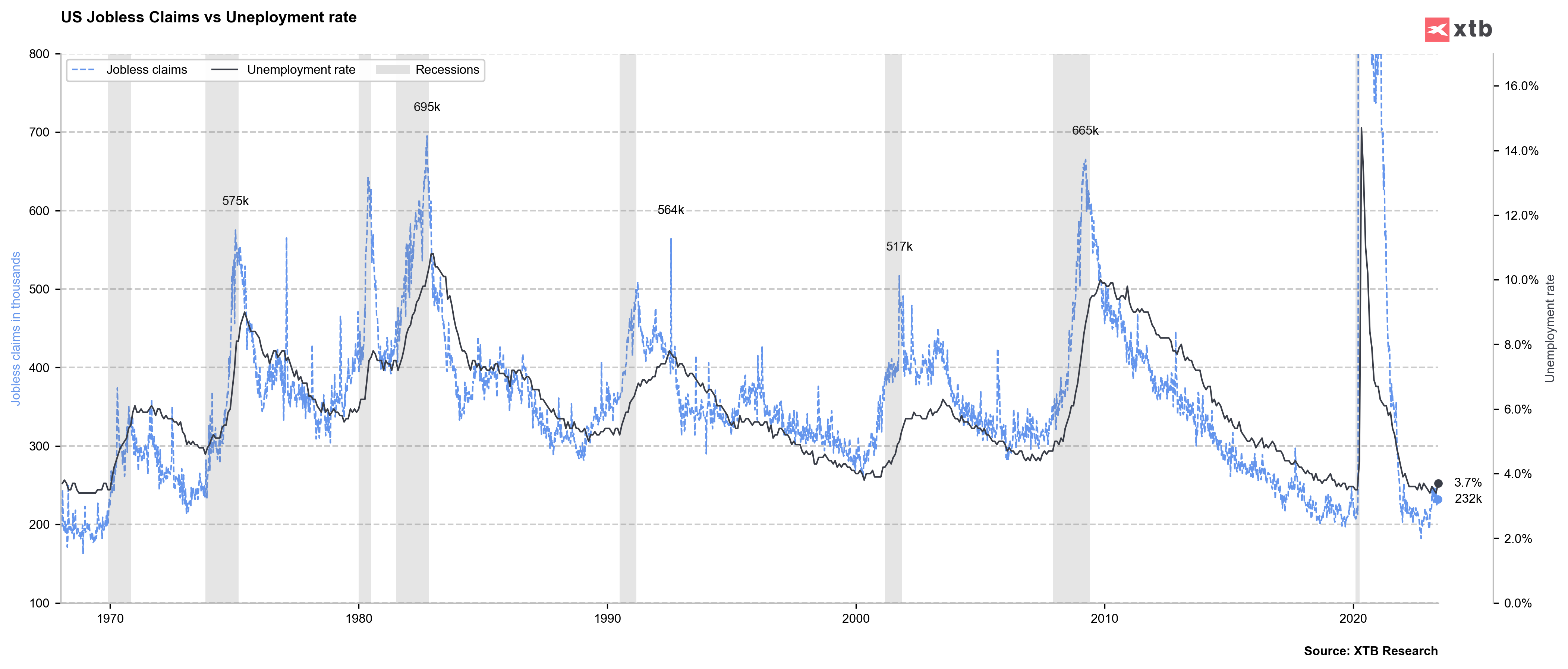

- Unemployment rate: 3.7% vs 3.5% expected (3.4% previously)

- Wage growth (monthly): 0.3% MoM vs 0.3% MoM expected (0.5% MoM previously)

- Wage growth (annually): 4.3% YoY vs 4.4% YoY expected (4.4% YoY previously)

Total nonfarm payroll employment increased by 339,000 in May, and the unemployment rate rose by 0.3 percentage point to 3.7%. Job gains occurred in professional and business services, government, health care, construction, transportation and warehousing, and social assistance.

Private employment from government report and ADP. Source: Macrobond, XTB

Source: Macrobond, XTB

EURUSD is clearly declining, along with a strong increase in yield. Although the unemployment rate is rising, the basis for a interest rate hike in June is significantly stronger. Now we are waiting for inflation data, which will give us the final answer. Theoretically, most recent data has been disinflationary, which could, however, lead to interest rates remaining unchanged in June.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)