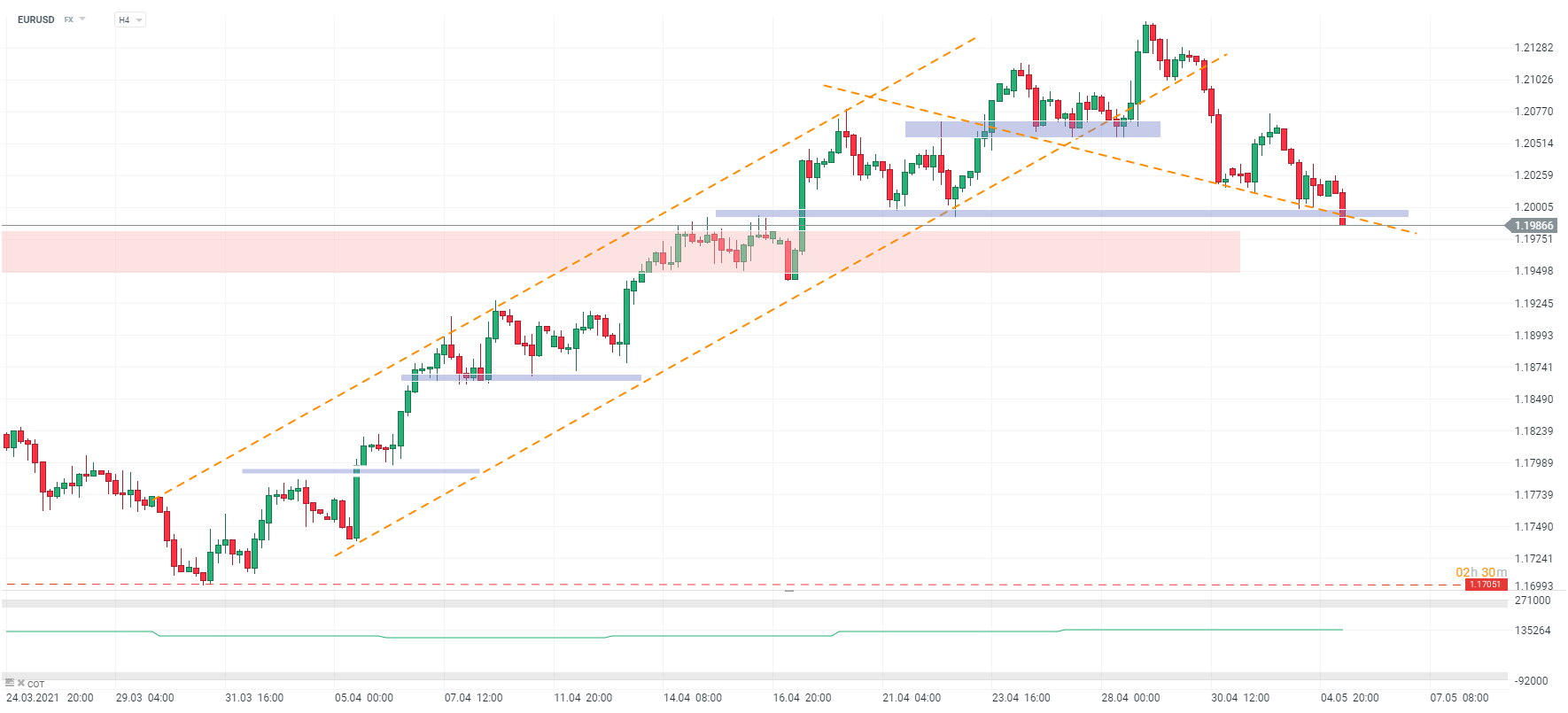

EURUSD dropped below 1.20 amid an increase in US yields. However, it should also be noted that volatility on the US bond market has been relatively limited during yesterday's stock market sell-off.

Main currency pair drops below 1.20 as well as the support zone that may be the neckline of a potential head and shoulders pattern. While this is not a textbook example of the pattern, the range of the pattern points to a potential decline to as low as 1.1880 - slightly above the next key support at 1.1850.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)