01:30 PM BST, United States - Inflation Data for May:

- CPI: actual 0.0% MoM; forecast 0.1% MoM; previous 0.3% MoM;

- CPI, n.s.a: actual 0.17% MoM; previous 0.39% MoM;

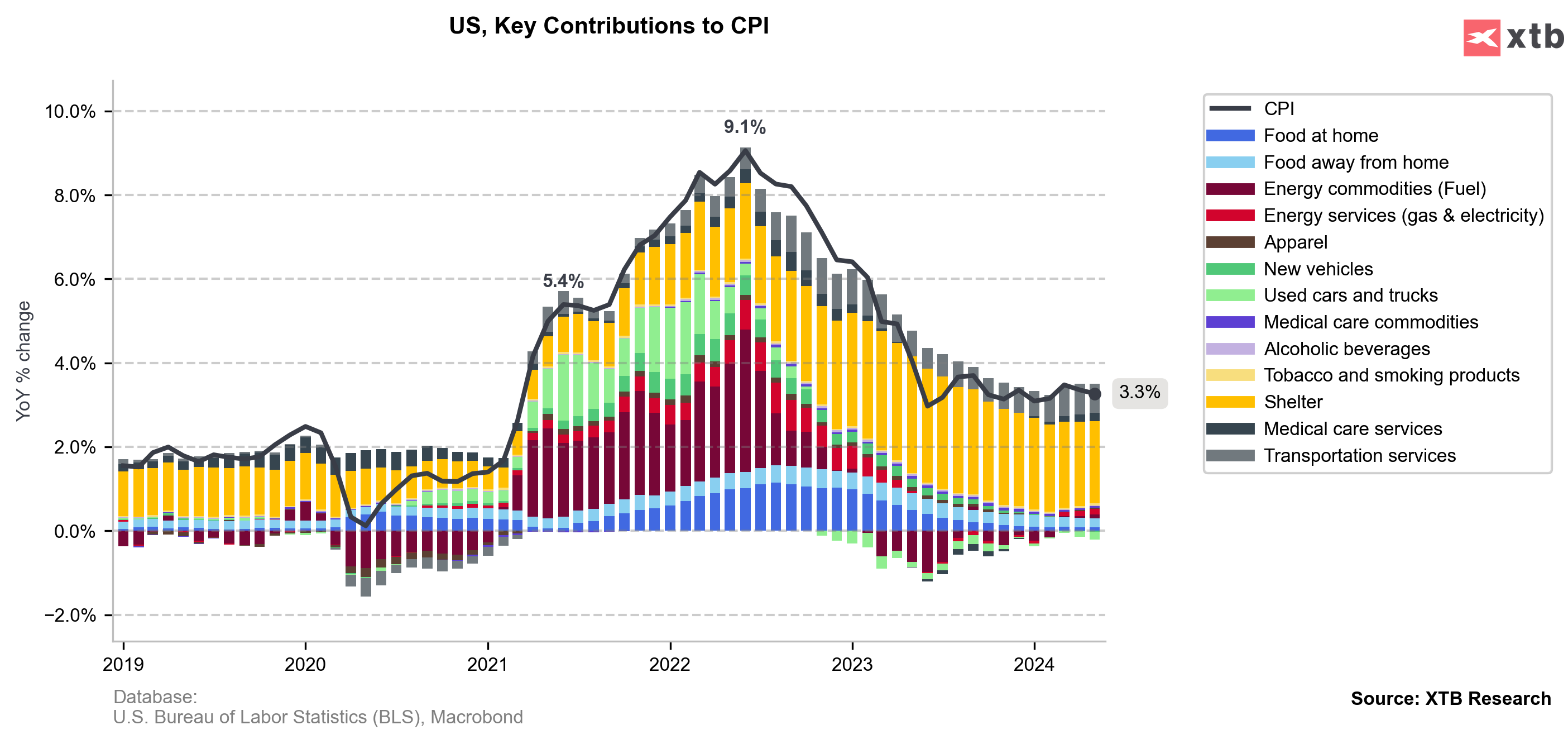

- CPI: actual 3.3% YoY; forecast 3.4% YoY; previous 3.4% YoY;

- Core CPI: actual 3.4% YoY; forecast 3.5% YoY; previous 3.6% YoY;

- Core CPI: actual 0.2% MoM; forecast 0.3% MoM; previous 0.3% MoM;

US short-term interest-rate futures jump after inflation data; traders price in a bigger chance of Fed rate cuts

The market closely watched core services excluding housing and auto insurance to differentiate between forward-looking indicators and remnants of past inflation. The market is now fully expecting two FOMC rate cuts this year, with an 80% probability of a cut in September.

On a year-on-year basis, inflation remains high and here the largest negative contribution continues to be used cars. However, investors' attention has focused on the m/m figures, which remained unchanged from April. The only noticeable contribution is shelter prices, which are significantly lagging the rest of the sector. Today's Fed decision could be interesting, in particular Jerome Powell's speech after the decision announcement.

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Daily summary: Markets capitulate under the influence of the Persian Gulf