US, NFP report for June.

- Non-farm payrolls: 209k vs 225k expected (339k previously)

- Unemployment rate: 3.6% vs 3.6% expected (3.7% previously)

- Wage growth (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

- Wage growth (annually): 4.4% YoY vs 4.2% YoY expected (4.4% YoY previously)

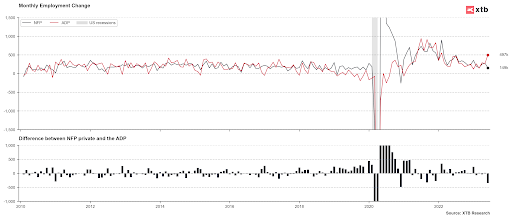

In June, the total nonfarm payroll employment in the United States increased by 209,000, while the unemployment rate remained relatively stable at 3.6%, according to the U.S. Bureau of Labor Statistics. The sectors that experienced employment growth were government, health care, social assistance, and construction. The number of long-term unemployed individuals remained unchanged at 1.1 million, accounting for 18.5%of the total unemployed. The labor force participation rate and the employment-population ratio remained unchanged as well. Additionally, there was an increase in the number of individuals employed part-time for economic reasons. In terms of the establishment survey, nonfarm employment increased by 209,000, with notable growth in government, health care, social assistance, and construction sectors. However, the rate of employment growth has been lower in 2023 compared to 2022. The report also indicated that average hourly earnings increased by 0.4%, and the average workweek remained relatively stable. There were revisions to the employment figures for April and May, resulting in a lower combined employment count than previously reported.

EURUSD thicks significantly higher after the publication, strong US labor market increases the likelihood of rate hikes in the next Federal Reserve (Fed) meeting, M15 interval, source: xStation5

Source: Bloomberg, XTB

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)