US, NFP report for July.

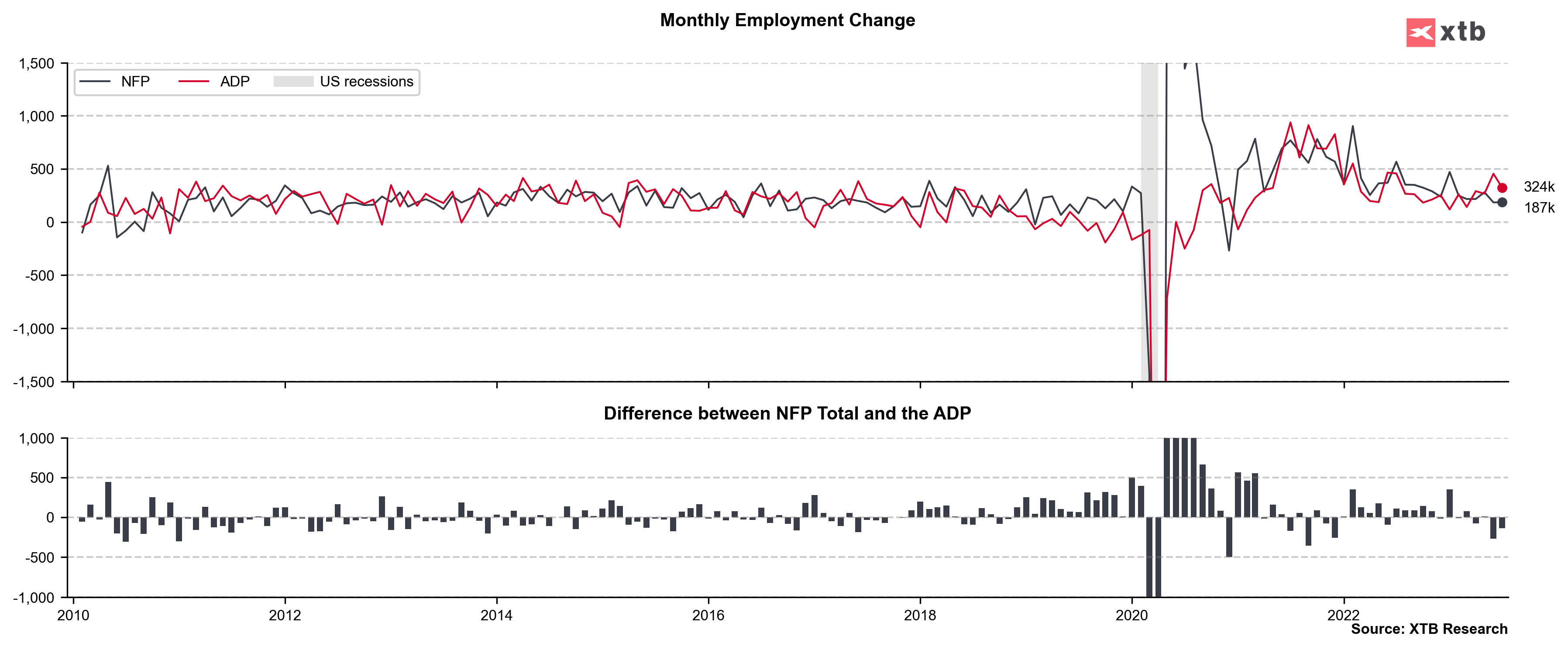

- Non-farm payrolls: 187k vs 200k expected (209k previously)

- Unemployment rate: 3.5% vs 3.6% expected (3.6% previously)

- Wage growth (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

- Wage growth (annually): 4.4% YoY vs 4.2% YoY expected (4.4% YoY previously)

In July, the U.S. total nonfarm payroll employment rose by 187,000, and the unemployment rate remained stable at 3.5%. Job gains were recorded in health care, social assistance, financial activities, and wholesale trade, while other industries saw little change. The unemployment rate for various demographic groups showed minimal fluctuations, with a notable decline for Asians to 2.3%. The number of persons on temporary layoff decreased by 175,000, while the number of permanent job losers remained stable at 1.4 million. The labor force participation rate stood at 62.6%, and the employment-population ratio was 60.4%. The number of part-time workers and those not actively looking for work remained relatively constant. Average hourly earnings increased by 14 cents, and the average workweek decreased slightly. The report also included downward revisions to May and June's total nonfarm payroll employment numbers by 49,000 combined.

EURUSD thicks significantly higher after the publication, strong US labor market increases the likelihood of rate hikes in the next Federal Reserve (Fed) meeting, M15 interval, source: xStation5

EURUSD thicks significantly higher after the publication, strong US labor market increases the likelihood of rate hikes in the next Federal Reserve (Fed) meeting, M15 interval, source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!