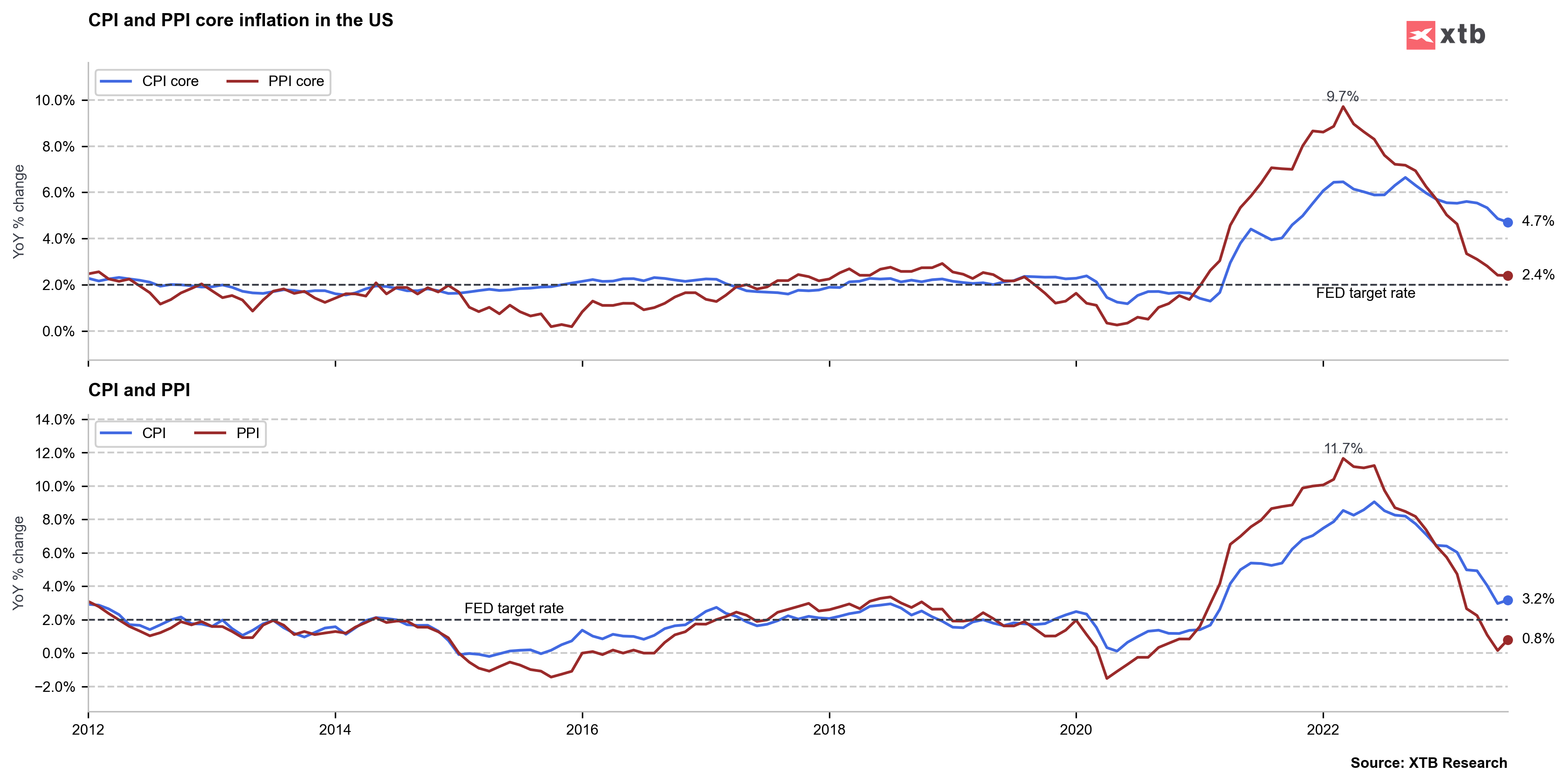

US, PPI inflation for July:

- Headline Annual. Actual: 0.8% YoY. Expected: 0.7% YoY. Previous: 0.1% YoY

- Core Annual. Actual: 2.4% YoY. Expected: 2.3% YoY. Previous: 2.4% YoY

- Headline Monthly: 0.3% MoM. Expected: 0.2% MoM. Previous: 0.1% MoM

- Core Monthly: 0.3% MoM. Expected: 0.2% MoM. Previous: 0.1% MoM

In July, the U.S. Bureau of Labor Statistics reported a 0.3% seasonally adjusted rise in the Producer Price Index for final demand, following unchanged prices in June and a 0.3% decline in May. Over 12 months, the index advanced 0.8%. This increase was influenced by a 0.5% surge in final demand services and a marginal 0.1% rise in final demand goods. Notably, 40% of the boost in final demand services was due to a 7.6% spike in portfolio management prices. The index for final demand services saw its largest uptick since August 2022, while the price of meats within final demand goods jumped by 5.0%. However, prices for diesel fuel dropped significantly by 7.1%.

In July, the U.S. Bureau of Labor Statistics reported a 0.3% seasonally adjusted rise in the Producer Price Index for final demand, following unchanged prices in June and a 0.3% decline in May. Over 12 months, the index advanced 0.8%. This increase was influenced by a 0.5% surge in final demand services and a marginal 0.1% rise in final demand goods. Notably, 40% of the boost in final demand services was due to a 7.6% spike in portfolio management prices. The index for final demand services saw its largest uptick since August 2022, while the price of meats within final demand goods jumped by 5.0%. However, prices for diesel fuel dropped significantly by 7.1%.

EURUSD, M15, source xStation 5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report