UK jobs market report for June was released today at 7:00 am BST. Report was expected to show a weakish 3-month/3-month employment change as well as an up-tick in unemployment rate. Moreover, headline average weekly earnings growth was expected to slow considerably as well.

Actual report turned out to be a big positive surprise. 3-month/3-month employment change beat expectations massively and showed a 97k increase, while the unemployment rate unexpectedly dropped to 4.2%. Headline earnings growth slowed more than expected, while core earnings growth matched expectations.

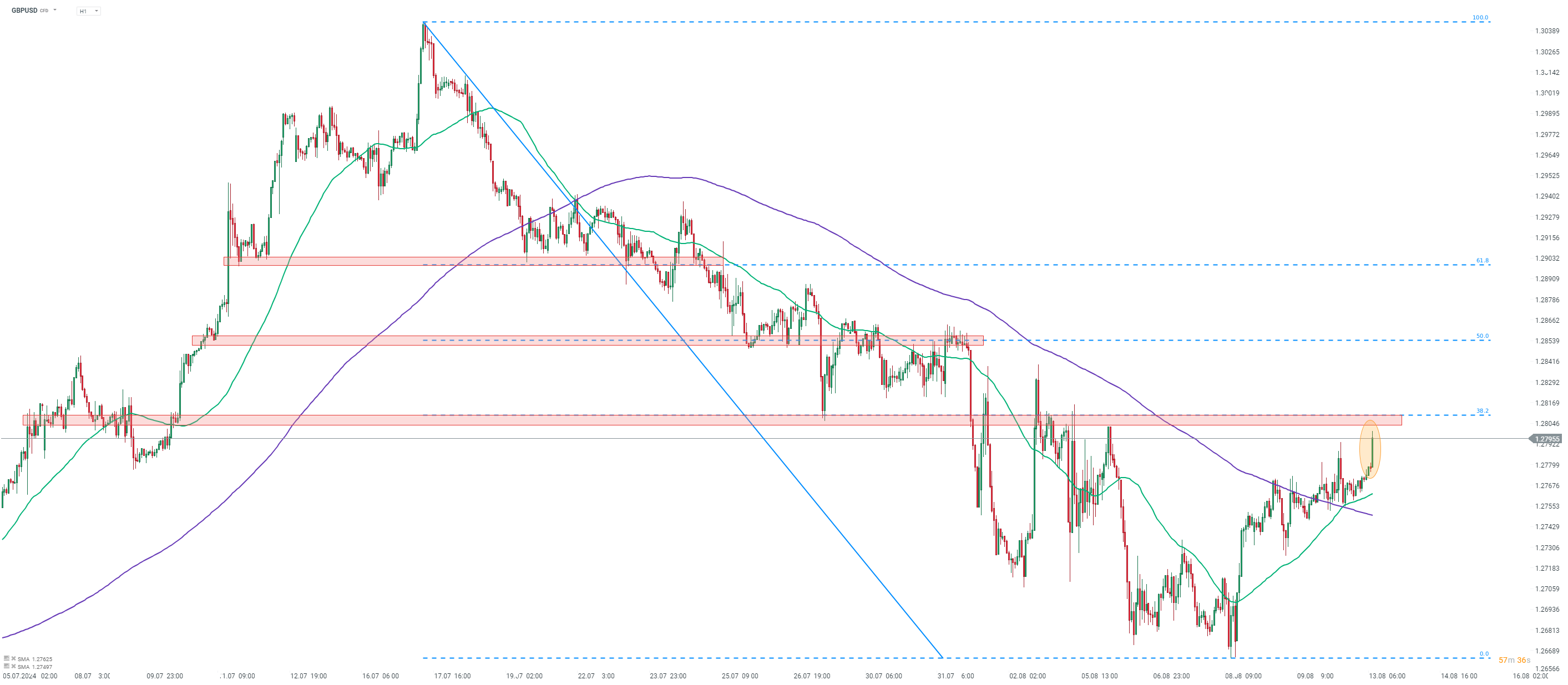

GBP jumped following the release, with GBPUSD climbing to a 1-week high.

UK jobs market data for June

- Employment change (3month/3month): +97k vs +3k expected (+19k previously)

- Unemployment rate: 4.2% vs 4.5% expected (4.4% previously)

- Average weekly earnings: 4.5% YoY vs 4.6% YoY expected (5.7% YoY previously)

- Average weekly earnings (excluding bonuses): 5.4% YoY vs 5.4% YoY expected (5.7% YoY previously)

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉