Flash PMI releases for November are key points in today's economic calendar. Readings captured impact of new coronavirus restrictions.

France (8:15 am GMT)

-

Manufacturing: 49.1 vs 50.1 expected

-

Services: 38 vs 38 expected

Germany (8:30 am GMT)

-

Manufacturing: 57.9 vs 56.5 expected

-

Services: 46.2 vs 46.3 expected

France has imposed much tougher pandemic restrictions and it is perfectly visible in a huge drop of services PMI from 46.5 to 38. French manufacturing gauge dropped into contraction territory, below 50. On the other hand, German manufacturing PMI beat expectations and made just a small drop from 58.2 to 57.9. German services sector remained in contraction territory.

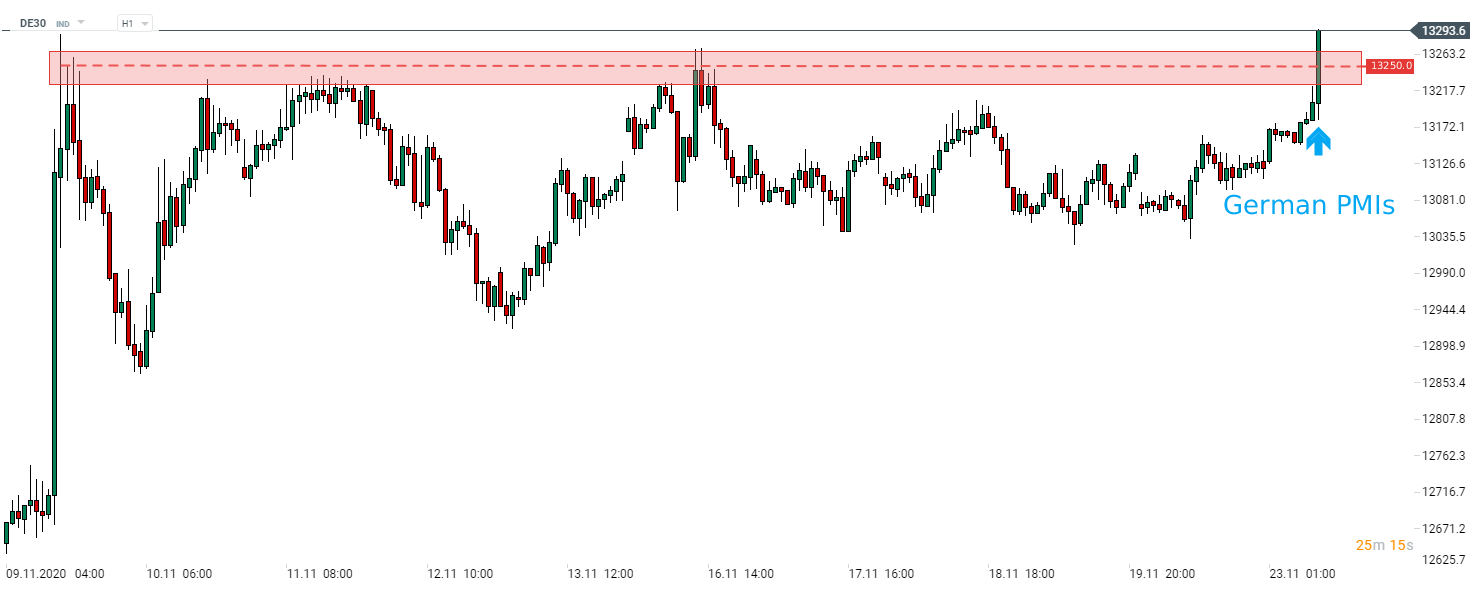

Markets barely reacted to French release but solid data from Germany has triggered gains on the EUR market as well as on the indices from the Old Continent. DE30 jumped above 13,250 pts while EURUSD recovered above 1.1870.

DE30 jumps above upper limit of trading range following German manufacturing PMI beat. Source: xStation5

DE30 jumps above upper limit of trading range following German manufacturing PMI beat. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion