The ISM Non-Manufacturing PMI index for the United States fell to 41.8 in April of 2020 from 52.5 in previous month and above market expectations of 36.8. There is considerable divergence with PMI data. Today, the PMI Index was at 26.7 points with a expectation of 27 points (initial reading) and at the previous reading at 39.8 points.

Employment index at 30 points compared to previous 47. Economic activity index at 26 compared to previous 48 points. Subindex on new orders 32.9 with the previous 52.9. Where is the improvement? The price subindex increases to 55.1 points at the previous level of 50 points. Therefore, it can be seen that a better overall reading should not necessarily be considered a good omen for investors.

The market reacts very little to today's data. EURUSD made up for previous losses and is just below 1.0880. The S&P 500 stays around daily heights, just below 2,880 pts.

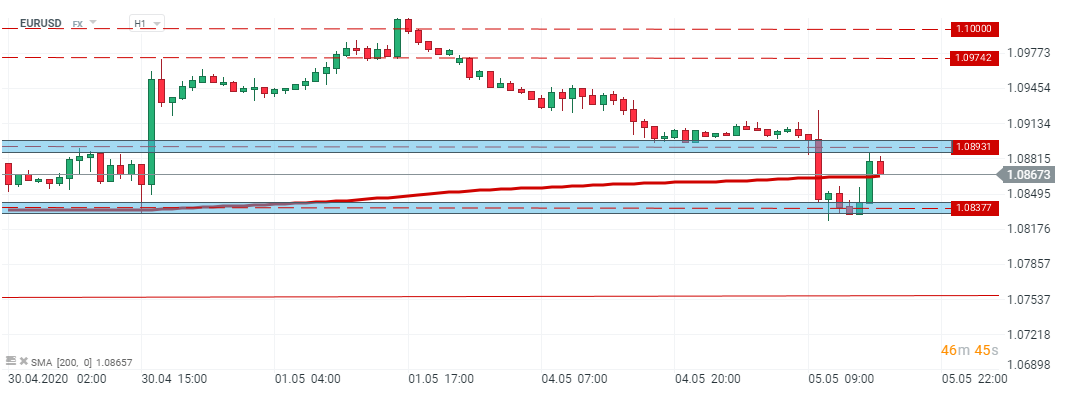

EUR/USD - publication of today's ISM Non-Manufacturing data did not have a significant impact on the EURUSD, which continues its sideways movement. Source: xStation5

EUR/USD - publication of today's ISM Non-Manufacturing data did not have a significant impact on the EURUSD, which continues its sideways movement. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)