Oil prices are on the rise this morning. The move was somewhat puzzling at first as it was quite steep and there was no accompanying news. However, the driver behind the move seems to have just been announced. Media reports suggest that Saudi Arabia will extend its 1 million barrel voluntary output cut for another month (August)! Shortly afterwards Russian Prime Minister Novak said that Russia will reduce oil supply in August by 500 thousand barrels by cutting exports to global markets by 500k bpd in August. Both Brent (OIL) and WTI (OIL.WTI) are trading around 1.4% higher at press time.

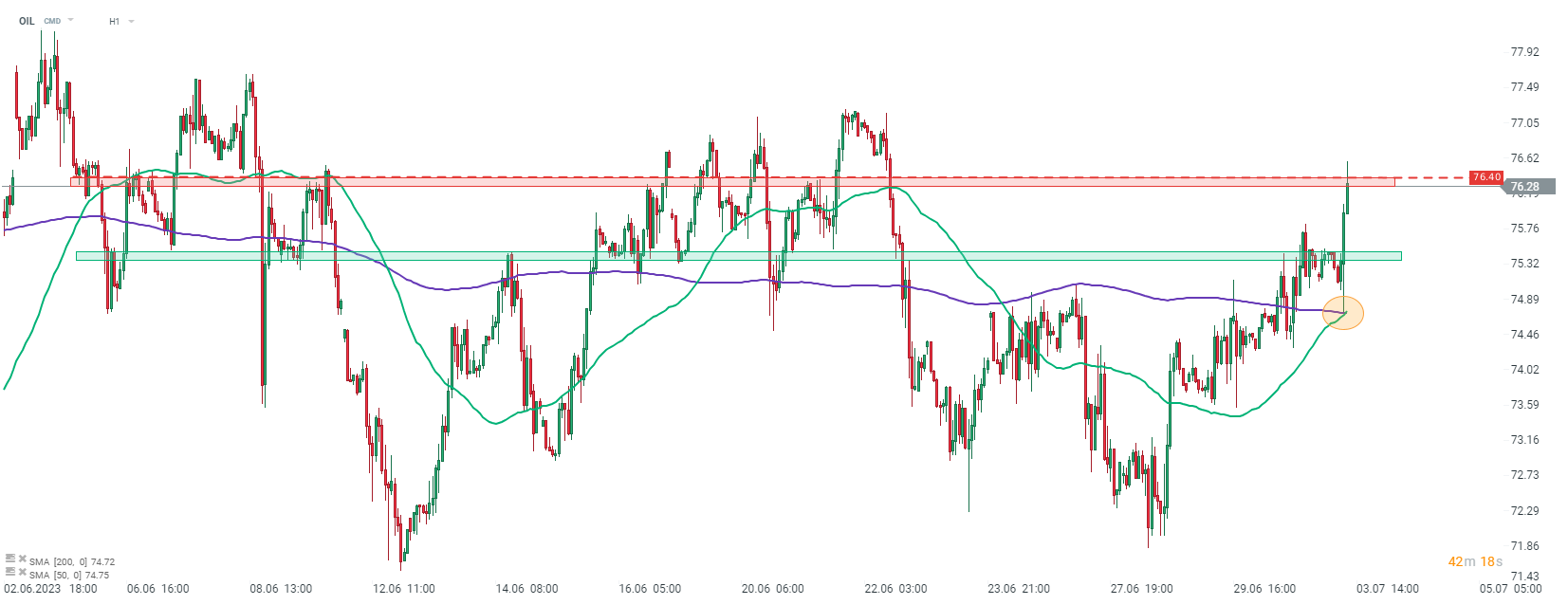

Taking a look at Brent chart (OIL) at H1 interval, we can see that price rested 50- and 200-hour moving averages this morning but failed to break below. A strong upward move was launched afterwards. Note that 50-period moving average broke above the 200-period moving average, painting the so-called 'golden cross' in the process, which is a bullish technical signal.

OIL at H1 interval. Source: xStation5

OIL at H1 interval. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30