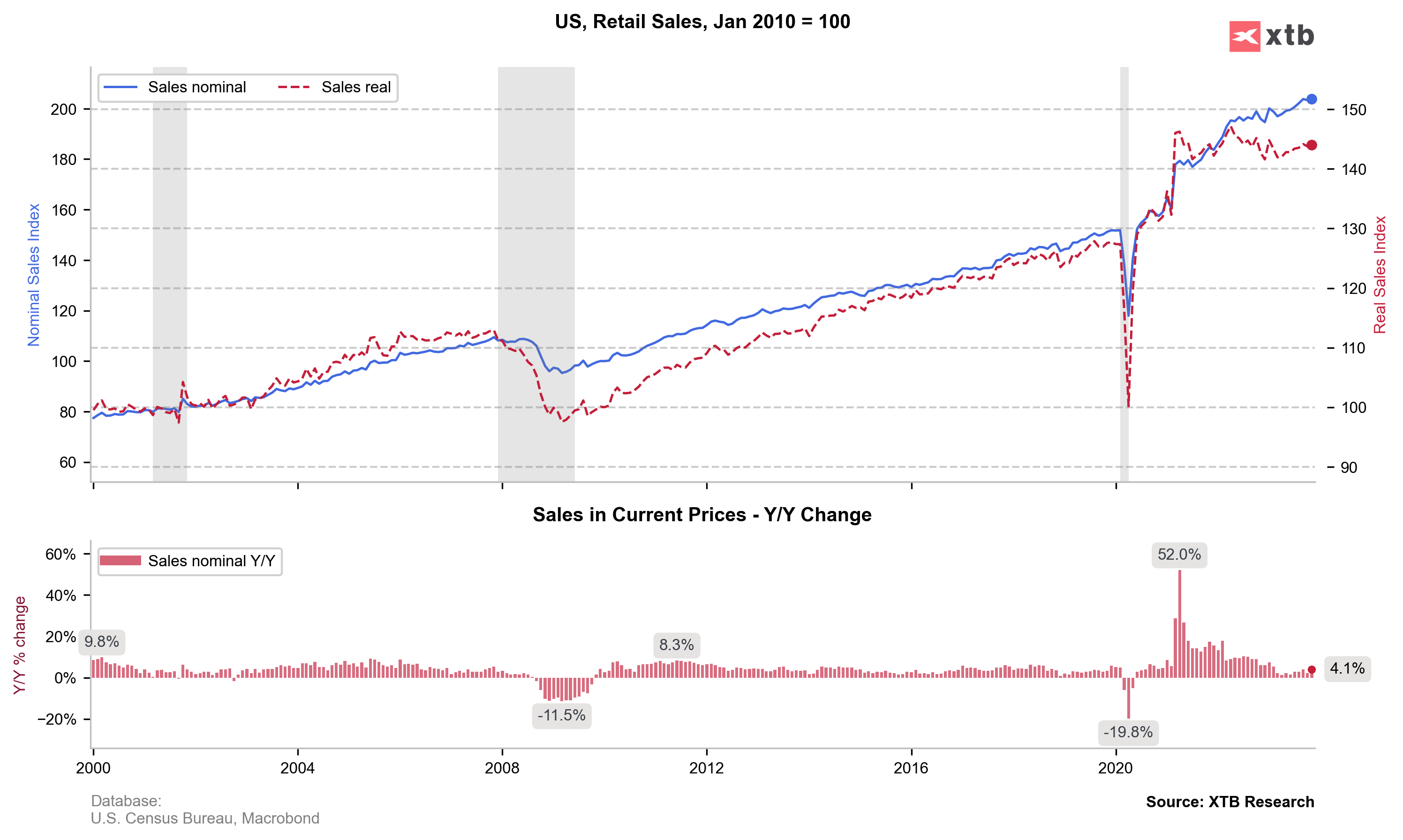

Retail sales in the USA increased by 0.3% month-over-month, against an expected decline of -0.1% month-over-month. The previous decrease was revised from -0.1% month-over-month to -0.2% month-over-month, so the current rebound might be slightly less surprising. Nonetheless, the data are really solid.

Core sales rose by 0.2% month-over-month, against an expected decline of -0.1% month-over-month, and compared to the previous level of 0.0% month-over-month (here, a positive revision from -0.1% month-over-month).

Retail Sales summary:

- Retail Sales MoM Actual 0.3% (Forecast -0.1%, Previous -0.1%, Revised -0.2%)

- Core Retail Sales MoM Actual 0.2% (Forecast -0.1%, Previous 0.1%, Revised 0%)

Jobless Claims:

- Initial Jobless Claims remain at an exceptionally low level. Readings for the last week indicated a decrease again to 202k compared to 220k previously and 220k forecasted.

The dollar reacted with a slight strengthening against the euro to the exceptionally strong data. However, this movement is not significant compared to the movement after today's ECB decision and yesterday's Fed announcement.

Source: xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS