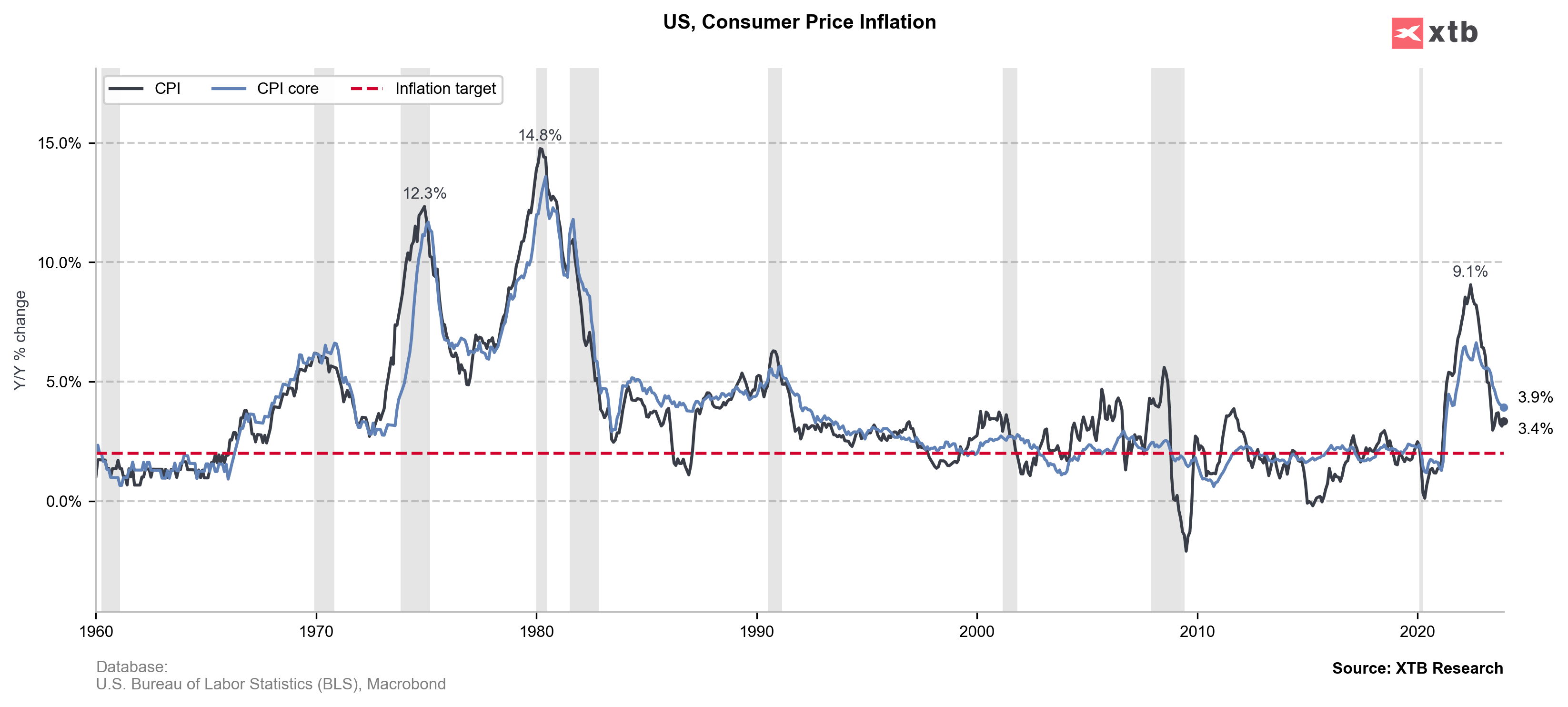

US CPI y/y for December came in: 3.4% vs 3.2% exp. and 3.1% previously

- CPI m/m came in 0.3% vs 0.2% exp. and 0.1% previously

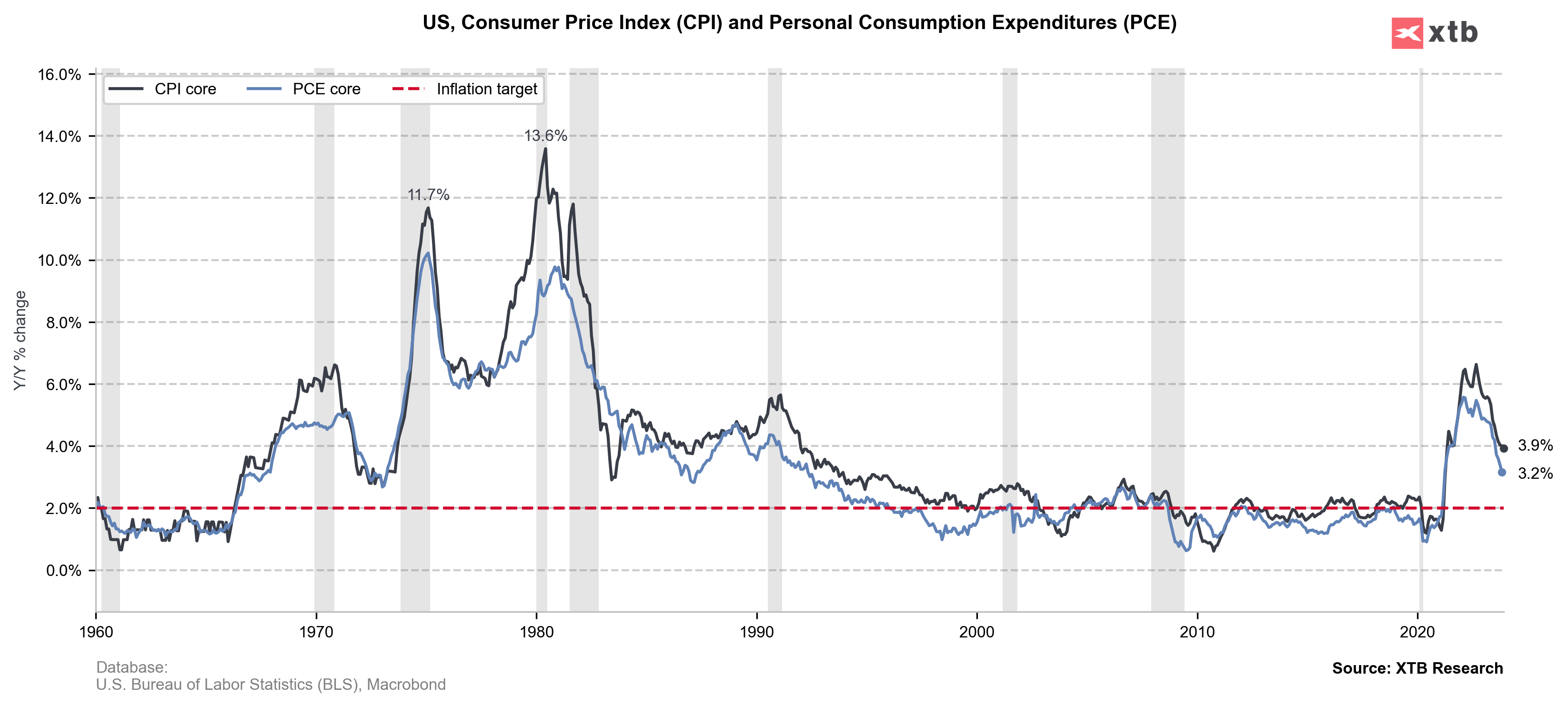

US core CPI y/y: 3.9% vs 3.8% exp. and 4% previously

- US core CPI m/m::0.3% vs 0.3% exp. and 0.3% previously

US jobless claims: 202k vs 210 k exp. and 202k previously

- Continued jobless claims: 1,834M vs 1.8695M and 1.855M previously

Fed swaps are pricing in less total monetary easing through 2024 after the CPI data. Today, key macro reading from US suggests that US economy is still strong and inflationary risks may persist for longer (especially if oil prices arise, which are currently low). The number of jobless claims was again very low with a much lower number of continued claims. On the other hand, surprise in readings wasn't very high and US core CPI reading y/y is still lower than previous one. We can see that some US dollar gains are erased, and Wall Street tries to hold momentum after firstly sharp sell-off reaction.

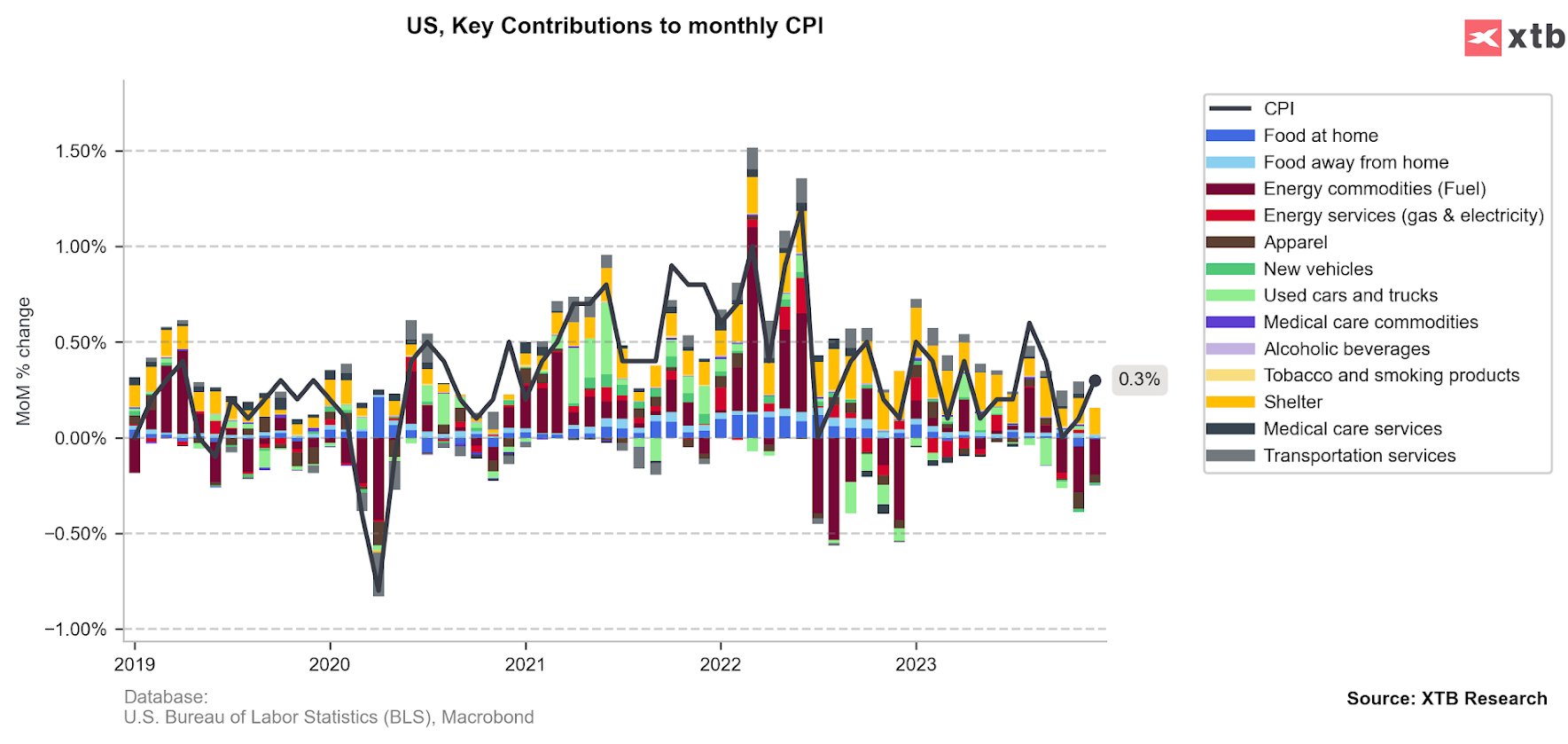

- Shelter was the biggest one contribution to CPI reading (well above 2%) as well as eating away from home (0.2%). The biggest negative effect to inflation were mostly fuel prices and energy.

- Housing costs contributed to more than 50% of the last month CPI, while vehicles insurance and medical care costs were also higher, which may be a sign that price pressures remain quite elevated in services sector

-

US short-term interest-rate futures drop after inflation reading. Traders of futures contracts tied to expected Fed policy rate reduce bullish bets on March rate cuts.

Source: xStation5

Source: xStation5 Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)