12:30 pm GMT - US, CPI inflation for February.

-

Headline. Actual: 6.0% YoY. Expected: 6.0% YoY. Previous: 6.4% YoY

-

Core. Actual: 5.5% YoY. Expected: 5.5% YoY. Previous: 5.6% YoY

Monthly inflation: 0.4% MoM (expected: 0.4% MoM; previous: 0.5% MoM)

Monthly core inflation: 0.5% MoM (expected: 0.4% MoM; previous: 0.4% MoM)

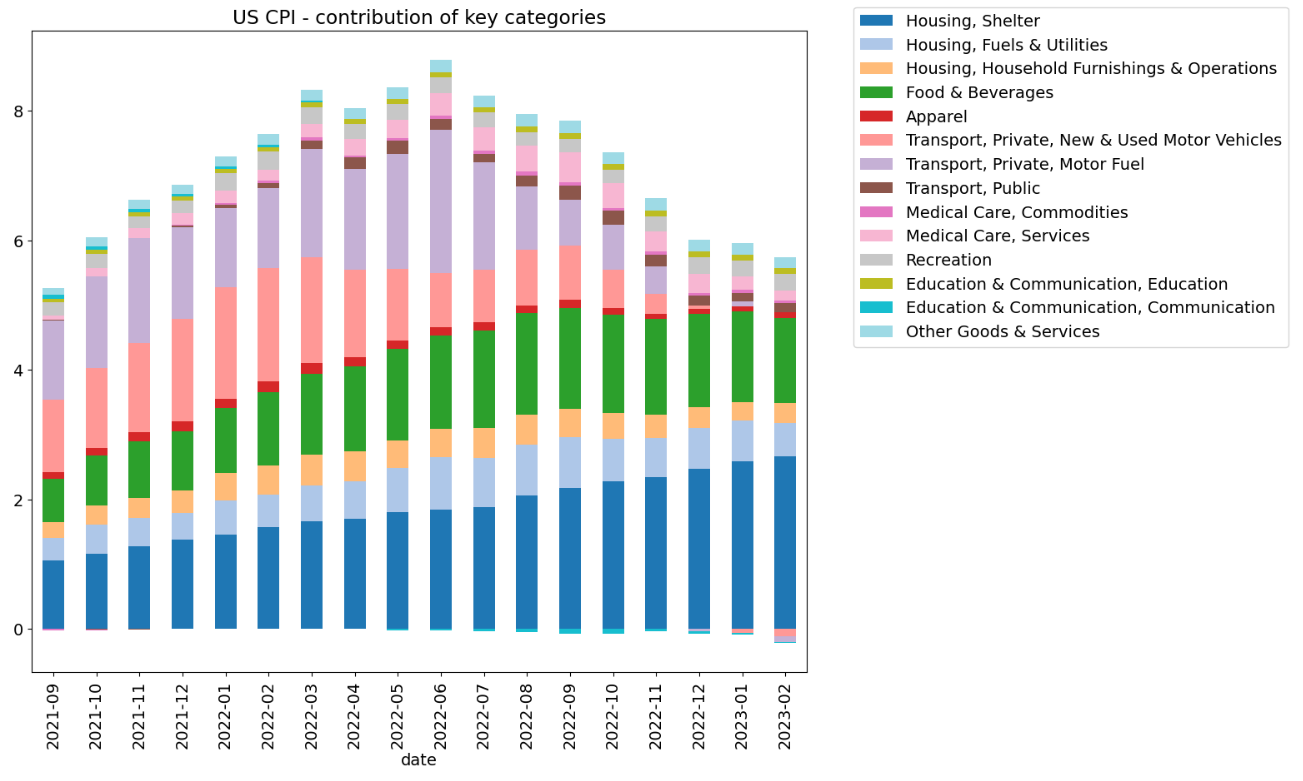

In general, shelter prices surprise sharply upward, a decline seen mainly in Transport, Food and Beverages and Health Care. Source: XTB

US futures in a mixed mood shortly after CPI publication, EURUSD holds above 1.07 support level.

Small year-on-year declines on the side of fuels or energy carriers in housing. Without major declines on this side, we may see a "plateau" in the 5-6% range. Source: Macrobond, XTB

Small year-on-year declines on the side of fuels or energy carriers in housing. Without major declines on this side, we may see a "plateau" in the 5-6% range. Source: Macrobond, XTB

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)