Publication of report from the US Department of Energy caused some moves on the oil market. Crude inventories fell unexpectedly, while gasoline stockpiles dropped more than expected. There was a surprise in distillate inventories data as it showed a big decline.

• Oil inventories: - 1.356 mb vs +2.052 mb expected (API: -1.77 mb)

• Gasoline inventories: -4.728 mb vs -1.334 mb (API: -3.47 mb)

• Distillate inventories: -3.443 mb vs -1.8 mb (API: -4.05 mb)

• Oil inventories at Cushing, Oklahoma: +0.273 million barrels vs +0.692 million barrels previously

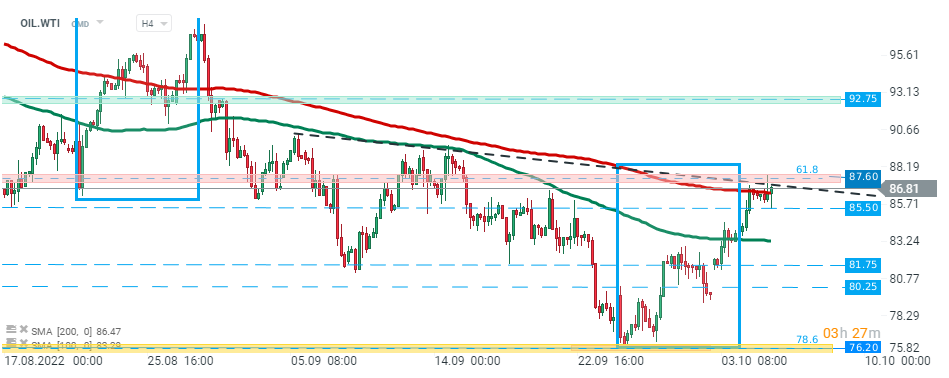

WTI Crude Oil (OIL.WTI) price is testing major resistance zone around $87.60. Source:xStation5

WTI Crude Oil (OIL.WTI) price is testing major resistance zone around $87.60. Source:xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion