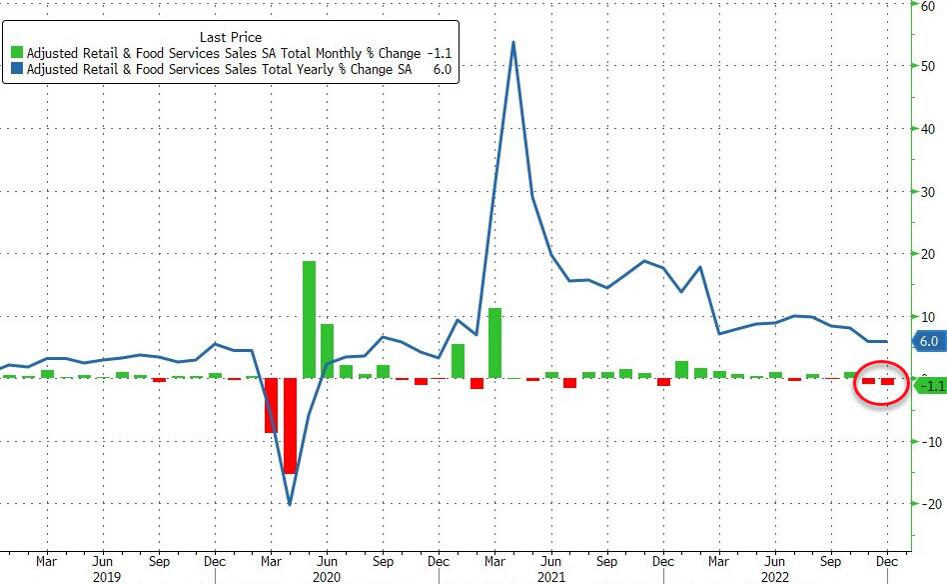

US retail sales data for December was released at 1:30 pm GMT. Report turned out to be weaker than expected and caused some moves on the markets. Highlights of the report:

• Headline: .-1.1% MoM vs -0.8% MoM expected (-0.6% MoM previous - upwardly revised to -1.0%)

Sales at gasoline stations recorded the biggest decrease (-4.6%), followed by furniture stores (-2.5%), motor vehicle dealers (-1.2%), electronics and appliances stores (-1.1%), miscellaneous (-1.1%) and nonstore retailers (-1.1%). In contrast, sales were up 0.3% in building materials and garden equipment stores (0.3%) and sporting goods, musical instruments and book sellers (0.1%). Sales at food and beverage stores were flat. Excluding sales at gasoline stations, retail sales were down 0.8%, in another sign of a weaker-than-expected holiday shopping as consumer spending slows amid high inflation and interest rates.

• Ex-autos: -1.1% MoM vs -0.4% MoM expected (-0.2% MoM previous)

Fresh retail sales report showed that 10 of 13 retail categories fell last month. Source: Bloomberg via ZeroHedge

Fresh retail sales report showed that 10 of 13 retail categories fell last month. Source: Bloomberg via ZeroHedge

Source: Census

Source: Census

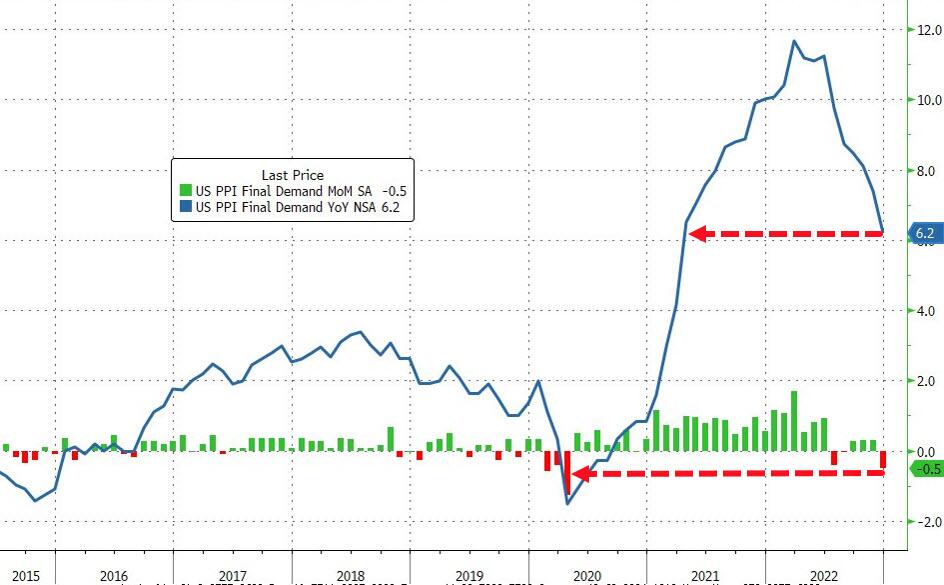

Simultaneously PPI data was released.

- Producer Prices in the US decreased to 6.2%YoY in December, lowest since March 2021, from 7.4% in the previous month, well below market expectations of 6.8%.

- Core PPI decreased to 5.5% YoY in December, lowest since May 2021, following a 6.2% increase in November and below market expectations of a 5.7%. However it rose 0.15 on MoM basis.

PPI fell sharply in December. Source: Bloomberg via ZeroHedge

Retail sales fell sharply for the second month in a row, which hints that customers are suffering from rising prices while PPI inflation is slowing down, which raises hopes that Federal will slow its aggressive tightening in the near future.

EURUSD pair is moving towards resistance at 1.0870. Source: xStation5

CPI OVERVIEW: Further Disinflation Puts Fed In Comfortable Position 🏦

BREAKING: US CPI below expectations! 🚨📉

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure