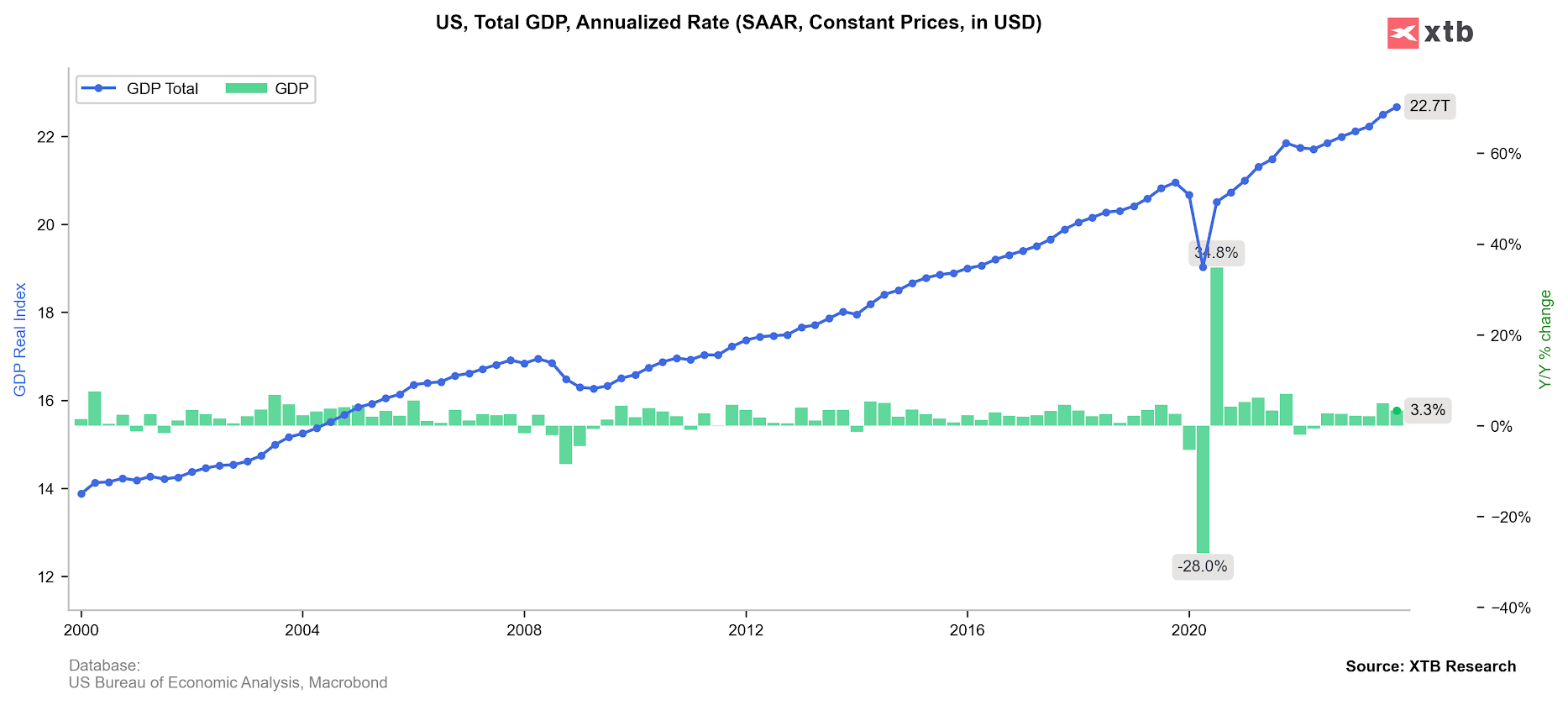

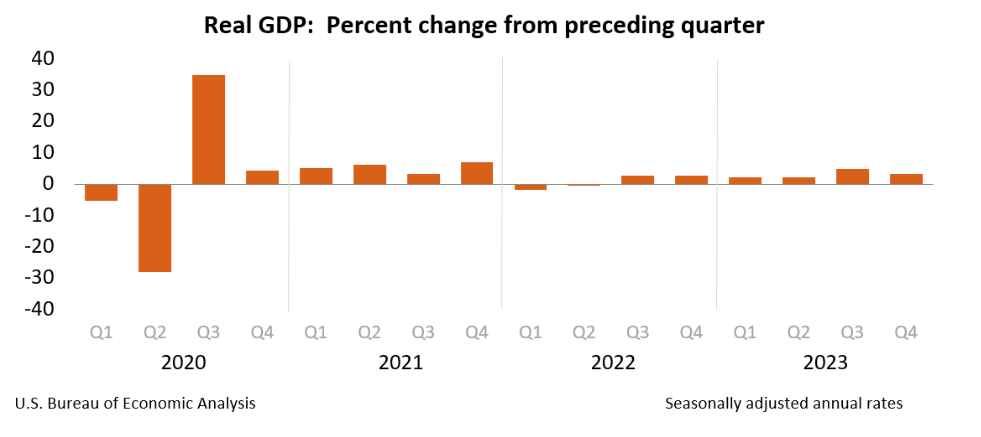

US GDP QoQ Advance: 3.3% vs 2% exp. 4.9% previously

- US GDP Price Index: 1.5% vs 2.2% exp. vs 3.6% previously

- US GDP Deflator: 1.5% vs 3.3% previously

US Core PCE prices: 2% vs 2% exp. and 2% previously

- US PCE Prices Advance: 1.7% vs 2.6% previously

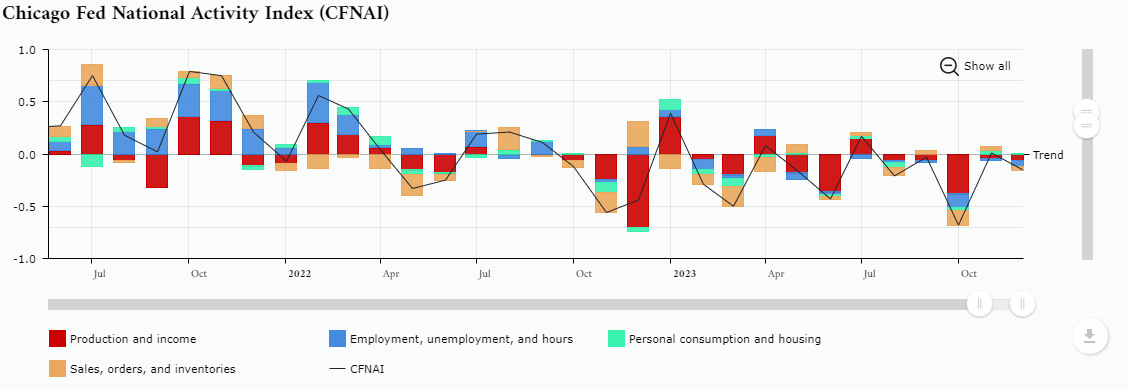

Chicago Fed National Activity Index: -0.15 vs 0.06 exp. and 0.03 previously

US short-term interest-rate futures gain after GDP reading, as speculators add to bets on Fed rate cuts. The data came in good for the stock market, GDP is higher, but price index was lower. Also, a spike in jobless claims fueled US500 gains after key readings from US economy and again regional data, this time from Chicago, surprised markets with a lower than expected reading. The US dollar index (USDIDX) loses slightly, but QoQ GDP reading were much stronger than expected, which signals that US currency may still be in a more favorable position, in a short term.

Source: xStation5

Source: xStation5 Source: US Bureau of Economic Analysis, Macrobond, XTB Research

Source: US Bureau of Economic Analysis, Macrobond, XTB Research

Source: US Bureau of Economic Analysis

Source: CFNAI

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)