Long-awaited US GDP report for Q1 2021 was released today at 1:30 pm BST. Data showed that the US economy grew at an annualized 6.4% QoQ from 4.3% expansion in Q4. Today’s reading came in slightly below market expectations of 6.5%.

Core personal consumer expenditures, the favored measure of inflation at the Federal Reserve, rose to 2.3% year-on-year from 1.3% in the previous month and below consensus estimates of 2.4%.

The number of Americans filling for unemployment benefits was 0.553 million in the week ended April 24th, compared to 0.547 million reported in the previous week. Today’s reading came in above market expectations of 0.549 million. Claims are still far from 200 thousand level reported back in February. Continuing claims reading, which lags initial jobless claims data by one week, dropped to 3.660 million, while analysts expected decrease to 3.61 million. Today’s reading still remain much above the 1.7 million average reported before the pandemic.

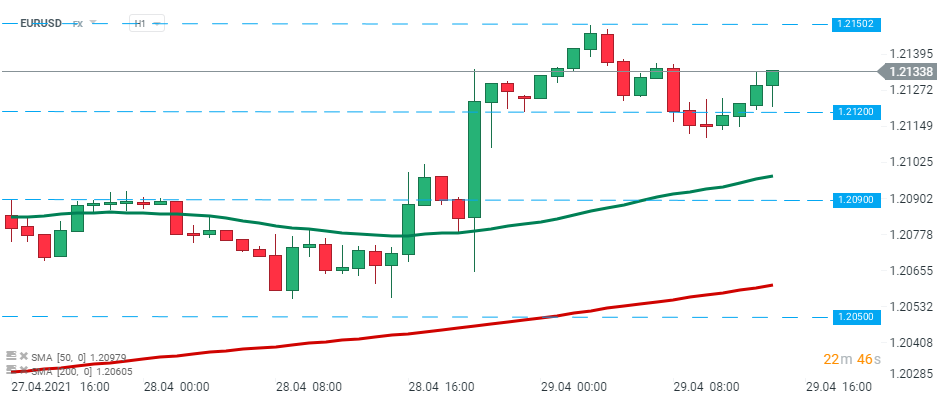

EURUSD rose after today's data releases and is heading towards the resistance level at 1.2150. Source:xStation5

EURUSD rose after today's data releases and is heading towards the resistance level at 1.2150. Source:xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉