01:30 PM BST, United States - GDP data:

- GDP (Q2): actual 3.0% QoQ; forecast 2.8% QoQ; previous 1.4% QoQ;

- GDP Price Index (Q2): actual 2.5% QoQ; forecast 2.3% QoQ; previous 3.1% QoQ;

- GDP Sales (Q2): actual 2.2%; forecast 2.0%; previous 1.8%;

- PCE Prices (Q2): actual 2.5%; forecast 2.6%; previous 3.4%;

- Real Consumer Spending (Q2): actual 2.9%; forecast 2.3%; previous 1.5%;

- Core PCE Prices (Q2): actual 2.80%; forecast 2.90%; previous 3.70%;

01:30 PM BST, United States - Employment Data:

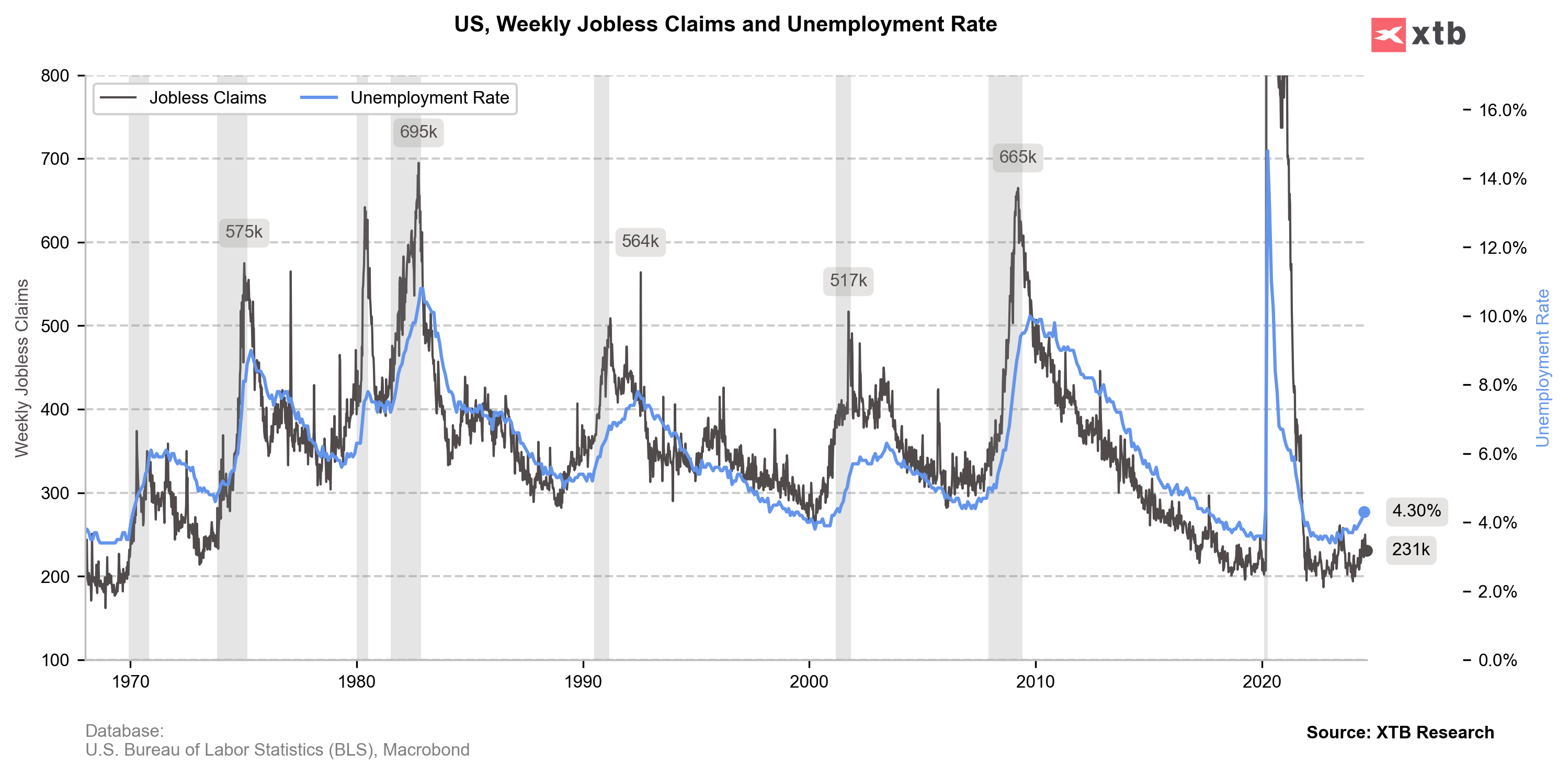

- Initial Jobless Claims: actual 231K; forecast 232K; previous 233K;

- Continuing Jobless Claims: actual 1,868K; forecast 1,870K; previous 1,855K;

- Jobless Claims 4-Week Avg.: actual 231.50K; previous 236.25K;

In the second quarter of 2024, the U.S. real GDP grew by 3.0% annually, up from 1.4% in the first quarter, driven by increases in consumer spending, private inventory investment, and nonresidential fixed investment. This represents an upward revision from the initial estimate of 2.8%. Current-dollar GDP rose by 5.5%, reaching $28.65 trillion. Personal income saw a $233.6 billion increase, while corporate profits rebounded by $57.6 billion after a decline in the previous quarter.

Market reaction is mostly bullish, with the dollar appreciation and decline in EURUSD. Overall, the market views the data optimistically, as a strong economy with decreasing inflationary pressure increases the chances of a soft landing scenario. Additionally, jobless claims do not indicate any deterioration in the labor market.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)