02:45 PM GMT, United States - PMI Data for January:

- S&P Global US Manufacturing PMI: actual 50.7; forecast 50.3; previous 47.9;

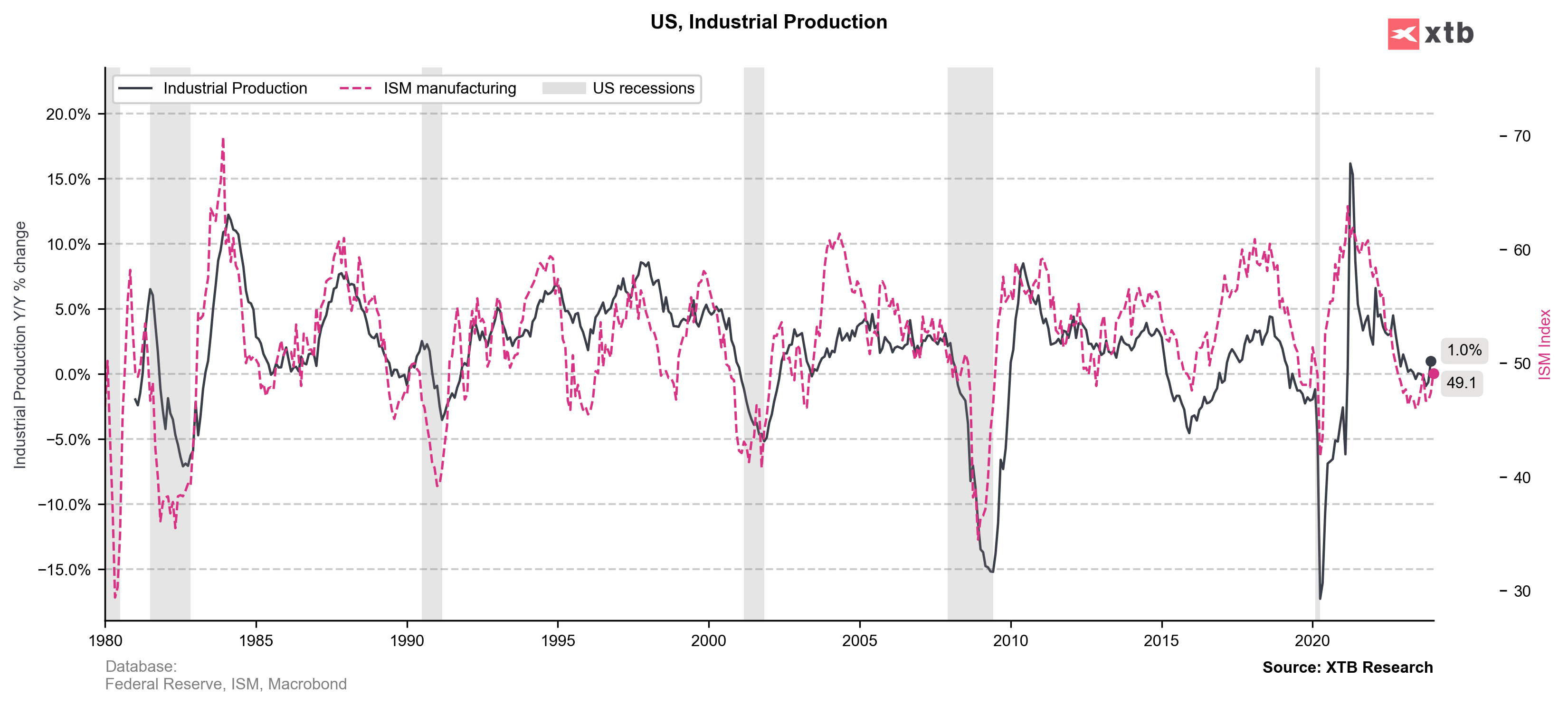

03:00 PM GMT, United States - ISM Data for January:

- ISM Manufacturing New Orders Index: actual 52.5; previous 47.0;

- ISM Manufacturing PMI: actual 49.1; forecast 47.2; previous 47.1;

- ISM Manufacturing Prices: actual 52.9; forecast 46.0; previous 45.2;

- ISM Manufacturing Employment: actual 47.1; previous 47.5;

January 2024 marked the first improvement in the US manufacturing sector since April 2023, as indicated by S&P Global's PMI survey. This modest growth was driven by a rise in new orders and a slower contraction in output, despite challenges like supplier performance decline and longer input deliveries. Input prices escalated due to higher transportation costs, leading to the steepest cost inflation in nine months and prompting firms to increase their selling prices at the fastest rate since April 2023. Employment saw a rise for the first time since September, fueled by greater orders and optimistic output expectations for the year.

Source: xStation 5

Source: xStation 5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀