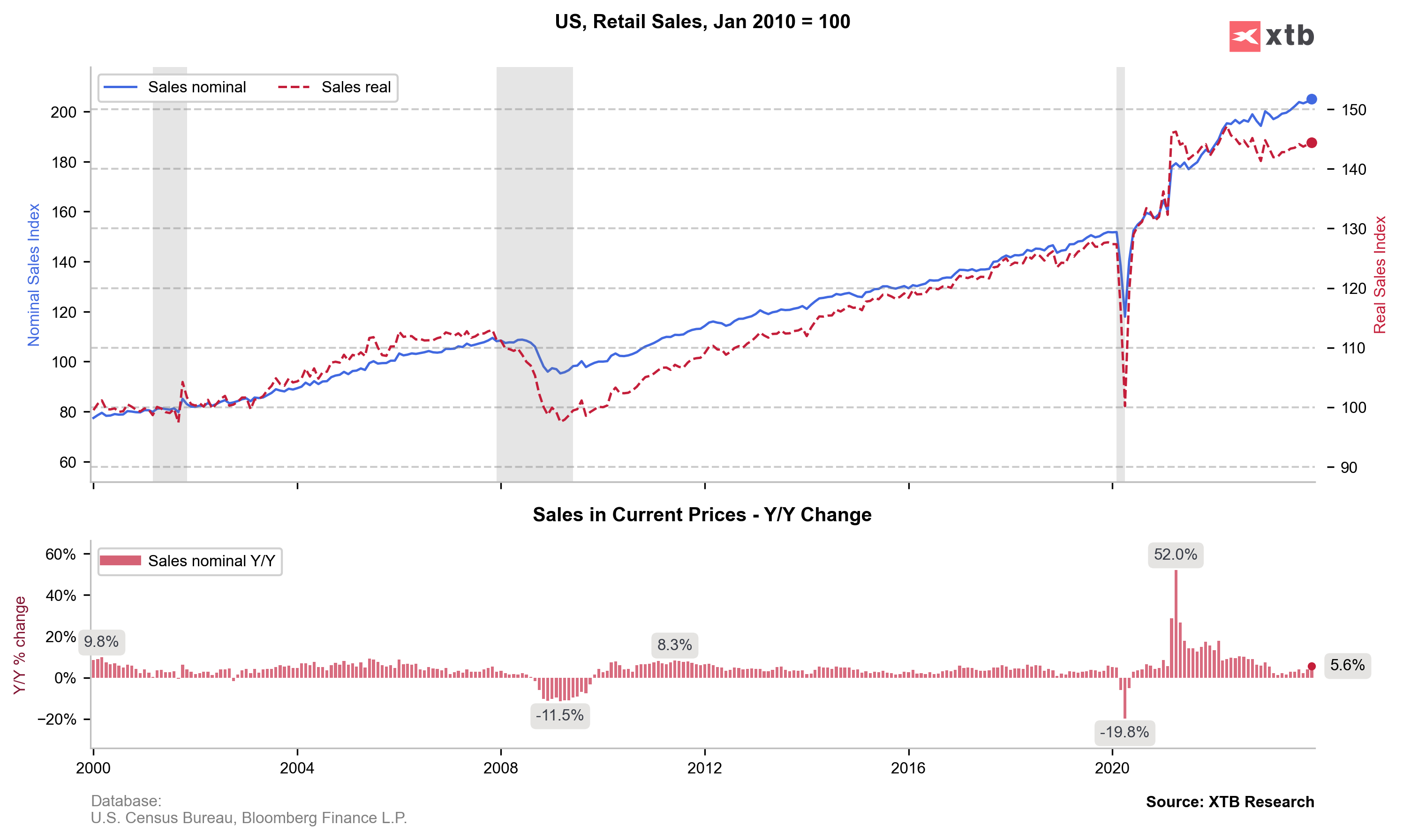

US retail sales reading for December came in 0.6% MoM vs exp. 0.4% exp. and 0.3% previously

- US core retail sales MoM: 0.4% vs 0.2% exp and 0.2% previously

- US retail sales y/y: 5.59% vs 4.09% previously

- US export prices MoM: -0.9% vs -0.7% exp. and -0.9% previously

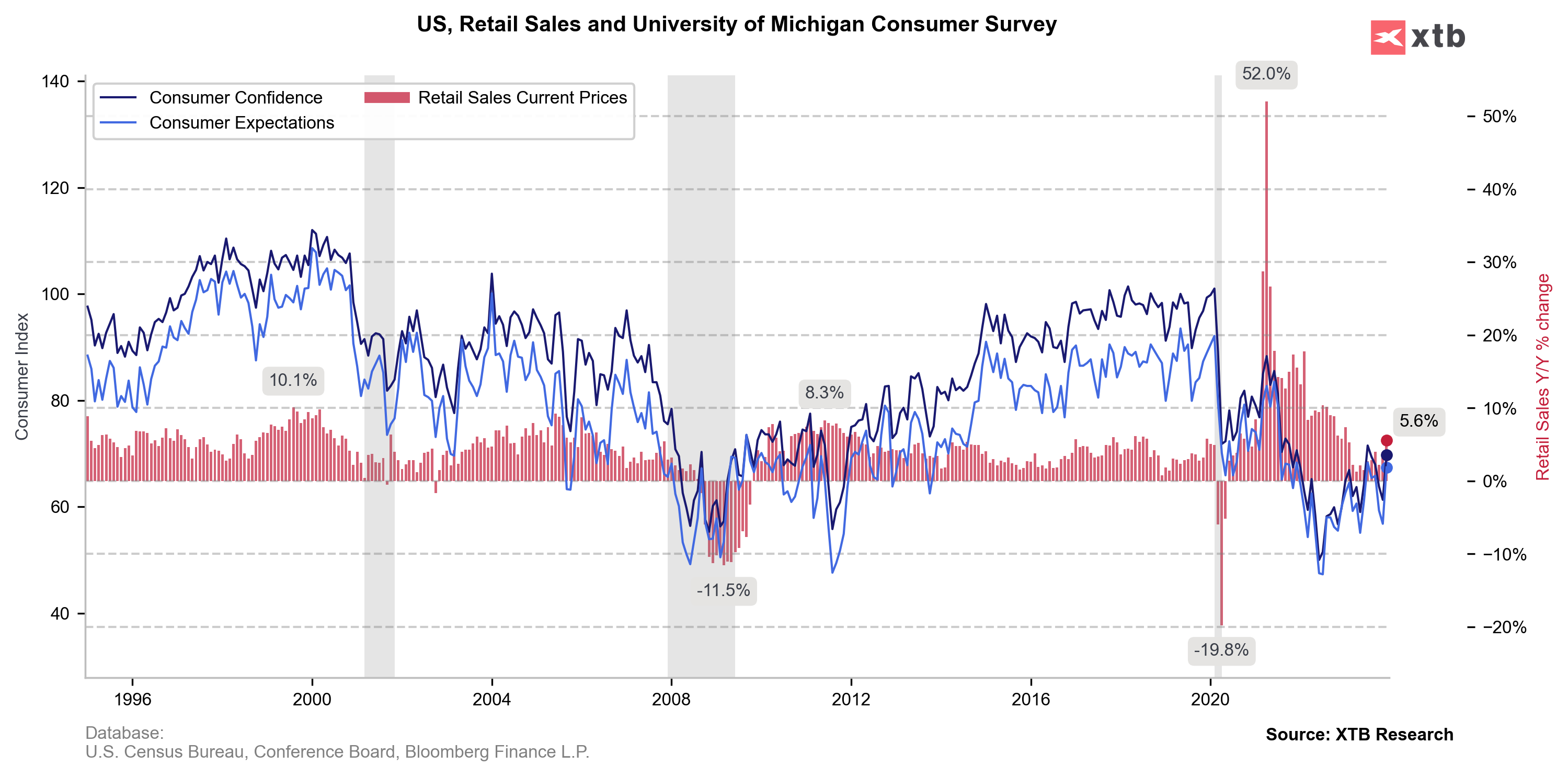

US100 loses after the data, we can see an uptick in yields and bonds under pressure. Also, US short-term interest-rate futures drop after stronger reading. Today, retail sales data suggest that US Consumers are still in good condition. It supported also favorable for US dollar narration of the Fed member Christopher Waller, who signaled yesterday that Fed will be not in hurry cutting rates and the possible scale of easing will be much less than markets expect.

- Despite today data, analysts from Citigroup expect that the Fed will start rates cuts in June vs previously expected July (125 bps of total cuts in 2024 vs 100 bps forecasted before). It's 50 bps higher that Fed Waller signalled yesterday, but the truth is that the future US economy momentum is still unknown.

- For now US economy reflects almost 75% Fed policy transmission, according to IMF analysts and as for now there are some signs that the soft landing is possible. The cost of that is quite persistent inflationary risk, which may signal a 'sea change' in Fed policy (higher rates, for longer). It may be also a sign that the Fed will cut but to higher than expected levels such as 3 or 4% and left rates for longer. In that case, higher risk-free rate may be good for fixed income assets but theoretically less favorable for stocks in the long term.

Source: xStation5

Source: xStation5

Source: Bloomberg Financial LP, US Census Bureau, XTB Research

Source: Bloomberg Financial LP, US Census Bureau, XTB Research

Source: US Census Bureau, Conference Board, Bloomberg Finance LP, XTB Research

Source: US Census Bureau, Conference Board, Bloomberg Finance LP, XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉