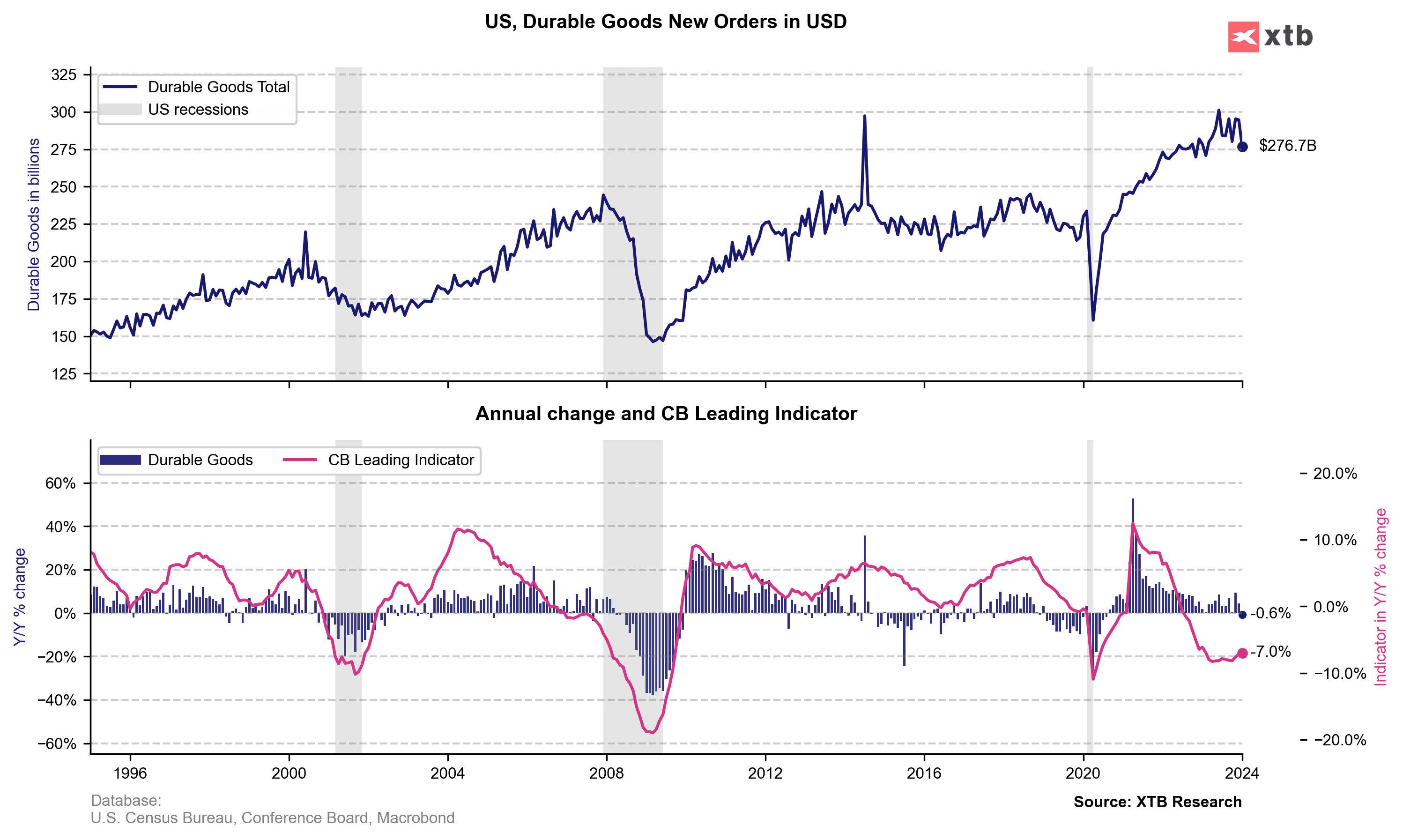

US durable goods orders data for January was released today at 1:30 pm GMT. Report was expected to show a big drop in headline orders as well as a small increase in core orders, that exclude transport.

Actual report turned out to be a disappointment with headline orders dropping more than expected and core orders unexpectedly coming in lower as well. USD took a hit following the release, with EURUSD bouncing off the 50-period moving average at 30-minute interval. Meanwhile, US index futures jumped in a knee-jerk move, but has erased gains later on and turned lower. Nevertheless, scale of moves on USD and equity markets was rather small.

US, durable goods orders for January

- Headline: -6.1% MoM vs -4.5% MoM expected (0.0% MoM previously)

- Ex-transport: -0.3% MoM vs +0.2% MoM expected (+0.5% MoM previously)

EURUSD jumped following disappointing US durable goods orders report for January. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion