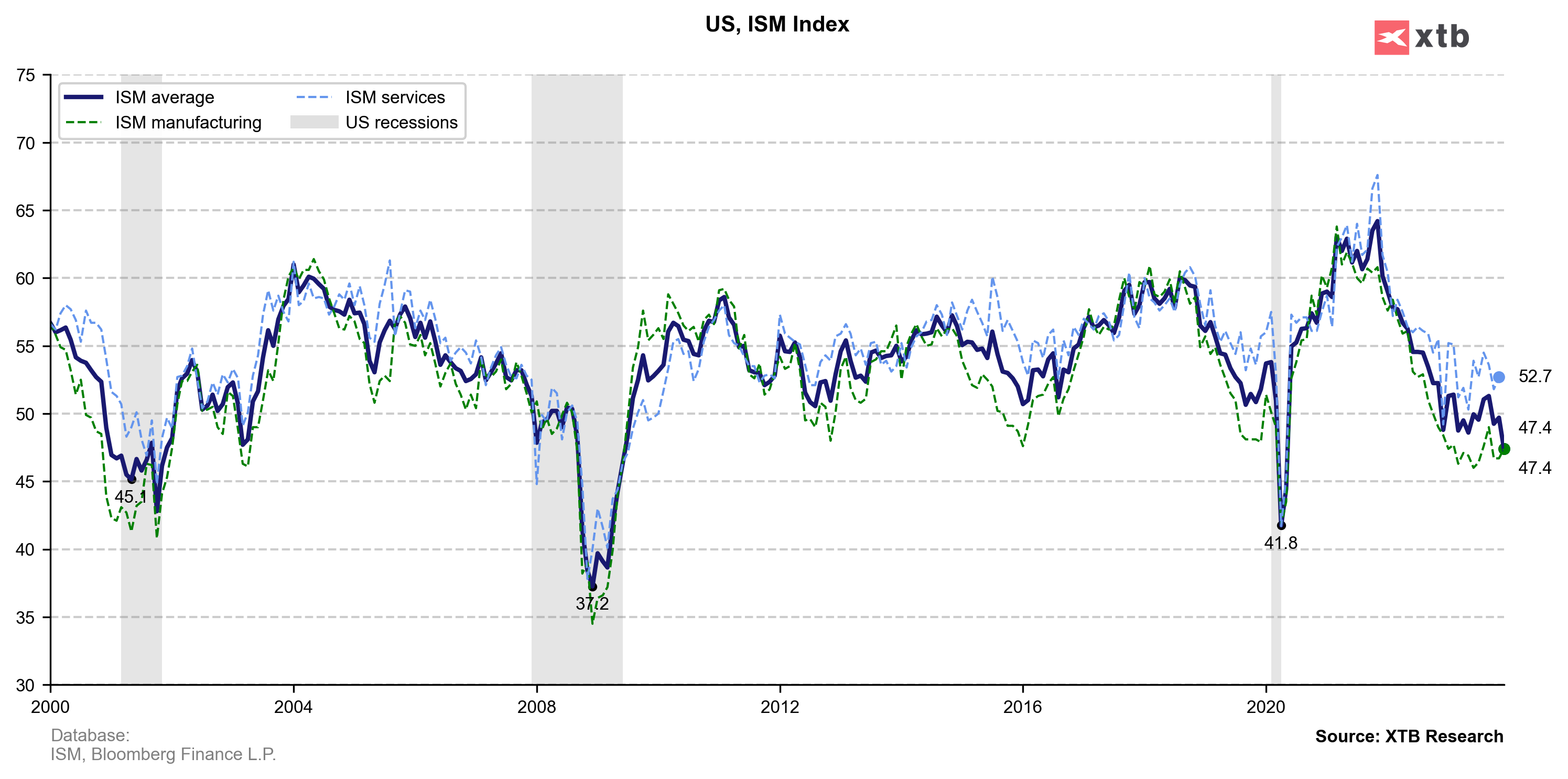

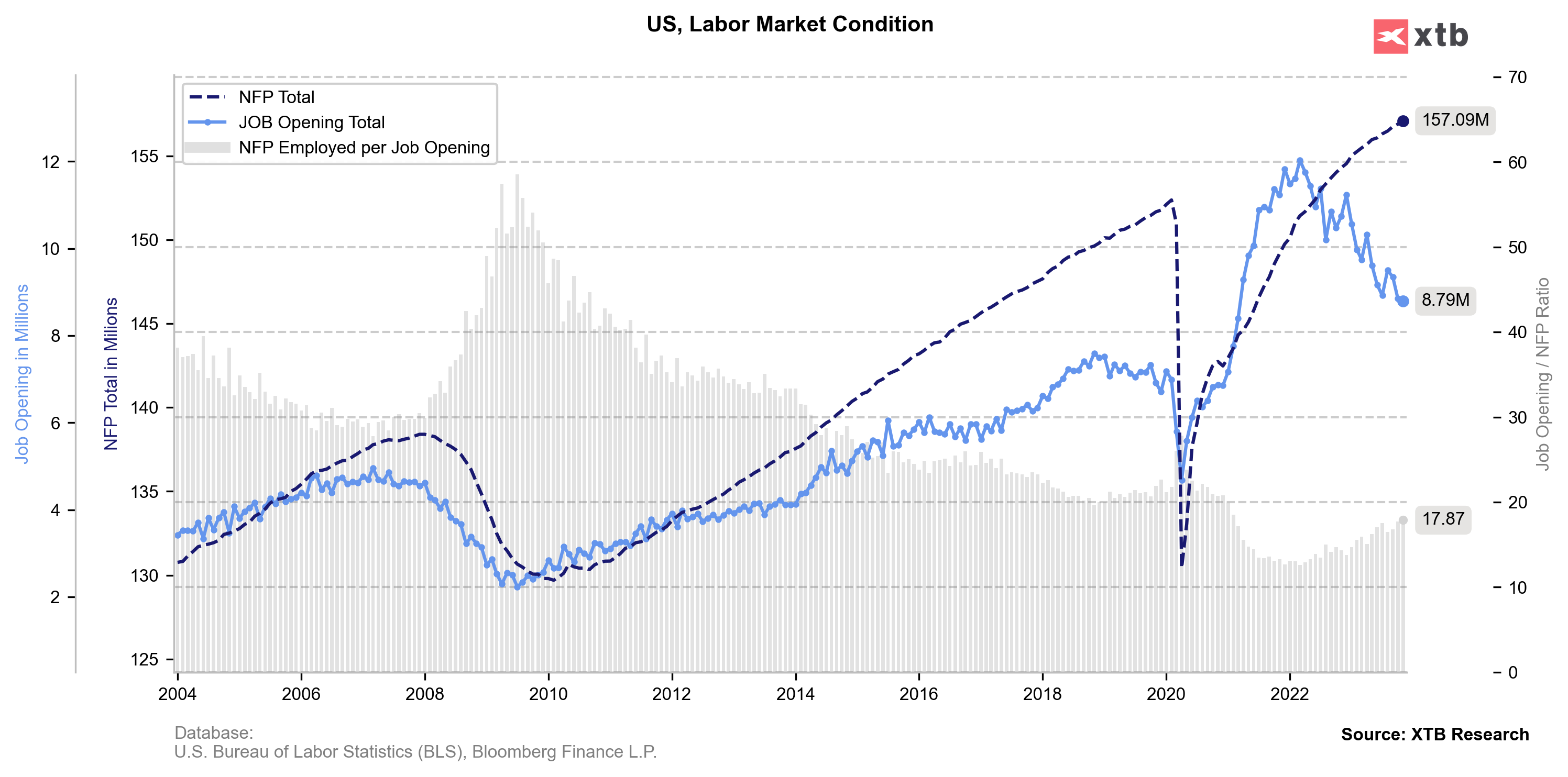

Two closely watched US reports were released today at 3:00 pm GMT - ISM manufacturing index for December and JOLTS report on job openings for November. Headline ISM index was expected to tick higher compared to November, thanks to expected improvement in Employment and New Orders subindices. JOLTS report was expected to show job opening around 1.3% higher than in October, at 8.85 million.

Actual data showed a headline manufacturing ISM coming in higher than expected. However, Prices Paid and New Orders subindices missed expectations and came in lower than a month ago. On the other hand, Employment subindex came in much higher than expected. JOLTS data came in lower-than-expected. Moreover, October's reading was revised higher from 8.73 to 8.85 million. This means that job openings in the United States dropped 0.7% MoM in November instead on an expected increase.

US, manufacturing ISM for December: 47.4 vs 47.1 expected (46.7 previously)

- Employment: 48.1 vs 46.5 expected (45.8 previously)

- Prices Paid: 45.2 vs 49.5 expected (49.9 previously)

- New Orders: 47.1 vs 49.1 expected (48.3 previously)

US, JOLTS report for November: 8.79 million vs 8.85 million expected (8.85 million previously)

US dollar weakened following releases, with EURUSD attempting to break back above the 1.0930 price zone, marked with 50% retracement of the upward move launched in early-December 2023. Source: xStation5

US dollar weakened following releases, with EURUSD attempting to break back above the 1.0930 price zone, marked with 50% retracement of the upward move launched in early-December 2023. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion