US data pack for October, including US PCE inflation, was released today at 1:30 pm GMT. Report was expected to show a slowdown in headline and core PCE inflation as well as slightly lower increase in personal spending and income, than it was the case in September.

Actual report turned out to be in-line with estimates, across almost all measures. In fact, only headline PCE inflation on a monthly basis came in slightly below estimates. Initial jobless claims that were released simultaneously turned out to be slightly lower than expected, while continuing claims came in above expectations.

US, data pack for October

- Headline (annual): 3.0% YoY vs 3.0% YoY expected (3.4% YoY previously)

- Headline (monthly): 0.0% MoM vs 0.1% MoM expected (0.4% MoM previously)

- Core (annual): 3.5% YoY vs 3.5% YoY expected (3.7% YoY previously)

- Core (monthly): 0.2% MoM vs 0.2% MoM expected (0.3% MoM previously)

- Personal spending: 0.2% MoM vs 0.2% MoM expected (0.7% MoM previously)

- Personal income: 0.2% MoM vs 0.2% MoM expected (0.3% moM previously)

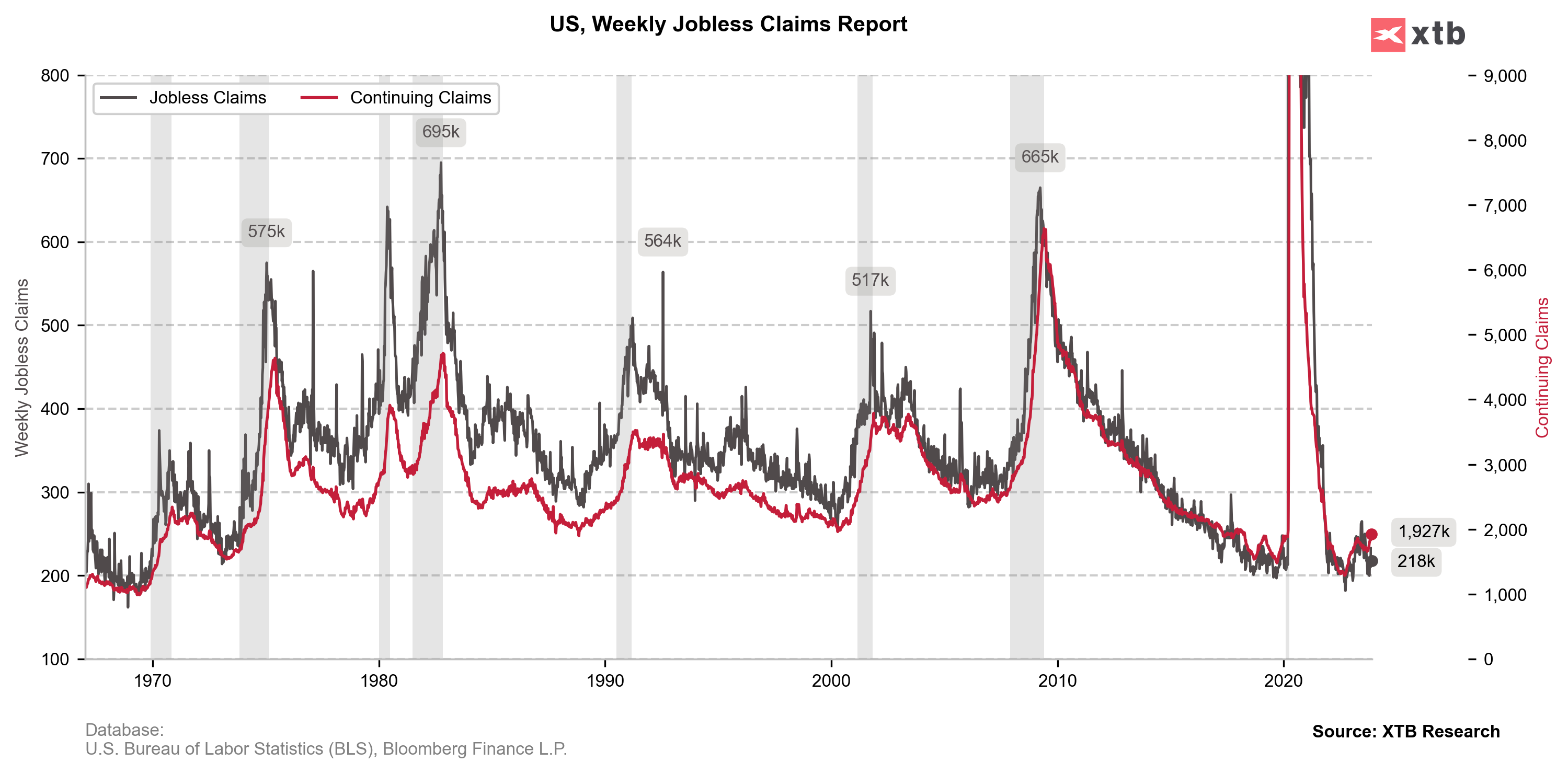

US, jobless claims data

- Initial jobless claims: 218k vs 220k expected (209k previously)

- Continuing jobless claims: 1927k vs 1865k expected (1840k previously)

USD ticked higher following the release but, overall, scale of market reaction was rather small given that the data came in-line with expectations.

Source: xStation5

Source: xStation5

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022