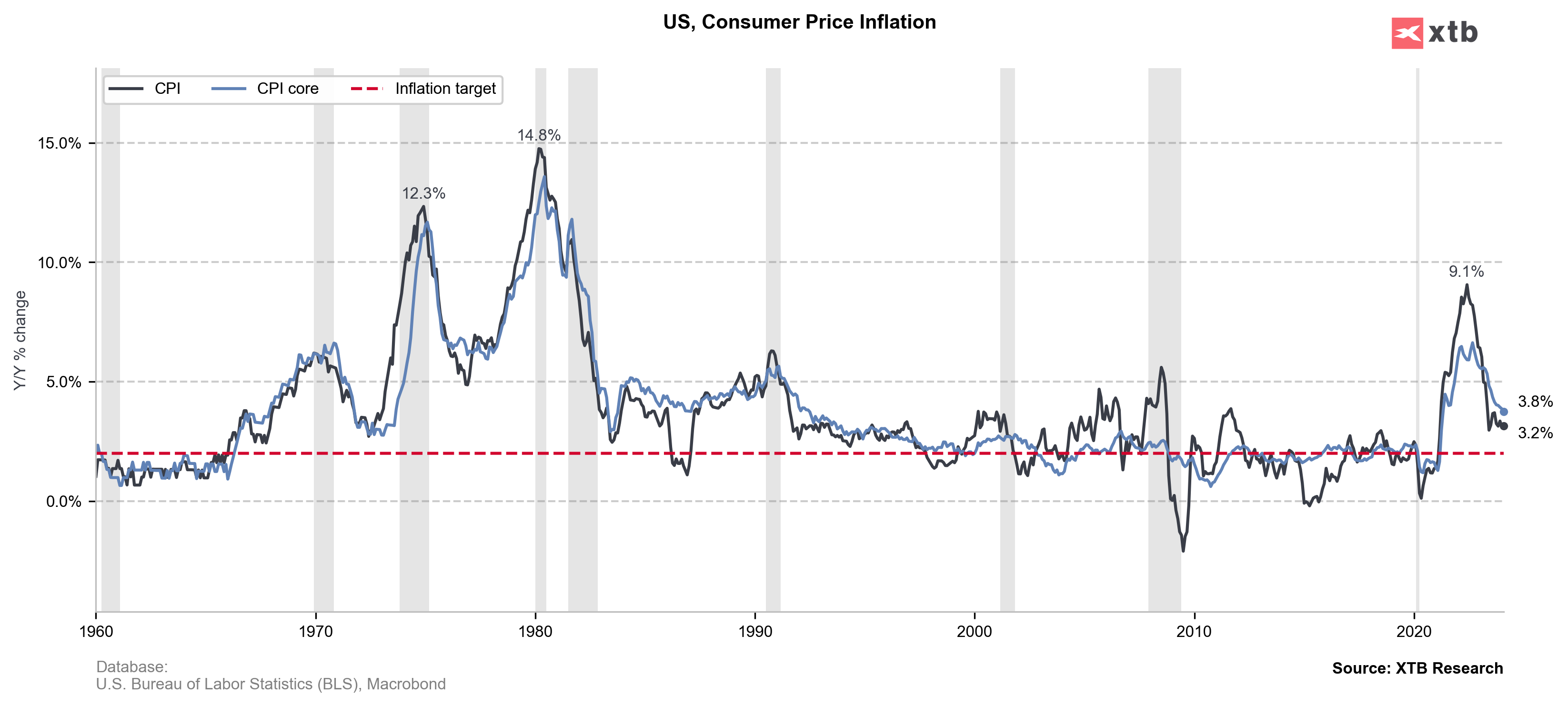

US CPI inflation data for February was released today at 12:30 pm GMT. Report was expected to show a slowdown in core price growth as well as headline price growth remaining unchanged compared to the previous month. The report was watched closely as Fed officials acknowledged that lack of confidence in inflation returning to target is what prevents them from cutting rates now.

Actual report turned out to be a hawkish surprise. Headline price growth unexpectedly accelerated from 3.1 to 3.2% YoY while core price growth slowed less than expected, from 3.9 to 3.8% YoY. Shelter was the biggest contributor to CPI figures, contributing almost 2.1 percentage points to annual reading and almost 0.2% percentage points to the monthly reading.

The release triggered a hawkish reaction in the markets with USD gaining and equities dropping. However, a big part of the post-release drop on EURUSD has been erased already.

US, CPI inflation report for February

- Headline (annual): vs 3.1% YoY expected (3.1% YoY previously)

- Headline (monthly): vs 0.4% MoM expected (0.3% MoM previously)

- Core (annual): vs 3.7% YoY expected (3.9% YoY previously)

- Core (monthly): vs 0.3% MoM expected (0.4% MoM previously)

Source: xStation5

Source: xStation5

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022