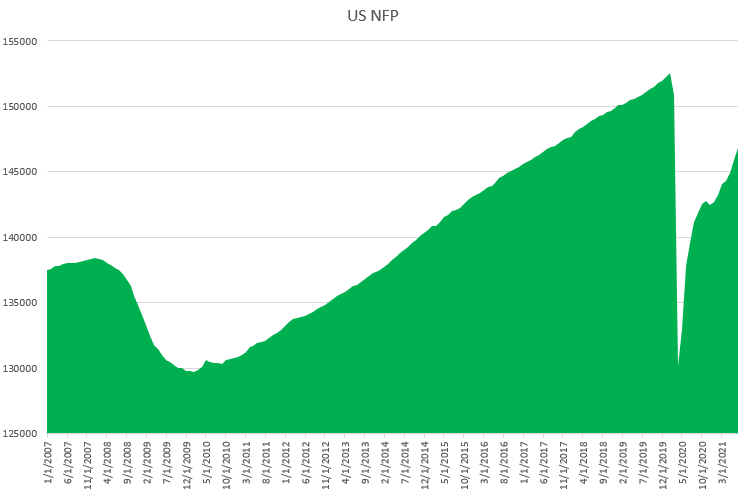

The long-awaited US labour market data for July has just been released. The NFP report turned out to be a positive surprise. The data showed that the US economy added 943k jobs in July. Last month's data was revised to the upside (938k vs previous 850k), which only emphasises that today’s figures are better-than-expected.

-

Nonfarm payrolls: 943k (vs exp. 900k)

-

Unemployment rate: 5.4% (vs exp. 5.7%)

-

Wage growth: 4.0% YoY (vs exp. 3.9% YoY)

Source: Macrobond, XTB Research

Source: Macrobond, XTB Research

How did markets react after the release? The US dollar strengthened and US equity futures gained slightly as well. US500 climbed to fresh all-time highs. Gold and silver plunged on the strong greenback. Gold is now trading below $1,800 an ounce while silver prices fell below $25 mark.

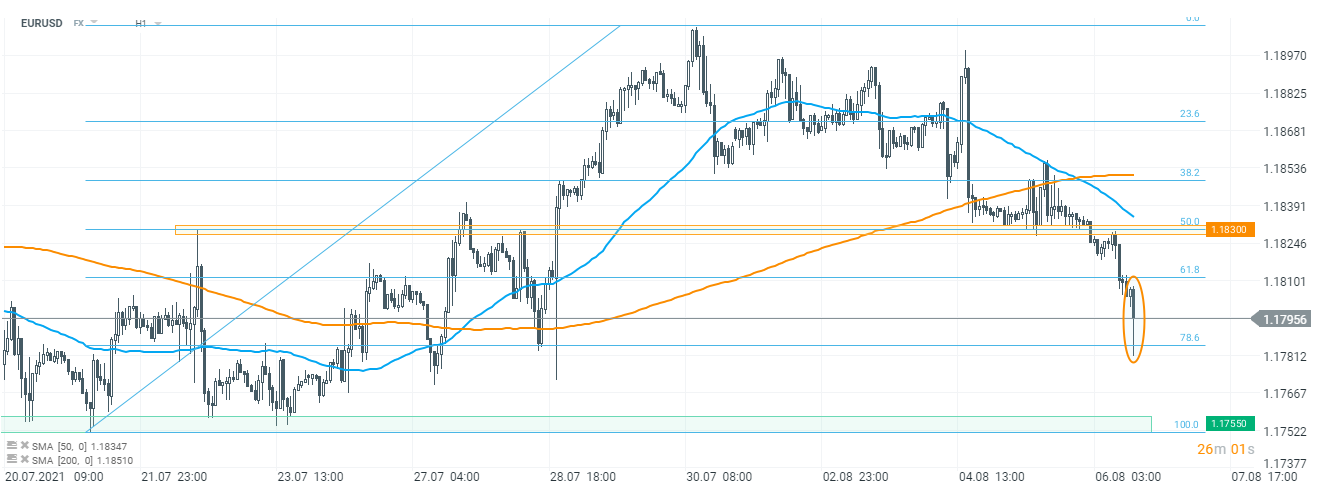

EURUSD plunged shortly after the release, falling towards the 78.6% Fibonacci rectracement of the recent upward impulse. The euro is trying to erase some losses, but the main currency pair stays below 1.18 mark. Source: xStation5

EURUSD plunged shortly after the release, falling towards the 78.6% Fibonacci rectracement of the recent upward impulse. The euro is trying to erase some losses, but the main currency pair stays below 1.18 mark. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion