Producer Prices in the US decreased to 6.0%YoY in January from 6.2% in the previous month and above market expectations of 5.4%.

On monthly basis producer prices increased 0.7% in January, the most in seven months and higher than analysts estimates of 0.4%, which raises further concerns about hawkish central bank policies.

Goods prices jumped 1.2%, also the largest increase since rising 2.1% in June 2022, led by a 6.2% surge in gasoline cost. The indexes for residential natural gas, diesel fuel, jet fuel, soft drinks, and motor vehicles also moved higher. Conversely, prices for fresh and dry vegetables decreased 33.5%. The indexes for residual fuels and for basic organic chemicals also declined. Meanwhile, services cost edged 0.4% higher, mainly hospital outpatient care (1.4%).

Core PPI fell slightly to 5.4%YoY in January, following a 5.5% increase in December and above market expectations of a 4.9%.

PPI inflation eased slightly on an annual basis, however unexpectedly increased on MoM as gas prices rebounded. Source: Bloomberg via ZeroHedge

The number of Americans filling for unemployment benefits was 194k million in the week ended February 11, compared to 196k reported in the previous week. Today’s reading came in below market expectations of 200k.

Continuing claims reading, which lags initial jobless claims data by one week, jumped to 1.696 million from 1.688 million, while analysts expected a increase to 1.695 million.

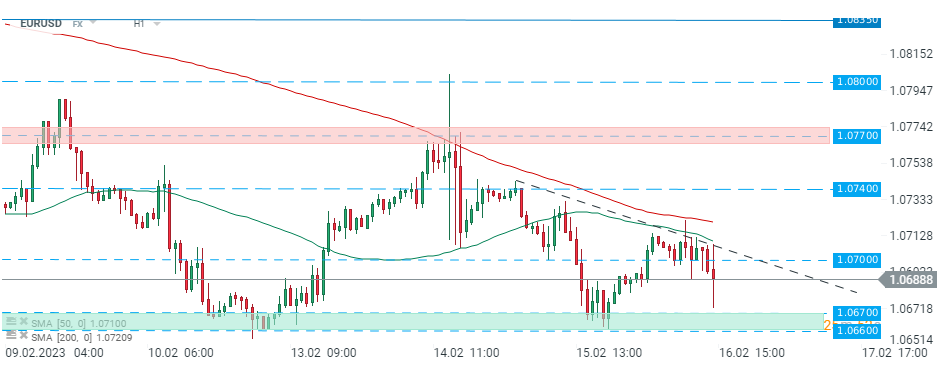

EURUSD initially currency pair fell, however buyers manage to quickly regain control. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS