US GDP data for Q3 2022 was revised higher to 2.9% from initial reading 2.6% , above market consensus of 2.7%. The strongest reading reflects upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. Imports decreased more than previously estimated.

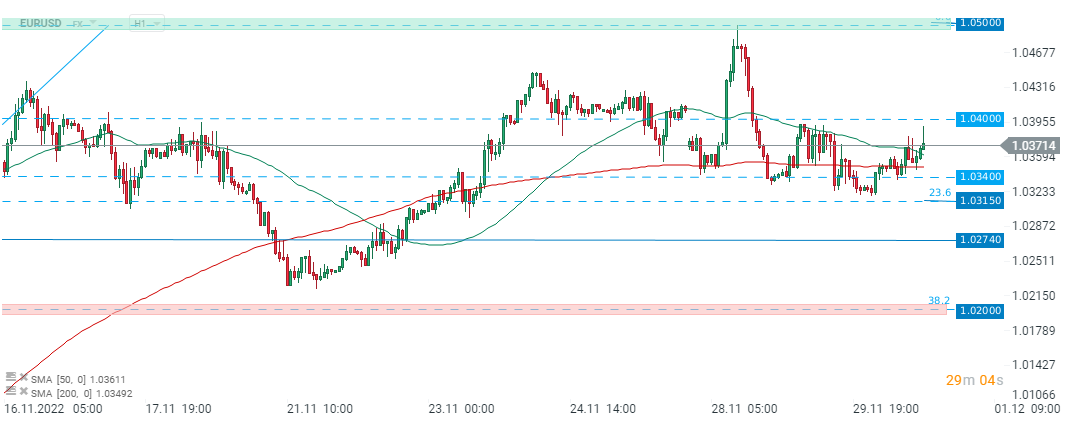

EURUSD, pair pulled back slightly after publication of today’s data and is approaching the 50 SMA green line). Should break lower occur, downward move may deepen towards local resistance at 1.0340. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)