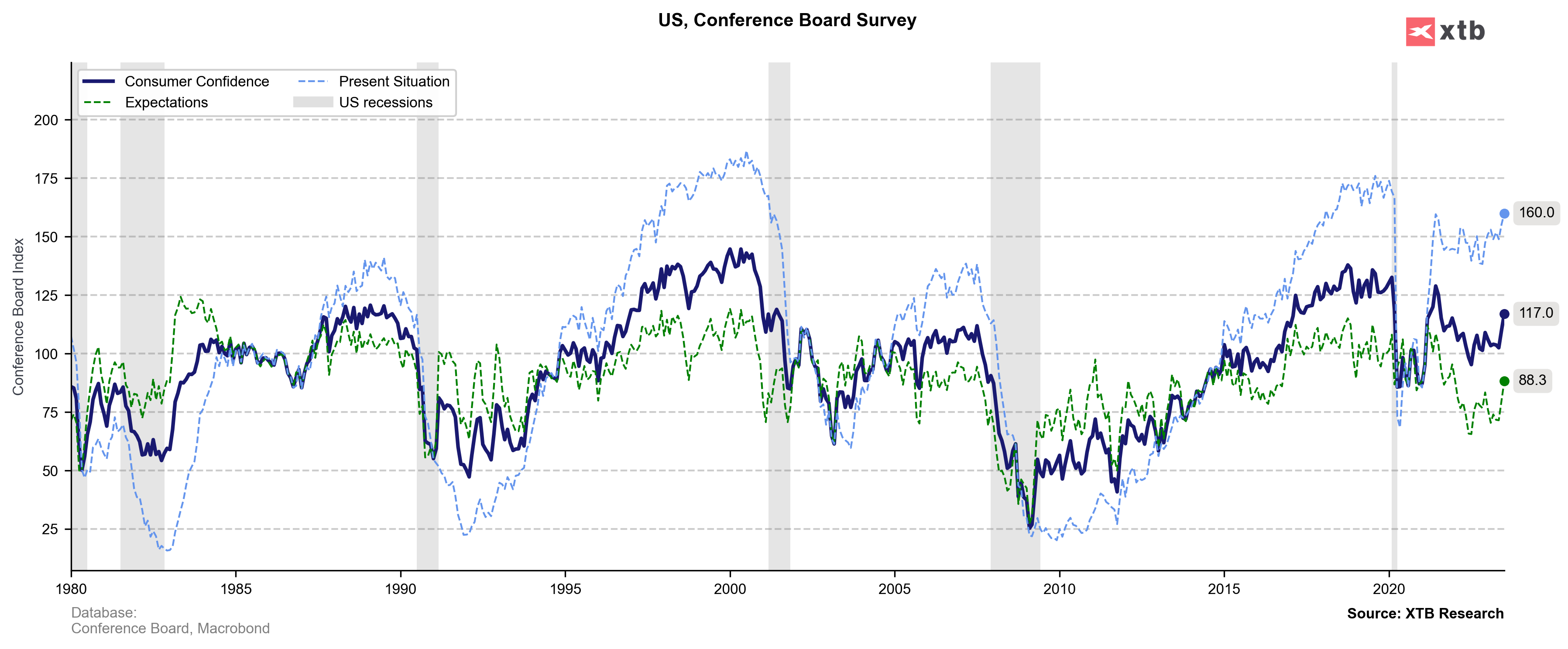

New set of indices from the Conference Board were released today at 3:00 pm BST. Report for July was expected to show an improvement compared to June's data. Indeed, this was the case with the headline Consumer Confidence index moving from 109.7 to 117.0! This is a major beat as the market expected the headline index to jump to 112.0. Improvement was driven primarily by a jump from 79.3 to 88.3 in Expectations subindex. Present Situation subindex jumped from 155.3 to 160.0. Richmond Fed index which was released simultaneously came in at -9, in-line with expectations.

USD gained following the release with EURUSD ticking lower. US index futures moved a touch higher. While beat in Conference Board data was big, market reaction was minial.

Conference Board data for July

- Consumer Confidence: 117.0 vs 112.0 expected (109.7 previously)

- Present Situation: 160.0 vs 155.3 previously

- Expectations: 88.3 vs 79.3 previously

Richmond Fed index for July: -9 vs -9 expected (-7 previously)

EURUSD continued to move lower following release of Conference Board data. Main currency pair has already erased over half of a recent upward impulse. Source: xStation5

EURUSD continued to move lower following release of Conference Board data. Main currency pair has already erased over half of a recent upward impulse. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)