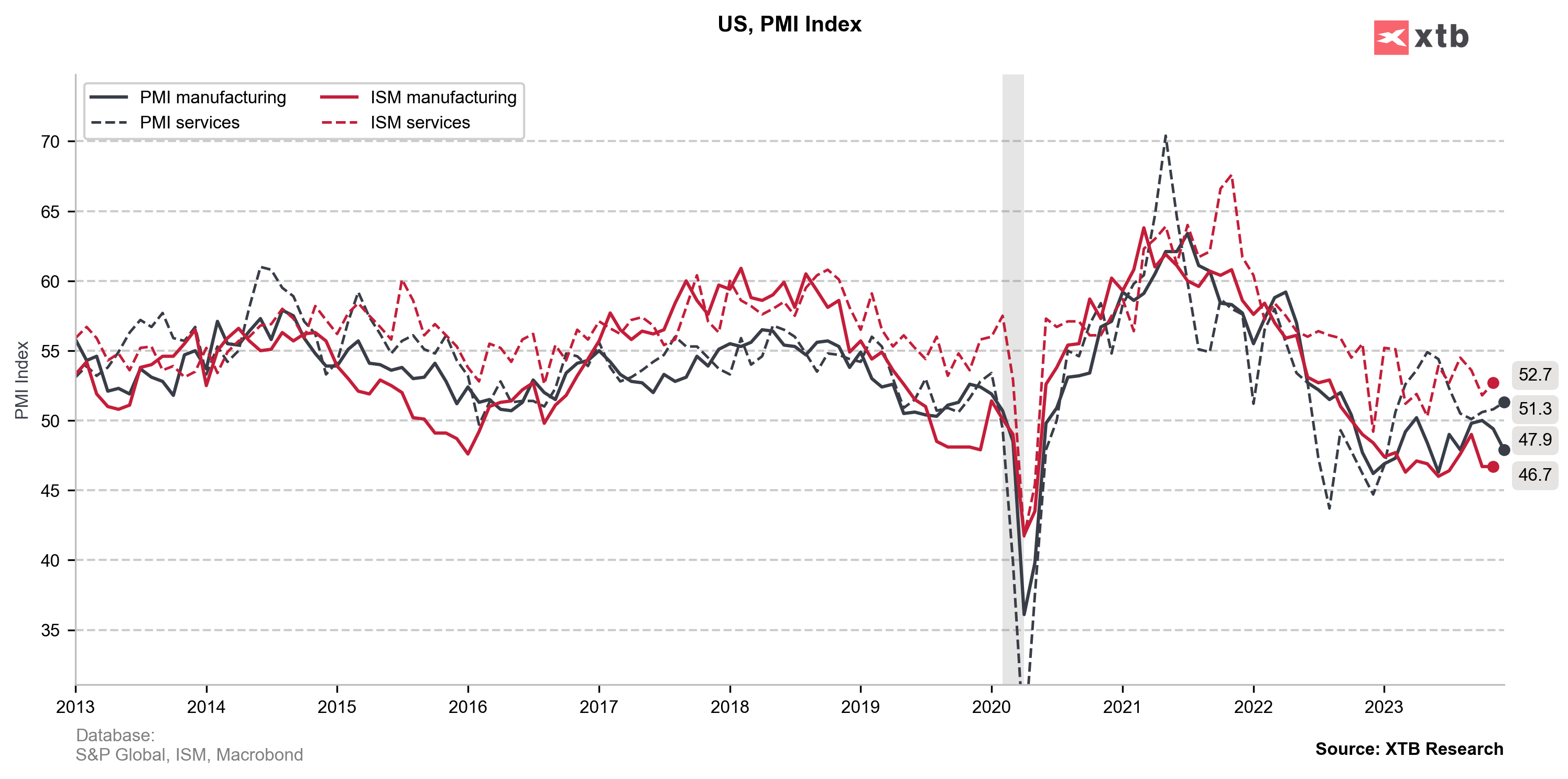

US, final PMI indices for December

- Manufacturing PMI Final Actual 47.9 (Forecast 48.4, Previous 48.2)

US manufacturing sector experienced a sharper contraction in December, with the S&P Global US Manufacturing PMI falling to 47.9 from 49.4 in November, marking the quickest decline since August. This downturn was driven by a significant drop in new orders due to weakened domestic and external demand, leading firms to reduce input buying and hiring. Inflationary pressures also intensified, with cost burdens and selling prices rising at a faster pace. Despite a modest overall decline, the sector's health deteriorated rapidly, with companies cutting production for the first time in four months and employment dropping at a rate not seen since 2009, barring the early pandemic months. This trend suggests an oversupply of goods, pointing to potential downside risks to production, employment, and prices as 2024 approaches.

Source: xStation 5

Economic Calendar: European Inflation and US PPI in the Spotlight

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

Economic calendar: US-Iran talks in Geneva in the spotlight

BREAKING: German GfK consumer sentiments worsen, GDP in line with expectations