ADP employment report for January was released today at 1:15 pm GMT. As a final hint ahead of the NFP release this Friday (1:30 pm GMT), the report was closely watched by investors. However, as today is also a FOMC decision day (7:00 pm GMT), one should not be surprised by the lack of major reaction to the news.

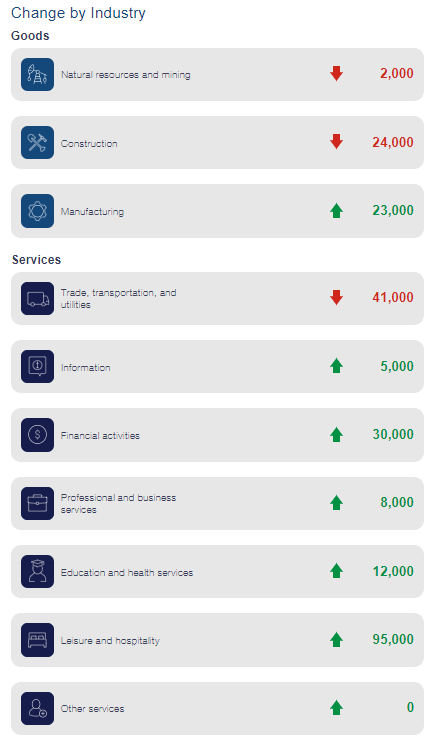

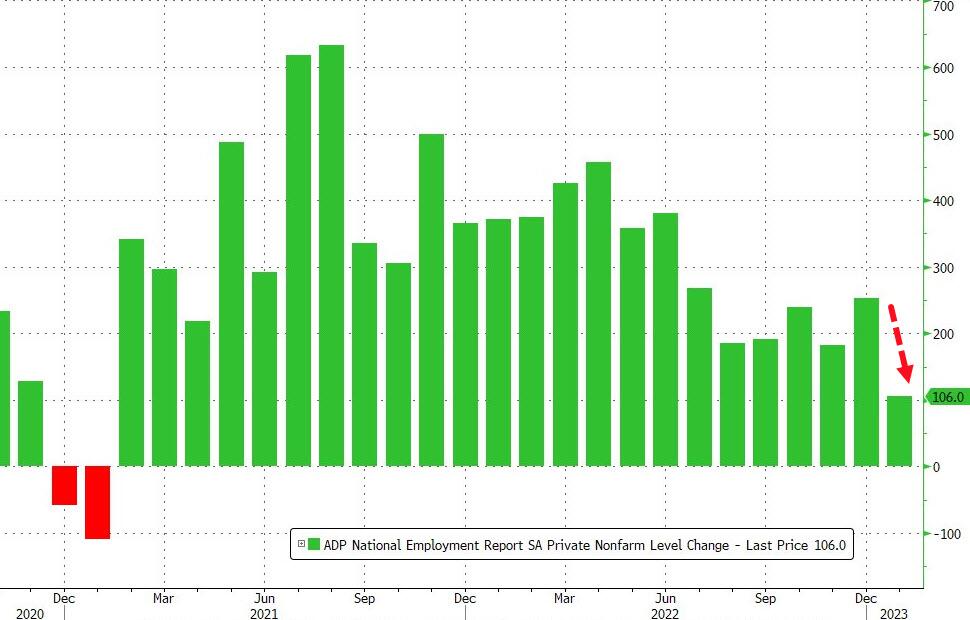

Report showed an employment gain of just 106k, a significant miss compared to market expectations of 178k. December reading has been upwardly revised to 253K. ADP noted that employment was soft during the January 12 reference week as the US was hit with extreme weather. Hiring was stronger during other weeks of the month, in line with the strength seen late last year. The services sector added 109K jobs, led by leisure and hospitality (95K), financial activities (30K), education/health services (12K), professional/business (8K) and information (5K) while trade/transportations and utilities lost 41K jobs. Meanwhile, the goods-producing industry lost 3K jobs due to construction (-24K) and mining (-2K) while the manufacturing sector added 23K.

Sentiment in the industrial sector is deteriorating. Source: ADP

It is the lowest reading since January of 2021 when businesses shed 109K jobs. Source: Bloomberg via ZeroHedge

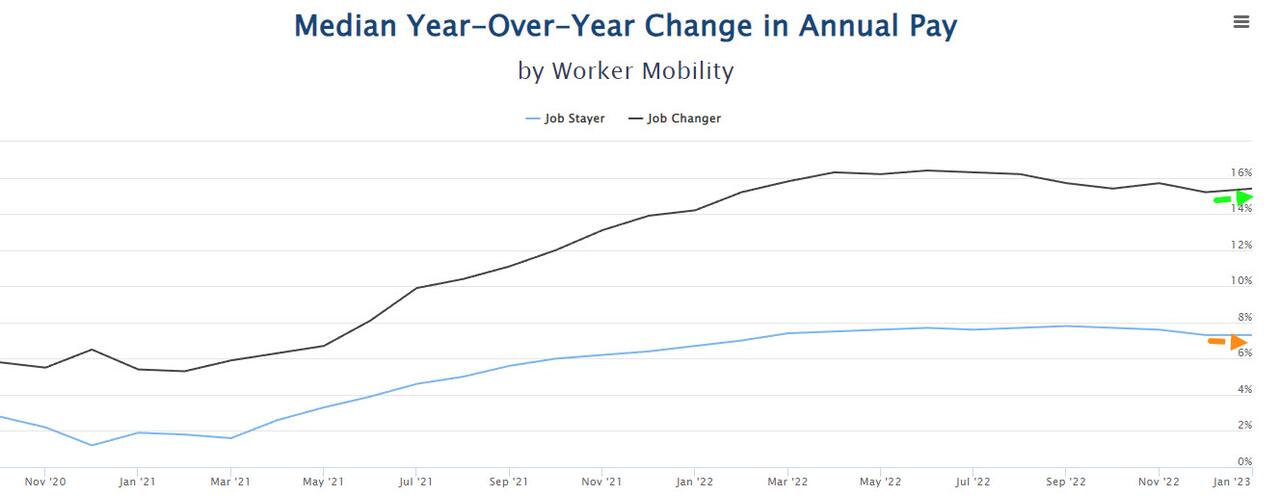

Pay growth for job stayers held at 7.3% for the second month. Source: Bloomberg via ZeroHedge

Pay growth for job stayers held at 7.3% for the second month. Source: Bloomberg via ZeroHedge

Today’s reading reinforces bets that the FED will ease the tightening process in the near future as the labour market shows signs of weakness.

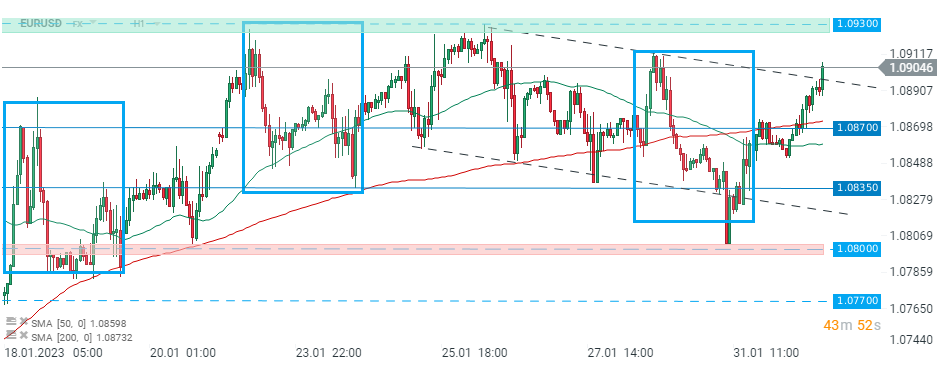

EURUSD pair broke above 1.0900 level. Source: xStation5

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

🔵 ECB Press Conference (LIVE)

BREAKING: ECB maintains rates in line with expectations!💶

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉