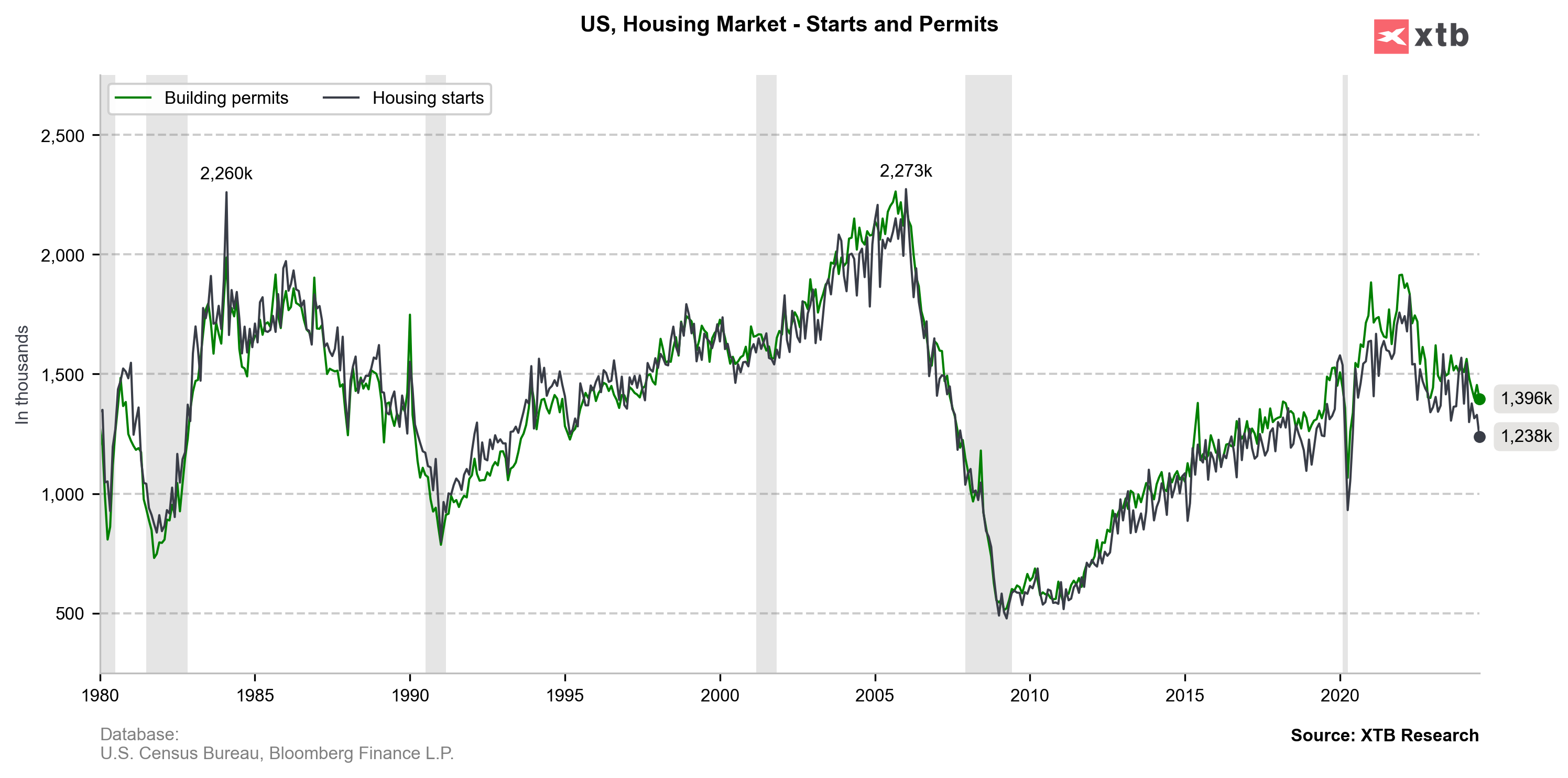

US housing market data for July was released today at 1:30 pm BST. Data was expected to show small month-over-month declines in building permits and housing starts, following decent increases in June.

Actual data turned out to be much worse than expected, with building permits and housing starts dropping more than expected. US dollar weakened following the released with EURUSD jumping back to the daily highs. US index futures moved fresh daily lows with US500 trading below 5,550 pts mark.

US, housing market data for July

- Building permits: 1396k vs 1430k expected (1454k previously)

- Building permits: -4.0% MoM vs -2.0% MoM expected (+3.9% MoM previously)

- Housing starts: 1238k vs 1340k expected (1353k previously)

- Housing starts: -6.8% MoM vs -1.5% MoM expected (+3.0% MoM previously)

EURUSD jumped and tested daily highs following release of weak US housing market data. However, big part of the post-release move was already erased. Source: xStation5

EURUSD jumped and tested daily highs following release of weak US housing market data. However, big part of the post-release move was already erased. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion