The USDJPY pair is losing sharply and going below the 140 barrier after NIKKEI's announcement about a possible modification of the yield curve control program. It is worth noting, however, that the announcement implies that the BoJ will discuss this topic at tomorrow's meeting, which does not mean that the actual decision to change will be made. What will be discussed is allowing yields to rise above the 0.50% limit by a certain degree.

In Japan, inflation concerns have been growing for a long time due in part to the weak yen, whose exchange rate against the USD is currently hovering near the 140 barrier. The BOJ's policy of keeping interest rates low has led to a widening of the interest rate differential with the US and Europe, causing the yen to fall. A more flexible version of yield curve control could narrow the gap easing downward pressure.

Source: xStation 5

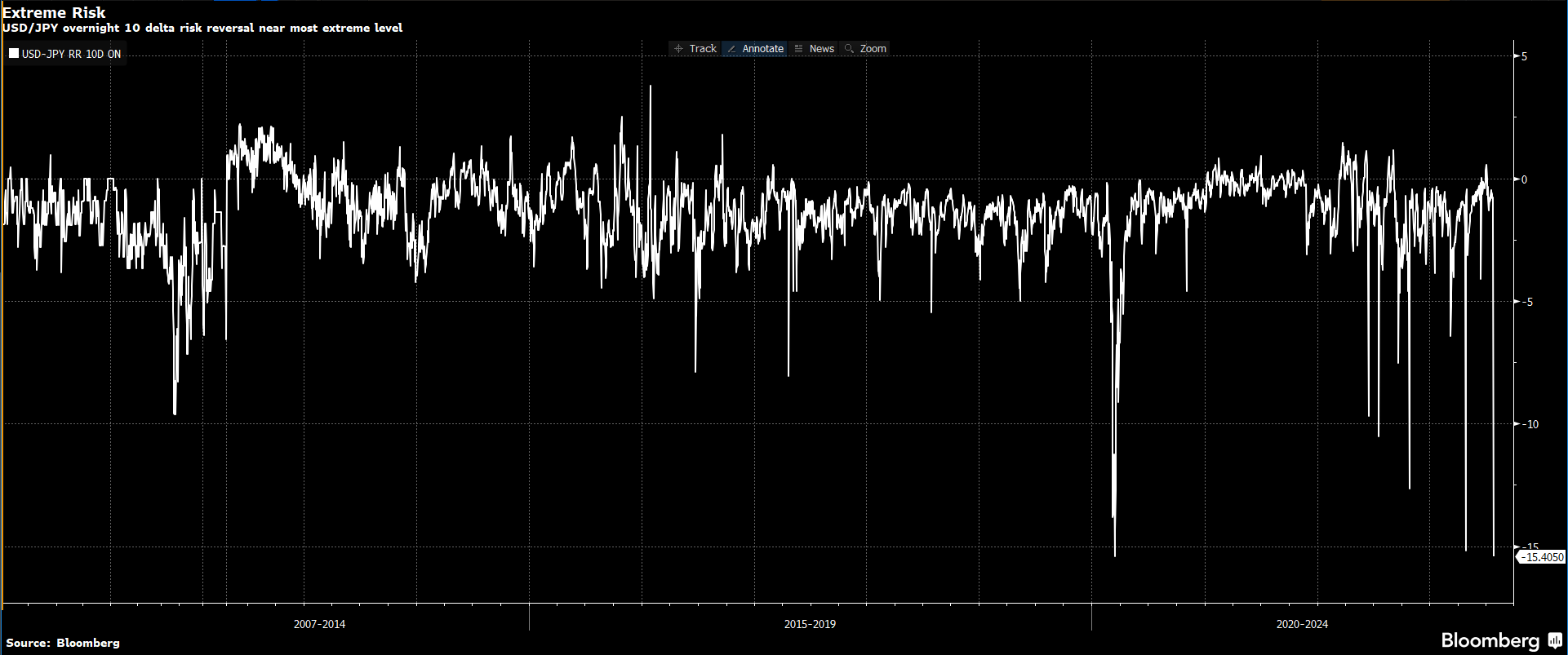

Source: Bloomberg

Source: Bloomberg

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS