Today's trading session brings a continuation of declines in oil prices reacting to recession fears, obstacles to the European Union ban on Russian oil and the spread of the COVID-19 virus in China caused sell-offs in financial markets.

-

In Europe, the resolution of the EU project to ban Russian oil imports continues to be hindered by Hungary, which is reluctant to consider requests from the European establishment. Yesterday, the head of Hungarian diplomacy, Mr. Peter Szijjarto announced that restricting oil supplies from Russia would create a problem for Hungary's economy, and the European Commission is at this point reluctant to present an alternative plan.

-

Oil prices also fell following the failure of the military mobilization scenario to materialize or Vladimir Putin's announcement of an escalation of the conflict during the Victory Day celebrations in Russia

-

Additional factors driving crude down are also China, which continues to fight the spread of the COVID-19 virus within its borders. Media outlets have reported that Shanghai is extending lockdowns and banning people from leaving their homes in many areas of the city.

-

Downward pressure on crude is also provided by general sentiment in international markets, which are increasingly concerned about a global recession. Central banks are continuing to raise interest rates, thus offsetting the stimulus of economies reeling from the Covid-19 pandemic.

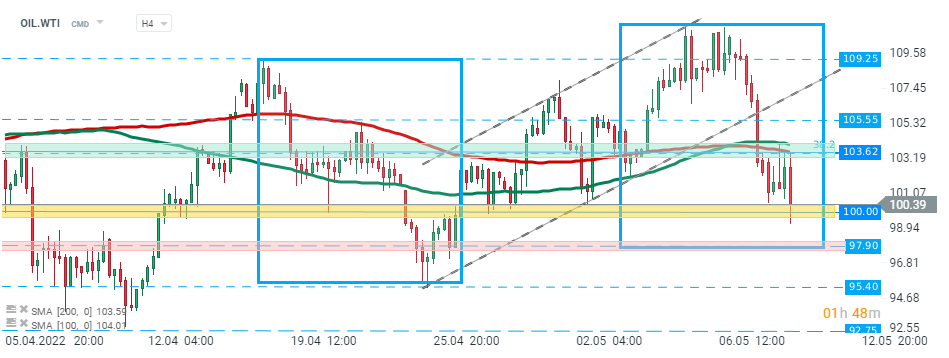

OIL.WTI continues to moves lower on Tuesday. Sellers managed even to briefly push the price below the psychological $100.00 level. Nevertheless, given the current negative market sentiment, a further downward impulse towards support at $97.90 cannot be ruled out. This level is marked with previous price reactions and lower limit of the 1:1 structure. On the other hand, if buyers regain control, the nearest resistance to watch lies at $103.62. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?