GBPUSD pair and UK100 futures contracts which are tied to the British FTSE100 index fell sharply today as investors dumped riskier assets amid ongoing concerns over the European banking system. Also traders digested UK finance minister Hunt's budget. The Chancellor pledged to halve inflation, lower debt and get the economy growing, saying the UK would not enter a technical recession this year and inflation will likely fall to 2.9% by the end of 2023. Hunt sees economic contraction of 0.2% in 2023, significantly lower compared to earlier forecasts of 1.4% contraction. Expects unemployment rate to rise to 4.4%.

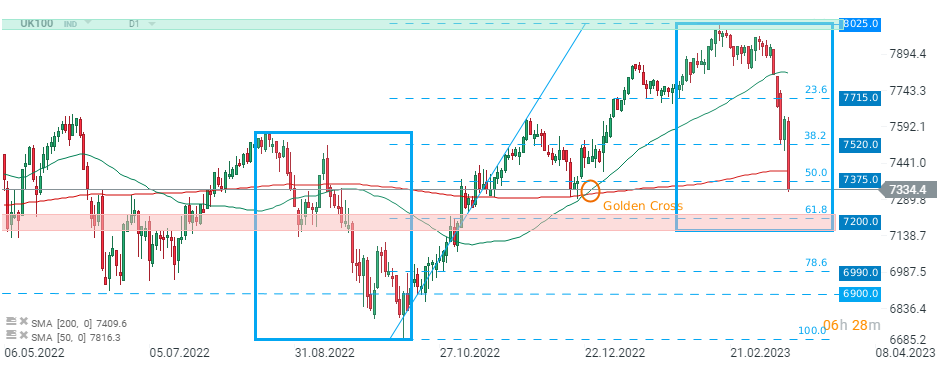

UK100 plunged over 3.7% on Wednesday and broke below major support at 7375 pts, which coincides with 200 SMA (red line) and 50.0% Fibonacci retracement of the last upward wave. If current sentiment prevails, sell-off may deepen towards the next major support zone around 7200 pts which is marked with lower limit of the 1:1 structure and 61.8% retracement. Source: xStation5

GBPUSD fell more than 1.0% as buyers failed to break above major resistance at 1.2215, which is marked with previous price reactions. Current pair approaches the earlier broken upper limit of the descending channel. Should break lower occur, next support to watch is located around 1.1850 and is marked with lower limit of the local 1:1 structure and 38.2% Fibonacci retracement of the downward wave started in June 2021. Source: xStation5

Market wrap: Strong sell-off in European equities amid the energy crisis 🔔

DE40 loses 2.6% 📉European stocks under pressure

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street