Can Ubisoft still turn things around?

A storm is brewing at Ubisoft (UBI) after hedge fund AJ Investments criticized the video games publisher's governance on 9 September. The fund is calling for a change of CEO and for the company to be delisted from the stock exchange. These demands come against a backdrop in which UBI shares have fallen by 50% since the start of the year and by 88% from their 2018 highs. AJ Investments is highlighting the need for significant reforms to turn around the company's fortunes as it faces continued challenges in the market.

UBI published its results for the first quarter of its 2024-2025 financial year in July. The company recorded net bookings of €290 million, compared with €873 million in the previous quarter. Net reservations are net sales excluding certain deferred revenues. Investors were expecting a figure of €300.9 million. For the second quarter, UBI has set a net reservations target of around 500 million euros, compared with 625 million euros for investors.

UBI: France's leading video games company

UBI is France's leading video game developer and publisher. In its 2023-2024 financial year, the group recorded net bookings of €2.32 billion.

The French studio is valued at €1.5 billion and is 13.98% owned by the Guillemot family, founders of the company. Since an initial investment in 2018, followed by a second in 2022, Chinese publisher Tencent has held nearly 10% of the company. Although Tencent is the group's second-largest shareholder, its capacity for influence is actually limited. The Guillemot family holds 5 of the 10 seats on Ubisoft's board of directors.

The studio's most famous franchises include Assassin's Creed, Rainbow Six, Rayman, Just Dance and Far Cry. UBI released Star Wars Outlaws on August 30, 2024 and plans to release Assassin's Creed Shadows on November 12, 2024.

Stagnating distribution and controversies

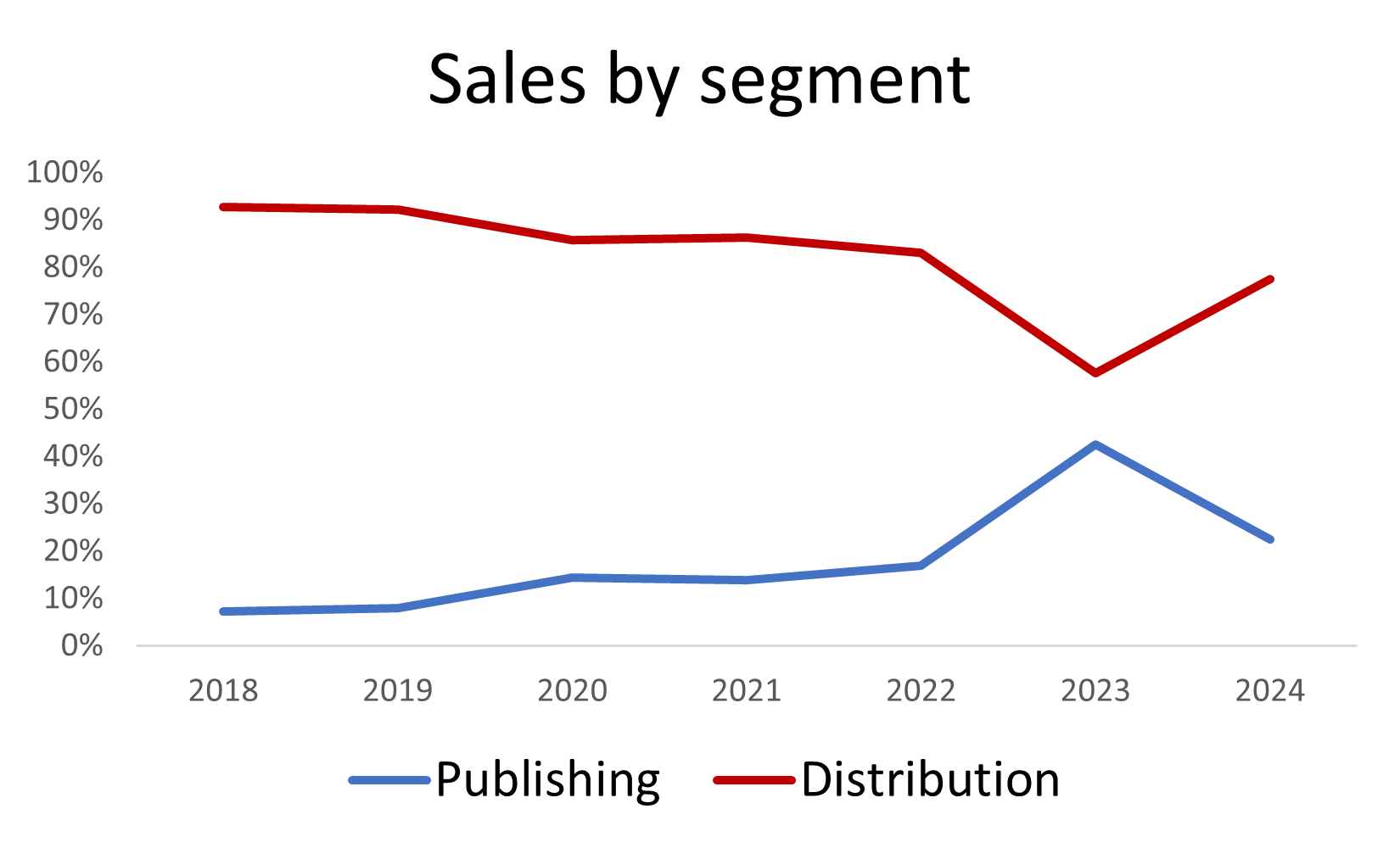

Although the company is French, its operations are mainly concentrated in North America, accounting for 53% of its business. Europe comes second with 35% of net bookings, followed by the rest of the world with 12%. Ubisoft (UBI) is both a publisher and distributor of video games, the latter accounting for 77% of its sales in the last financial year. However, publishing is playing an increasingly important role in its revenue breakdown. In 2018, publishing accounted for just 7% of sales, compared with 42% and 23% respectively in 2023 and 2024. In monetary terms, publishing generated €125 million in 2018, compared with €518 million today. Distribution accounted for €1,607 million in 2018, compared with €1,044 million in 2023 and €1,782 million in 2024, so growth in this activity is much lower, when it exists at all.

This relative decline in distribution activity is mainly attributed to a series of commercial failures and scandals since 2018, Ubisoft's last major success being Assassin's Creed Odyssey, released that year. The studio has been heavily criticized by gamers and employees alike for its toxic and sexist management, numerous layoffs and development delays (such as Skull and Bones, originally planned for 2017 but finally released in 2024). More recently, the studio has been accused of cultural appropriation and plagiarism with its Assassin's Creed Shadows game, which hasn't even been released yet. Its latest blockbuster Star Wars Outlaws was widely mocked on social networks for the lack of detail in its textures and the idiocy of the artificial intelligence of its non-player characters.

The studio's profitability has been severely dented by these problems. The studio is struggling to turn a profit, and even recorded a massive loss of €494 million in 2023. In 2024, the group partially recouped its losses with a profit of €157 million, giving a net margin of 6.8%, compared with over 17% for its American rival Electronic Arts and 19% for Chinese giant Tencent.

Is there any hope for UBI?

Video game studios, more than in other sectors, are particularly sensitive to their reputation. Gamers, as informed consumers, use tools such as Metacritic to make their purchasing decisions. This site aggregates game reviews from both journalists and gamers, and a good rating on Metacritic is closely linked to a game's ability to sell. The last Ubisoft blockbuster to score over 80/100 on Metacritic was Assassin's Creed Odyssey in 2018, which coincided with highs for the company's stock. Star Wars Outlaws, the latest title released by Ubisoft received a Metacritic score of 76/100, and a mediocre consumer rating of 5.5/10. To say that Ubisoft has failed to produce any good games since then is a short step.

This concern is shared by investors, who value Ubisoft at a significant discount to its competitors. For example, Electronic Arts and Tencent are valued at 36 and 22 times earnings respectively, while Ubisoft is valued at just 8 times earnings. This reflects the market's perception that the company has less potential for future growth. Similarly, the market has punished UBI's share price by 88% from its 2018 highs.

Is it possible for Ubisoft to regain the favor of the market and gamers? Investors seemed optimistic, anticipating a good performance from Xdefiant, which was launched on May 21 and attracted 11 million players according to the publisher. For the second and third quarters of the 2024-2025 financial year, analysts were forecasting net bookings of €625.2 million and €938.2 million respectively. These forecasts now seem too high, with Ubisoft having announced a target of just €500 million for the next quarter. The market is now expecting less from Star Wars Outlaws, released on 30 August, which will only boost the third quarter for two days (in addition to its pre-orders), and Assassin's Creed Shadows, due out on 12 November. Both of these games are among the most eagerly-awaited of the year, with little competition for their release.

It is now clear that these launches will not be enough to solve the structural problems facing the group. The video games sector is going through a phase of consolidation, as illustrated by Microsoft's acquisition of Activision-Blizzard. Ubisoft is well aware of this, having already been the target of hostile takeover attempts by Vivendi in 2018. On that occasion, Ubisoft enlisted the help of Tencent to protect itself. However, such strategies can only be temporary. To defend itself effectively, the group must win back the hearts of gamers by offering experiences that better meet their expectations.

Upcoming opportunity at UBI?

From a technical standpoint, the stock has been in a clear downtrend since July 2018, recently reaching the critical support zone between 11.8 and 13.1€. This level lies just above the lower boundary of its macro upward channel. Historically, UBI has seen bear markets with drawdowns as steep as -90%, as evidenced by the tech and housing market crashes of 2000-2002 and 2008-2011. Currently, the drawdown stands at -89.6%. With just a week left before the monthly candle closes, this period will be crucial for the bulls. To strengthen the case for a bottom, the stock must reclaim the 13€ level before the close. We can observe a bullish divergence on the monthly RSI. A break below the key geometric support, represented by the major trendline in black, could trigger a further drop, potentially down to 3.6€.

UBI.FR on a monthly timeframe. Source : xStation.

Matéis Mouflet and Antoine Andreani,

XTB Research

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning