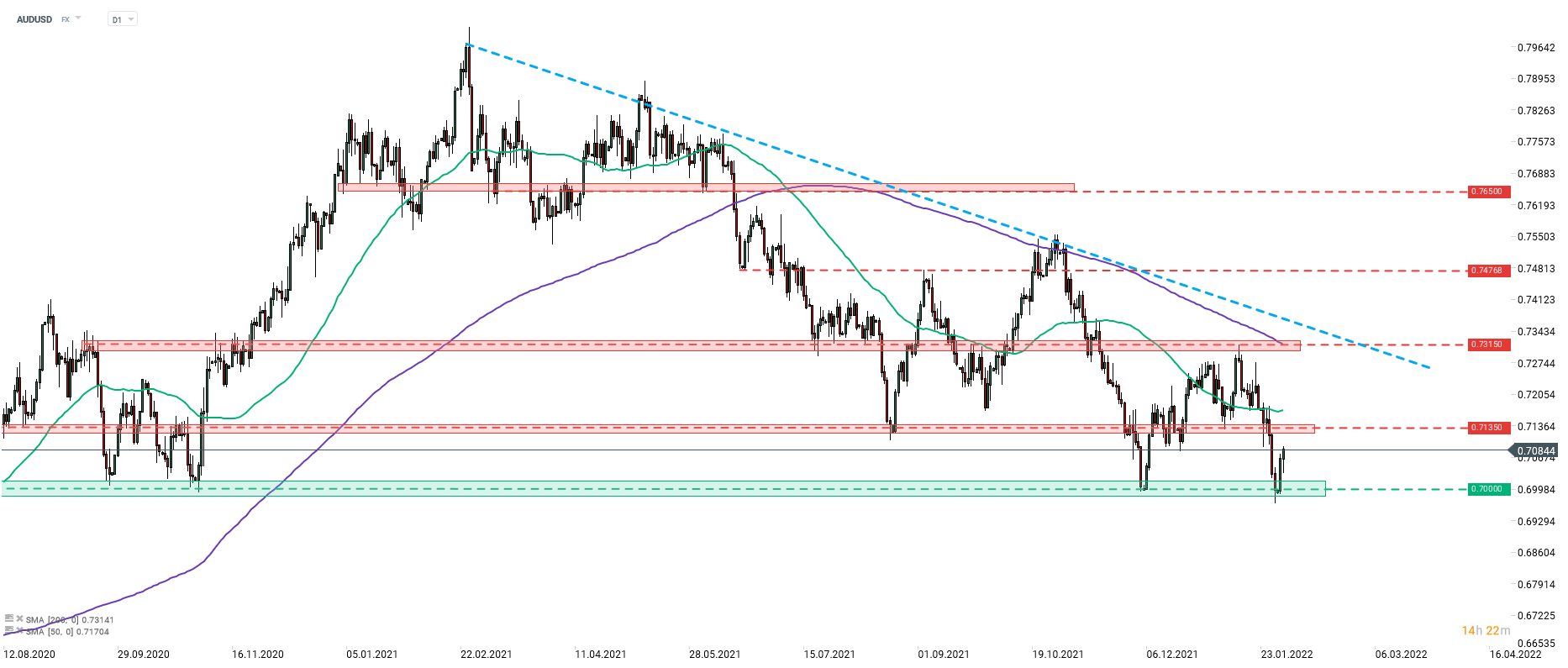

As expected, the Reserve Bank of Australia left rates unchanged at today's meeting. The bank announced that it will terminate its quantitative easing programme and the final purchase will be made on February 10, 2022. While this was a hawkish announcement, RBA declined to provide a timeline for rate hikes and instead repeated that it does not see a need to increase rates in the near future. RBA said that it won't increase rates until inflation is sustainably back in the 2-3% target range. Markets' initial reaction was negative for the Australian currency but it should be noted that AUD was already weak due to disappointing retail sales report released earlier in the day. AUDUSD deepened decline following RBA announcement and traded 0.5% lower at one point of today's session. However, situation began to improve as the European session drew near and losses were erased. AUDUSD is now trading higher on the day and continues the rebound launched yesterday after a test of the 0.7000 support zone. The near-term resistance zone to watch can be found ranging around 0.7135.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️