The Australian dollar was very active during today's Asian session, thanks to two events - speech from RBA Governor Lowe and RBA minutes release. RBA minutes have shown that the Bank sees need for further rate hikes to combat inflation and normalize monetary conditions in Australia. However, RBA Board noted that delivering a 25 basis point rate hike at every remaining meeting this year would be a rapid policy tightening. Meanwhile, the market priced-in the Australian cash rate at 4% by the end of this year! These expectations were watered down during Governor Lowe speech as he said that hiking cash rate to 4% by the end of 2022 is a rather unlikely scenario. Nevertheless, he said that a 25 or 50 basis point rate hike is being considered for the July meeting.

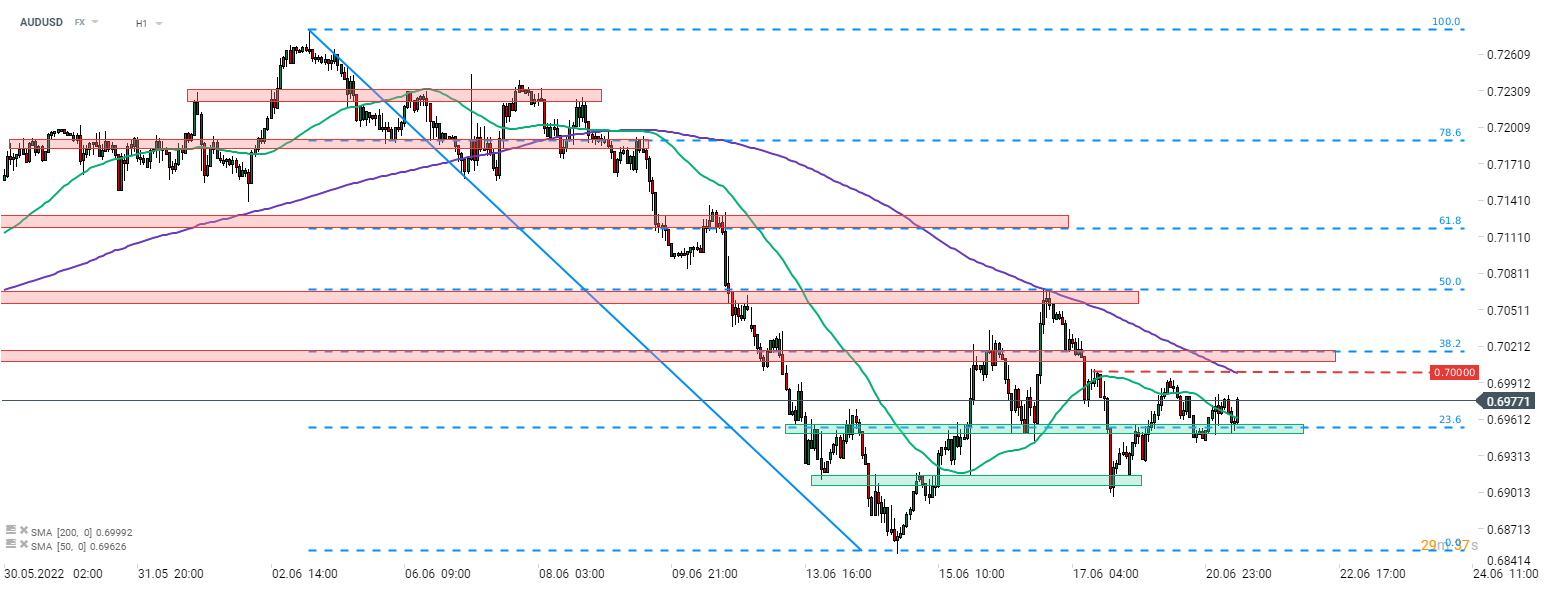

AUDUSD dipped after the RBA Governor casted doubt over the possibility of 4% cash rate at the end of the year. However, this brief dip was halted at the support zone ranging around 23.6% retracement of the downward move launched at the beginning of June (0.6950 area) and the pair started to recover later on. The nearest resistance to watch can be found at 0.70 handle, marked with 200-hour moving average (purple line). A zone marked with 38.2% retracement is the next resistance in line.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️